As the markets eagerly await FOMC rate decision and the release of new economic projections, Dollar is currently holding steady within a narrow range. The spotlight is particularly on the revised dot plot, as it is expected to provide crucial insights into the pace of monetary policy easing by Fed in the coming year. Investors are keenly looking for any signs of dovish policy shifts that could trigger risk-on sentiment, dragging down treasury yields and the greenback.

In the European trading session, the focus shifts momentarily to UK’s GDP data, which is crucial for understanding the trajectory of the UK economy. This data will offer insights into whether the UK economy is cooling sufficiently to bring inflation down, possibly negating the need for additional policy interventions by BoE. Concurrently, European majors are range bound against each other. Their next moves hinge on the outcomes of today’s UK data and probably even more on the upcoming central bank meetings of SNB, BoE, and ECB tomorrow.

In other currency market developments, commodity currencies, along with Yen, are showing weakness. Australian and New Zealand Dollar traders faced some disappointment following China’s Central Economic Work Conference, which refrained from announcing substantial stimulus programs, opting instead for policy adjustments focused on “stabilizing expectations, stabilizing growth, and stabilizing employment.” Canadian Dollar is also under pressure due to a renewed decline in oil prices.

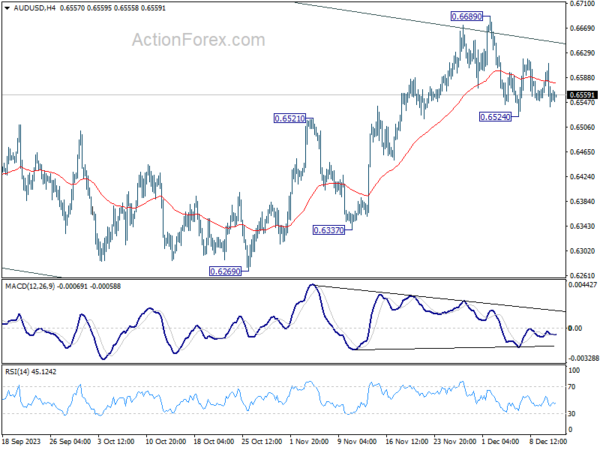

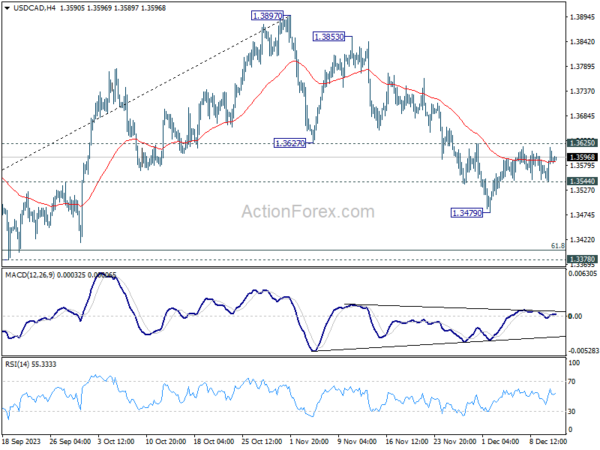

From a technical analysis standpoint, the performance of commodity currencies relative to the Dollar warrants attention today, especially since movements in European majors might be constrained ahead of the central bank announcements tomorrow. In particular, a break below the 0.6524 minor support in AUD/USD and above 1.3625 minor resistance in USD/CAD would indicate that Dollar is regaining momentum and for extending its near-term rebound.

In Asia, Nikkei rose 0.25%. Hong Kong HSI is down -0.87%. China Shanghai SSE is down -0.83%. Singapore Strait Times is down -0.01%. Japan 10-year JGB yield is down -0.0474 at -0.691, back below 0.7 handle. Overnight, DOW Rose 0.48%. S&P 500 rose 0.46%. NASDAQ rose 0.70%. 10-year yield fell -0.033 to 4.206.

Record highs on the horizon for DOW as market awaits FOMC dot plot

US stock market closed generally higher overnight. In particular, DOW now stands just about 1% shy of its all-time high after recent rally. The current uptrend in major indexes is primarily fueled by an increasing speculation among investors that Fed would start cutting interest rates. Today’s FOMC statement and the accompanying “dot plot” are eagerly awaited, as any signs of a dovish stance or indications of policy easing could further fuel the market’s ascent, potentially catapulting the DOW to new record heights before year-end.

Expectations are leaning overwhelmingly towards Fed maintaining federal funds rate at the 5.25-5.50% range at today’s meeting. Should Fed decide to keep rates unchanged, it would mark the third successive meeting without a rate hike. Such a decision could be interpreted as a signal that the Fed views its cycle of rate hikes as effectively complete. This sentiment is likely to be mirrored in the revised dot plot, which is anticipated to exclude the rate increase previously suggested for this year. There remains, however, a much less probable scenario where the median dots may indicate a postponed hike.

Traders are aggressively pricing in the prospect of Fed beginning its rate-cutting cycle as early as May, with the odds exceeding 50%, as indicated by fed funds futures. Moreover, there’s a similar probability assigned to the expectation of a cumulative one percent rate cut by the end of 2024. It’s important to note, however, that market predictions often tend to be rather unreliable for periods extending beyond one or two months.

As for DOW, near term outlook will stay bullish as long as 36010.85 support holds. Next target is 36952.65 record high. Clearing of this record high would pave the way to 100% projection of 28660.94 to 34712.28 from 32327.20 at 38378.54.

Japan’s Tankan manufacturing index rose to 12, highest in nearly 2 years

Japan’s Tankan survey for Q4 show signs of strength in both manufacturing and non-manufacturing sectors. Yet, the cautious outlook among manufacturers suggests uncertainty about future economic conditions.

Large Manufacturing Index rose from 9 to 12, surpassing the expected figure of 10. This increase marks the third consecutive quarter of improvement and the highest level since Q1 2022. The Non-Manufacturing Index also showed positive development, rising from 27 to 30, exceeding the forecast of 27. This improvement represents the seventh consecutive quarter of growth, reaching its highest point since 1991.

However, the outlook for the next three months tells a different story. Large Manufacturing Outlook Index fell from 10 to 8, falling short of the expected 9, indicating less optimism among manufacturers for the near future. In contrast, Non-Manufacturing Outlook Index did improve from 21 to 24, yet it missed the anticipated mark of 25.

In terms of capital expenditure, big firms in Japan are projecting an increase of 13.5% for the current fiscal year ending in March 2024. This projection is more optimistic than the median market forecast, which anticipated a 12.4% increase.

ADB raises 2023 growth forecast, driven by stronger performance in China and India

Asian Development Bank upgrades growth forecasts Developing Asia for 2023, raising projection from 4.7% to 4.9%. This upgrade is primarily attributed to stronger than expected growth in two of the region’s largest economies, China and India. On the other hand, growth forecast for 2024 remains unchanged at 4.8%.

Specifically, for China, ADB now projects growth to reach 5.2% in 2023, an increase from previous forecast of 4.9% made in September. Growth rate for China in 2024 is expected to slow to 4.5%, unchanged from prior predictions. In contrast, India’s growth forecast for 2023 is raised from 6.3% to 6.7%, and the country is anticipated to maintain this robust growth rate of 6.7% in 2024.

In terms of inflation, ADB made slight adjustments to its forecasts for Developing Asia. Inflation expectation for 2023 is reduced from 3.6% to 3.5%, while forecast for 2024 sees a minor increase from 3.5% to 3.6%.

ADB, in its release, highlighted several downside risks to these forecasts. Key among these are the potential for “higher-for-longer interest rates in advanced economies,” which could lead to financial instability. Additionally, potential supply disruptions from factors like El Niño and the ongoing Russian invasion of Ukraine pose risks of renewing energy and food security challenges, which could reignite inflationary pressures.

Elsewhere

UK GDP, production and trade balance in focus in European session, together with Eurozone industrial production. UK will release PPI and crude oil inventories before FOMC rate decision.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3551; (P) 1.3585; (R1) 1.3625; More…

Intraday bias in USD/CAD remains neutral at this point as range trading continues. On the upside, firm break of 1.3265 minor resistance will confirm short term bottoming at 1.3479. More importantly, whole correction from 1.3897 could have completed too. Intraday bias will be back on the upside for strong rally back to 1.3853/3897 resistance zone. However, break of 1.3544 minor support will turned bias back to the downside for 1.3479 and below, to resume the decline from 1.3897.

In the bigger picture, rise from 1.3091 is seen as the fifth leg of the whole rise from 1.2005 (2021 low). Further rally is expected as long as 1.3378 support holds, to 61.8% projection of 1.2401 to 1.3976 from 1.3091 at 1.4064. However, decisive break of 1.3378 will dampen this view and bring deeper fall back to 1.3091 instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturing Index Q4 | 12 | 10 | 9 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q4 | 8 | 9 | 10 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q4 | 30 | 27 | 27 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q4 | 24 | 25 | 21 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q4 | 13.50% | 12.40% | 13.60% | |

| 07:00 | GBP | GDP M/M Oct | -0.10% | 0.20% | ||

| 07:00 | GBP | Industrial Production M/M Oct | -0.10% | 0.00% | ||

| 07:00 | GBP | Industrial Production Y/Y Oct | 1.10% | 1.50% | ||

| 07:00 | GBP | Manufacturing Production M/M Oct | 0.00% | 0.10% | ||

| 07:00 | GBP | Manufacturing Production Y/Y Oct | 1.90% | 3.00% | ||

| 07:00 | GBP | Goods Trade Balance (GBP) Oct | -14.1B | -14.3B | ||

| 08:00 | CHF | SECO Economic Forecasts | ||||

| 10:00 | EUR | Eurozone Industrial Production M/M Oct | -0.30% | -1.10% | ||

| 13:30 | USD | PPI M/M Nov | 0.10% | -0.50% | ||

| 13:30 | USD | PPI Y/Y Nov | 1.00% | 1.30% | ||

| 13:30 | USD | PPI Core M/M Nov | 0.20% | 0.00% | ||

| 13:30 | USD | PPI Core Y/Y Nov | 2.20% | 2.40% | ||

| 15:30 | USD | Crude Oil Inventories | -1.9M | -4.6M | ||

| 19:00 | USD | Fed Interest Rate Decision | 5.50% | 5.50% | ||

| 19:30 | USD | FOMC Press Conference |