Commodity currencies, particularly Australian Dollar, are experiencing notable selling pressure today. However, it should be noted that European investor sentiment, while not explicitly full-blown risk-on, clearly lacks the typical features of risk aversion. In the US, futures markets are just slightly down, indicating a cautious rather than outright negative sentiment among traders. This subdued response across markets suggests that investors are not engaging in widespread risk aversion but are instead selectively cautious.

A key factor influencing market sentiment is the today’s decision by Moody’s to downgrade its outlook on China’s government credit ratings from stable to negative. This adjustment reflects increasing expectations that the Chinese government will be compelled to provide additional financial support to heavily indebted local governments and state-owned enterprises. According to Moody’s, this necessity poses significant risks to China’s overall fiscal, economic, and institutional integrity. The statement from Moody’s emphasizes concerns about “structurally and persistently lower medium-term economic growth” and challenges within China’s property sector, indicating broader economic issues that could impact global markets.

In other currency markets, Yen and Dollar are emerging as stronger contenders, followed by Sterling and Swiss Franc. Euro is trailing behind its European counterparts, especially after dovish remarks fro a know hawk ECB Executive Board member Isabel Schnabel.

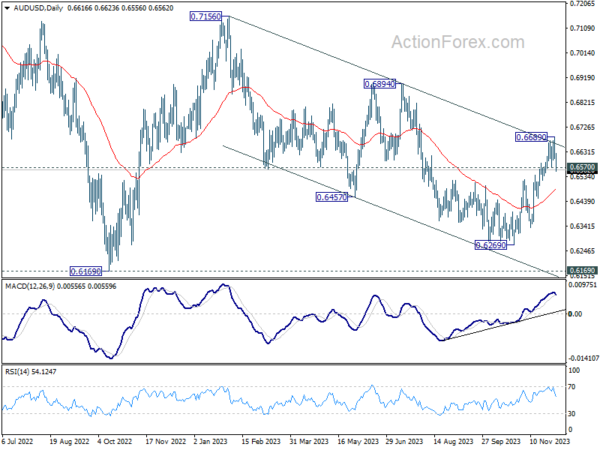

Technically, AUD/USD’s break of 0.6570 support today indicates first rejection by medium term channel resistance from 0.7156. It’s still early to conclude if the rise from 0.6269 has completed. But deeper fall is now in favor back to 55 D EMA (now at 0.6482). Sustained break there will argue that the whole fall from 0.7156 is still in progress for another low. Nevertheless, strong bounce from the EMA will keep the bullish scenario alive, that is, fall from 0.7156 has completed as a correction with three waves down to 0.6269.

In Europe, at the time of writing, FTSE is down -0.50%. DAX is up 0.26%. CAC is up 0.33%. Germany 10-year yield is down -0.0070 at 2.289. Earlier in Asia, Nikkei fell -1.37%. Hong Kong HSI fell -1.91%. China Shanghai SSE fell -1.67%. Singapore Strait Times fell -0.22%. Japan 10-year JGB yield fell -0.0179 to 0.673.

ECB’s Schnabel: Another rate hike now rather unlikely

In an interview with Reuters, ECB Executive Board member Isabel Schnabel remarked that the slowdown to 2.4% in Eurozone’s November flash CPI a “very pleasant surprise.” More importantly, that made “further rate increase rather unlikely”.

Schnabel emphasized the significance of the decline in “underlying inflation”, which has proven “more stubborn”, is now also “falling more quickly than we had expected”. Such trends have bolstered her confidence in achieving ECB’s 2% inflation target no later than 2025.

However, she cautioned against premature victory declarations over inflation, expecting some upticks in the coming months due to fiscal changes and base effects, and not ruling out potential new spikes in energy or food prices.

On the growth front, Schnabel acknowledged mixed signals. While some hard data points are concerning, softer indicators, like PMI, are showing signs of stabilization and are “giving us hope.”

She forecasts a gradual uptick in growth next year, driven by rising real incomes, which should boost confidence and consumption. Regarding the labor market, she noted some softening but does not anticipate a significant deterioration or a deep, prolonged recession.

Eurozone PPI at 0.2% mom, -9.4% yoy in Nov, matches expectations

Eurozone PPI came in at 0.2% mom, -9.4% yoy in November, matched expectations. For the month, industrial producer prices increased by 1.0% mom in the energy sector and by 0.1% mom for durable consumer goods, while prices remained stable for capital goods, and prices decreased by -0.1% mom for non-durable consumer goods and by -0.3% mom for intermediate goods. Prices in total industry excluding energy decreased by -0.2% mom.

EU PPI was at 0.2% mom, -8.7% yoy. The biggest monthly increases in industrial producer prices were observed in Ireland (+4.9%), Italy (+2.2%) and the Netherlands (+0.7%), while the largest decreases were recorded in Luxembourg (-3.7%), Latvia (-2.7%) and Greece (-1.9%).

Eurozone PMI composite finalized at 47.5, on the brink of recession

Eurozone’s PMI Services for November showed a slight improvement, finalizing at 48.7, up from 47.8 in October. PMI Composite also experienced an uptick, reaching 47.5 from the previous month’s 46.5.

Looking at individual member states, PMI composite revealed mixed results. Ireland registered a three-month high at 52.3, while Spain hit a three-month low at 49.8. Italy reported a two-month high at 48.1, and Germany saw a four-month high at 47.8. France remained unchanged, with its PMI holding steady at 44.6.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, stated, “The service sector maintained its downward slide in November.” He noted that the modest improvement in the activity index offers little optimism for a swift recovery in the immediate future. De la Rubia also highlighted concerning trends, such as the fifth consecutive monthly decline in new business and subdued business expectations, which remain “well below the long-term average.”

Outlook for Eurozone’s economy, as inferred from these PMI indicators, is not encouraging. De la Rubia mentioned, “As per our GDP nowcast, factoring in the latest PMI indicators, a fall in GDP is on the cards for the fourth quarter.” He warned that if two consecutive quarters of negative growth define a recession, the Eurozone is currently “on the brink” of one.

UK PMI services finalized at 50.9, composite at 50.7

UK’s PMI Services for November improved to 50.9 from October’s 49.5, indicating expansion for the first time in four months. PMI Composite also rose to 50.7, crossing the critical 50 mark for the first time since July.

Tim Moore of S&P Global Market Intelligence remarked on the positive shift: “UK service providers moved back into expansion mode” However, he cautioned about inflation, noting “another round of strong input cost pressures” mainly due to rising staff wages. This improvement in the service sector, although positive, is shadowed by ongoing inflationary challenges.

RBA holds rates following sparse information since last meeting

RBA kept its cash rate target unchanged at 4.35%, aligning with market expectations. The central bank’s latest statement indicates continued openness to further rate hikes, but emphasizes that any such decision “will depend upon the data and the evolving assessment of risks.” This stance reflects a careful approach, as RBA awaits more comprehensive data, particularly the Q4 inflation figures due in January, before its next meeting in early February.

In its review of the “limited information” available since November meeting, RBA acknowledged that the data were “broadly in line with expectations.” The October monthly CPI update suggested continued moderation in inflation, but did not provide substantial insights into services inflation. While wage growth accelerated in Q3, it is “not expected to increase much further”. The labor market conditions are seen as “continuing to ease gradually,” though they remain tight.

RBA also highlighted “still significant uncertainties” regarding the economic outlook. It pointed out the potential for persistent services inflation in Australia. Domestically, the uncertainties include the lag effects of monetary policy and household consumption patterns. On a global scale, the ongoing uncertainty around Chinese economy’s trajectory and the broader implications of international conflicts were noted as significant factors influencing Australia’s economic environment.

Japan’s Tokyo CPI core slows to 2.3% yoy in Nov, core-core still stick at 3.6% yoy

November’s inflation data in Japan’s capital Tokyo shows a notable slowdown. CPI core, which excludes fresh food, dropped from 2.7% yoy to 2.3% yoy, falling slightly below the expected 2.4%. This decline brings the reading further towards BoJ target of 2%.

Headline CPI also experienced a decrease, falling back to 2.6% yoy. This reduction comes after an unexpected rise from 2.8% yoy in September to 3.2% yoy in October.

Furthermore, CPI core-core, which excludes both food and energy, showed some progress. It declined from 3.8% yoy to 3.6% yoy, a reduction from its peak of 4.0% seen in July and August. However, the still relatively high CPI core-core reading indicates that underlying inflationary pressures remain persistent within the economy, despite the overall slowdown.

Japan’s PMI services finalized at 50.8, weakening in a year of strong growth

Japan’s PMI Services for November was finalized at 50.8, down from October’s 51.6, marking the weakest reading since November 2022. PMI Composite also fell to 49.6, down from 50.5 in the previous month, indicating the first contraction since December 2022.

Trevor Balchin, Economics Director at S&P Global Market Intelligence, contextualized these numbers, stating, “November data signalled a further loss of momentum in the services sector, but this should be viewed in the context of a year of strong growth.” He highlighted that Business Activity Index for 2023 is trending at 53.7, the highest annual reading since the survey’s inception in 2007.

Balchin also pointed out several positive aspects in the latest survey. The rise in new business, sustained employment growth, and the increase in outstanding work indicate ongoing economic activity. Furthermore, the 12-month outlook for activity improved and was “among the strongest on record”. Despite these optimistic signs, price pressures in November eased but remained above long-term trends.

China’s PMI services rose to 51.5 in Nov, composite rose to 51.6

China’s Caixin PMI Services rose from 50.4 to 51.5 in November, above expectation of 50.8. PMI Composite rose from 50.0 to 51.6.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the macroeconomy showed signs of a positive recovery, with steady growth in consumer spending, solid progress in industrial production and improved market expectations.

“However, due to various unfavorable factors, both domestic and external demand still face challenges and employment pressures remain relatively high. The foundation for economic recovery needs to be further consolidated.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0795; (P) 1.0845; (R1) 1.0886; More…

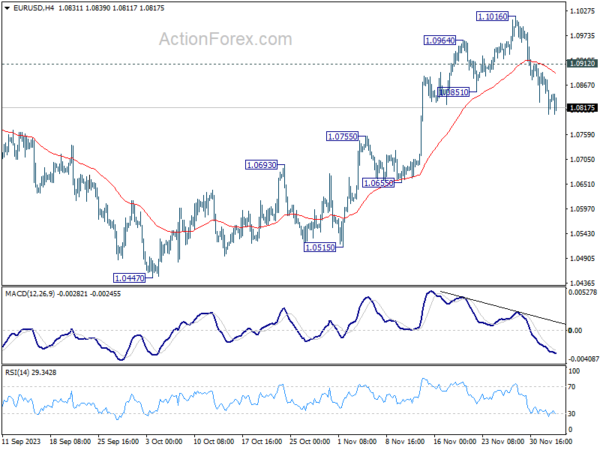

EUR/USD’s fall from 1.1016 is still in progress and intraday bias remains on the downside. Next target is 55 D EMA (now at 1.0770. Sustained break there will target 1.0447 support next. On the upside, above 1.0912 minor resistance will turn intraday bias neutral again first. Further break of 1.1016 will resume the rise from 1.0447 to retest 1.1274 high instead.

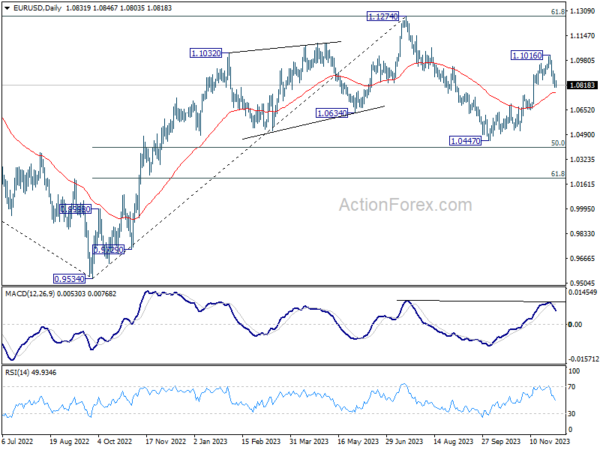

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is tentatively seen as the second leg. Hence while further rally could be seen, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 55 D EMA will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Nov | 2.60% | 3.30% | 3.20% | |

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Nov | 2.30% | 2.40% | 2.70% | |

| 23:30 | JPY | Tokyo CPI ex Food Energy Y/Y Nov | 3.60% | 3.80% | ||

| 00:30 | AUD | Current Account (AUD) Q3 | -0.2B | 3.5B | 7.7B | 7.8B |

| 01:45 | CNY | Caixin Services PMI Nov | 51.5 | 50.8 | 50.4 | |

| 03:30 | AUD | RBA Interest Rate Decision | 4.35% | 4.35% | 4.35% | |

| 07:45 | EUR | France Industrial Output M/M Oct | -0.30% | -0.20% | -0.50% | -0.60% |

| 08:45 | EUR | Italy Services PMI Nov | 49.5 | 48.2 | 47.7 | |

| 08:50 | EUR | France Services PMI Nov F | 45.4 | 45.3 | 45.3 | |

| 08:55 | EUR | Germany Services PMI Nov F | 49.6 | 48.7 | 48.7 | |

| 09:00 | EUR | Eurozone Services PMI Nov F | 48.7 | 48.2 | 48.2 | |

| 09:30 | GBP | Services PMI Nov F | 50.9 | 50.5 | 50.5 | |

| 10:00 | EUR | Eurozone PPI M/M Oct | 0.20% | 0.20% | 0.50% | |

| 10:00 | EUR | Eurozone PPI Y/Y Oct | -9.40% | -9.40% | -12.40% | |

| 14:45 | USD | Services PMI Nov F | 50.8 | 50.8 | ||

| 15:00 | USD | ISM Services PMI Nov | 52.6 | 51.8 |

breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending