In today’s trading, the USDJPY experienced a notable rebound, with its key technical targets positioned above, including the

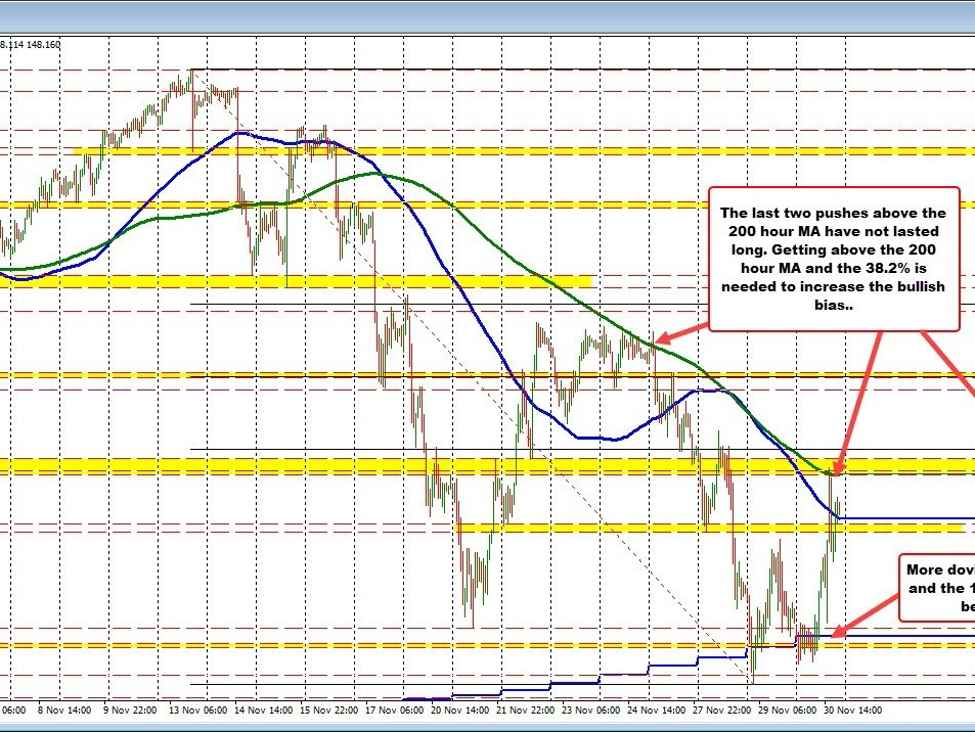

- 200-hour moving average at 148.45,

- a swing area between 148.44 and 148.59, and

- the 38.2% Fibonacci retracement of the decline from the November 13 high at 148.665.

The pair briefly surpassed the 200-hour moving average, reaching a high of 148.50 within the swing area. However, similar to Monday’s trading pattern, the upward momentum waned, and the price reversed downwards. This led to a drop to a low of 147.71, followed by a rise to 148.26. The 100-hour moving average currently stands at 148.077, suggesting a potential consolidation in price action.

Notably, tomorrow, although the first Friday of the month, will not feature the U.S. jobs report, which is scheduled for release next Friday, December 8. Attention is also focused on Fed Chair Powell’s two scheduled speeches at 11 AM ET and 2 PM ET, which will be the last public comments from a Fed official before the pre-decision blackout period ahead of the December 13 interest rate decision.

Market reactions will likely hinge on Powell’s tone; a more hawkish stance could push the USDJPY above the 38.2% retracement at 148.66, signaling further upside momentum. Conversely, a dovish tilt, akin to Fed Governor Waller’s recent stance, could see the pair challenge and potentially break through the 100-day moving average at 147.07, paving the way for further gains.

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)