The NASDAQ is on pace for its 2nd consecutive day to the downside. The price has been down 4 of the last 5 trading days. That sounds ominous, but the price is only down -0.85% over that period – with today’s decline of -0.78% the bulk of the decline. Also for the month, the index is still up 10.10%. So, we can’t be too alarmist about the daily losses over the last 5 trading days

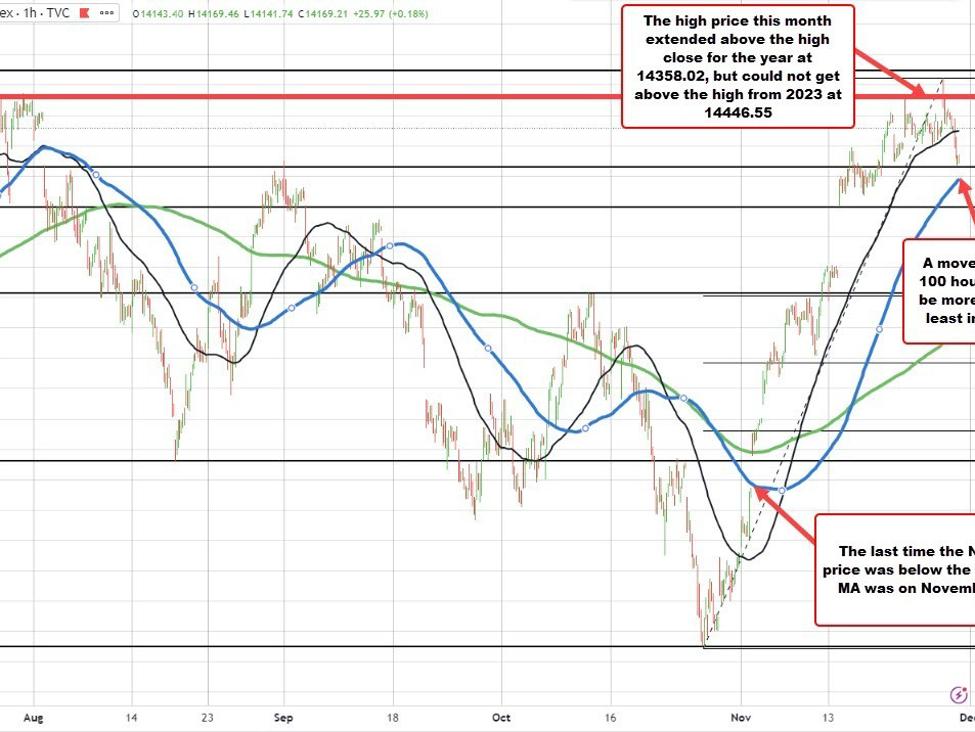

Nevertheless, in the short term, the price today fell below its 50-hour moving average at 14247.04 (black line on the chart above). It is approaching its rising 100-hour moving average that 14085.86. The last time the price was below the 100-hour moving average was back on November 1. So for nearly the whole month of November, the price has been above the 100-hour moving average. If there is more selling today, moving below that level would be a bearish tilt at least in the short term.

Looking at the hourly chart, the high price that we saw this month extended up to 14423.22. That high got within 23 points of the last swing high going back to July at 14446.55. The high close for 2023 was at 14358.02. The high price intraday extended above that high close level but could not sustain the momentum.

As a result, there may be some concern that a high is in place, and the larger correction is in order.

The 100 hour moving average will be a key barometer in the short term. Watch that level if more selling materializes today. Moving below would increase the bearish bias. Staying above it and the buyers are still in more control.

breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending