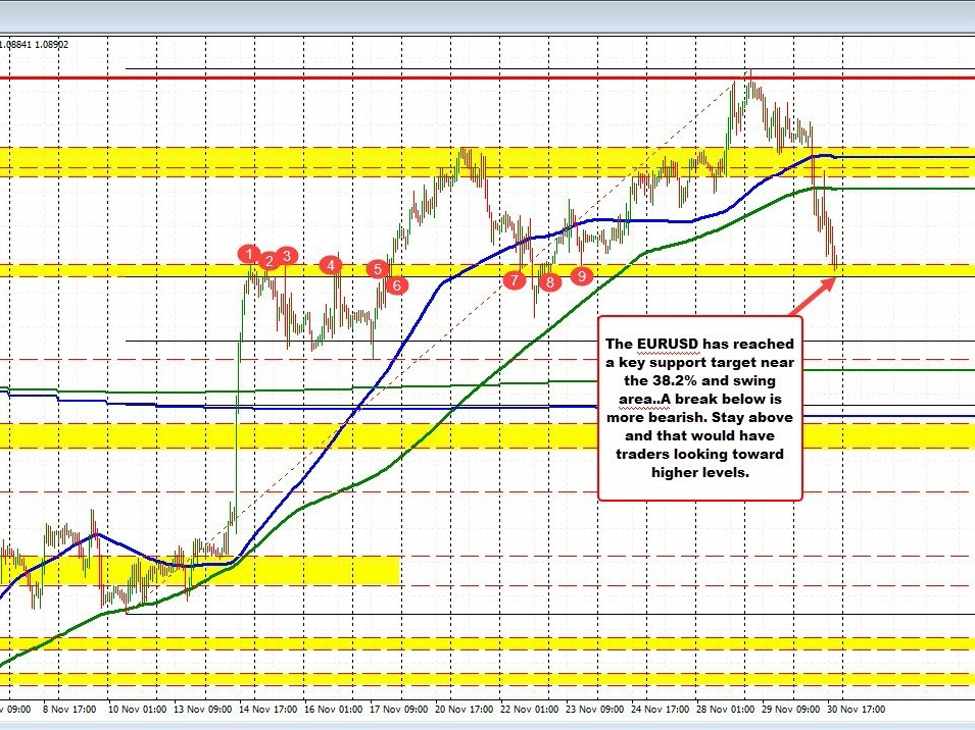

EURUSD falls to technical barometer near 38.2% retracement

The EURUSD pair recently hit a new session low, testing a critical swing area and the 38.2% Fibonacci retracement level, ranging between 1.0878 and 1.0887. The pair’s low touched 1.08829, influenced partly by the Eurozone CPI coming in weaker than expected, which favored the downside. Technically significant, the EURUSD fell below its 200-hour moving average for the first time since November 13. Post the release of U.S. data at 8:30, there was a brief spike above the 200-hour moving average, but this proved temporary as selling pressure resumed.

For a stronger bearish bias, the 38.2% retracement of the upward movement from the November 10 low needs to be decisively broken. Notably, a similar dip below this level occurred on November 22, but the price remained above the 200-hour moving average then, prompting a shift from selling to buying. However, the recent break below the 200-hour moving average has tilted the balance in favor of the sellers. Despite this, the proximity to the 38.2% retracement level and the swing area is causing some hesitation among traders, as it presents a well-defined risk limitation point.

Looking ahead, tomorrow’s speech by Fed Chair Powell is highly anticipated and will likely have a significant impact on the EURUSD’s trajectory. His remarks could either bolster the EURUSD (weakening the U.S. dollar) or apply further bearish pressure (strengthening the U.S. dollar), depending on the tone and content of his address.