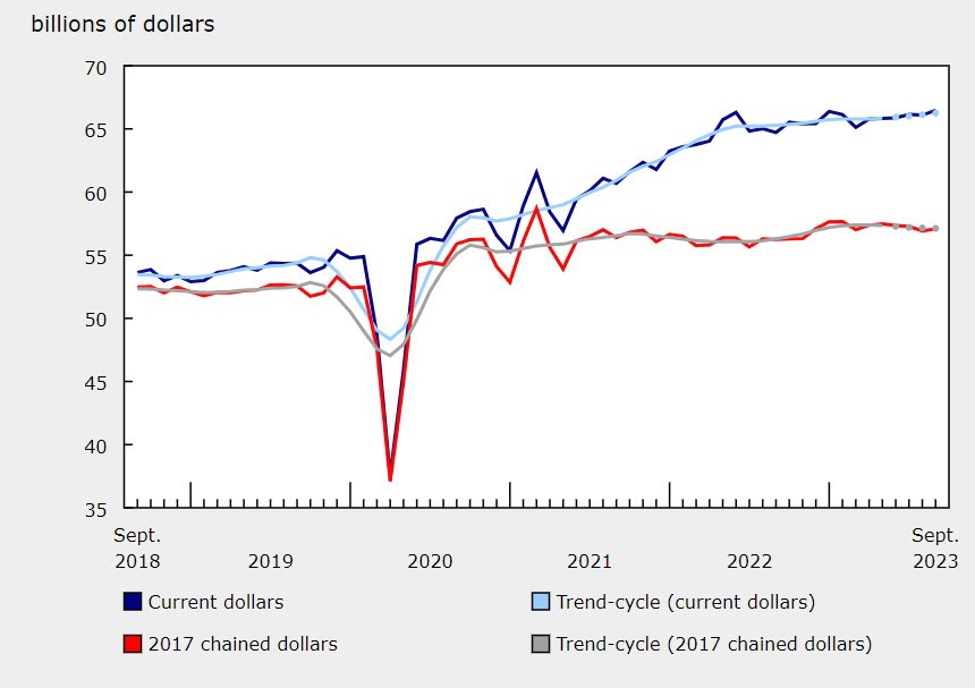

Canada retail sales

Friday’s Canadian retail sales report for September far-surpassed expectations at +0.6% compared to a flat reading expected. In addition, the advance reading for October was +0.8% in a sign of even-more strength.

CIBC highlights a contrast in consumer spending patterns in the report. While auto sales surged, there was a noticeable dip in discretionary spending in areas like clothing, sporting goods, and furniture. The latter could reflect the ongoing correction in house prices and a slowdown in home sales.

“The September print suggests that overall GDP in that month will have looked slightly better

than the advance estimate, at 0.1% m/m,” CIBC writes. “And while the underlying core group of sales continues to suggest a wilting

consumer, solid auto sales may prevent another drop in goods consumption in the final quarter.”

CIBC also notes that the October print could have been impacted by auto sales, which surged in part due to a delay in deliveries following a port strike.

Looking ahead, the risk here is that strong car sales hide a broader weakening of the consumer and delay Bank of Canada rate cuts beyond what’s prudent. Ultimately, that could kneecap the spring housing market and lead to a deeper downturn.