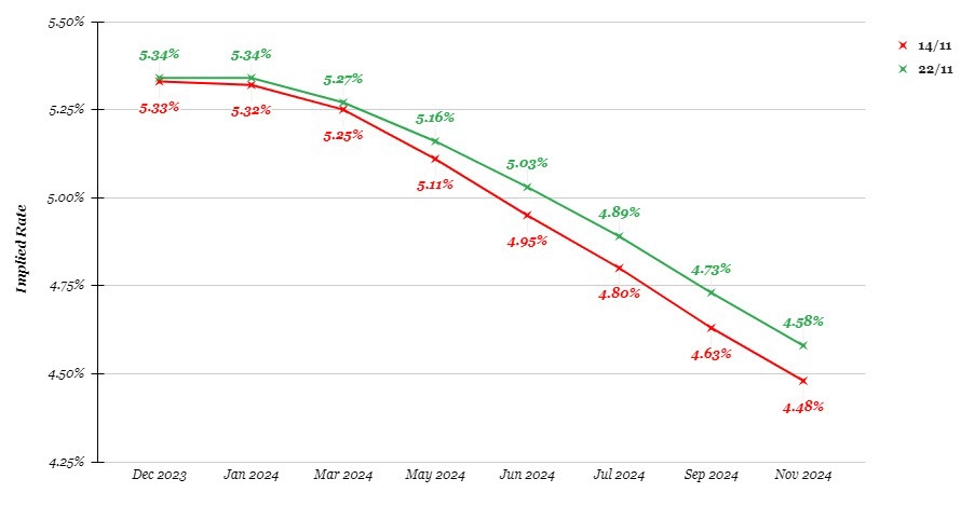

There has been a myriad of reasons why the dollar is dropping in the last week. But as it turns out, softening Fed odds is not exactly one of them. Here’s a look at the Fed funds futures curve since after the US CPI data:

Sure, the latest snapshot is still reflecting softer odds compared to before the US CPI data on the same day (14/11) itself. But since then, markets have actually repriced lesser odds of a rate cut i.e. Fed will be sticking with a higher for longer narrative.

I think that’s important to note when trying to identifying what is going wrong for the dollar right now. And if there are reasons to pin that down to, it seems like a combination of lower yields, a couple of technical breakdowns, and a squeeze of sorts seem to be the best answer.