Investor sentiment is riding high in the wake of the latest US CPI report, with a notable surge in the DOW futures, climbing over 300 points, and a marked drop in 10-year yield, plunging from above 4.6% to below 4.5%. The report presented a picture of easing inflation, with both headline and core inflation rates falling short of market expectations. Significantly, core CPI has reached its lowest point in over two years. The weaker monthly price rise also bolsters the notion that disinflation is underway. This development could potentially revive Fed Chair Jerome Powell’s “confidence” that the existing monetary policy is sufficiently restrictive to steer inflation back towards target.

In the currency markets, Dollar is experiencing broad decline following CPI release, with EUR/USD notably breaking through a critical resistance level at 1.076. The upbeat risk sentiment is propelling Australian and New Zealand Dollars, while other European currencies are also exhibiting strong performance. Canadian Dollar and Japanese Yen, despite trailing behind, are still recording substantial gains against the greenback.

From a technical perspective, the significant rebound in Gold, propelled by Dollar’s weakness, suggests that the correction from 2009.26 high might have concluded at 1931.39. This turnaround occurred after Gold found support from 38.2% retracement of 1810.26 to 2009.26 at 1933.24. Focus is now on 1965.34 resistance. A decisive break through here would strengthen the bullish scenario and set the stage for a retest of 2009.26 high.

In Europe, at the time of writing, FTSE is down -0.34%. DAX is up 0.50%. CAC is up 0.12%. Germany 10-year yield is down -0.0727 at 2.648. Earlier in Asia, Nikkei rose 0.34%. Hong Kong HSI dropped -0.17%. China Shanghai SSE rose 0.31%. Singapore Strait Times dropped -0.07%. Japan 10-yer JBG yield fell -0.0202 to 0.856.

US CPI core down to 4%, lowest since Sep 2021

US CPI slowed from 3.7% yoy to 3.2% yoy in October, below expectation of 3.3% yoy. CPI core (less food and energy) fell from 4.1% yoy to 4.0% yoy, below expectation of being unchanged at 4.1% yoy. That’s the lowest core CPI reading since September 2021. Energy index was down -4.5% yoy. Food index was up 3.3% yoy.

For the month, CPI was flat at 0.0% mom, below expectation of 0.1% mom. CPI core rose 0.2% mom, below expectation of 0.3% mom. Energy index fell -2.5% mom. Food index rose 0.3% mom.

Germany’s ZEW economic sentiment surges to 9.8, suggesting bottoming out

Germany’s ZEW Economic Sentiment soared to 9.8 in November, far surpassing the anticipated 4.9, signaling increasing optimism among financial market experts. However, Current Situation Index barely moved, nudging from -79.9 to -79.8, and falling short of expected -75.5.

Eurozone’s ZEW Economic Sentiment experienced a similar upswing, rising from 2.3 to 13.8, well ahead of the forecast of 6.1. Despite this, Current Situation Index in Eurozone showed a decline, dropping by -9.4 points to -61.8.

Achim Wambach, ZEW President, noted that while current economic conditions are still challenging, there’s growing optimism. He added, “These observations support the impression that the economic development in Germany has bottomed out.”

The increase in economic expectations is supported by a more positive view of the German industrial sector and both domestic and foreign stock markets. Additionally, “inflation and short- and long-term interest rates also appear to have reached turning points in expectations,” he added.

SNB’s Jordan: Price stability not ensured, won’t hesitate to tighten further

In today’s remarks at a central bank conference in Zurich, SNB Chairman Thomas Jordan warned that “price stability may not yet be ensured.” He pledged that the central bank “will not hesitate to tighten monetary policy further if necessary.”

This statement comes as inflation have dipped and interest rates have risen compared to last year, presenting a challenging environment for policy to balance the risk of tightening too much and too little.

“Given the high uncertainty regarding the economic outlook, there is no clearly mapped-out path for monetary policy in the near future,” he remarked.

With SNB’s next policy meeting scheduled for December 15, market expectations currently lean towards maintaining policy rate at 1.75%.

UK payrolled employment rose 33k in Oct, unemployment rate unchanged at 4.2% in Sep

UK payrolled employment rose 33k, or 0.1% mom in October. Over the year, payrolled employment rate 398k or 1.3% yoy. Median monthly pay rose 5.9% yoy, down from prior month’s 6.0% yoy. Claimant count rose 17.8k, above expectation of 15.0k.

In the three months to September, unemployment rate was unchanged at 4.2%, matched expectations. Average earnings including bonus rose 7.9% yoy, above expectation of 7.4%, slowed from prior 8.2%. Average earnings excluding bonus rose 7.7% yoy, matched expectations, slowed from prior month’s 7.8%.

Australia’s consumer sentiment plummets post RBA rate hike

Australia’s Westpac Consumer Sentiment Index saw a significant decline in November, dropping by -2.6% mom to 79.9, reflecting a deepening pessimism among consumers.

Westpac attributed this drop to the recent RBA rate hike, noting a -6% decrease in confidence during the survey period. Despite the overarching pessimism, labor market confidence and housing-related sentiment remained relatively stable.

Westpac further commented, “The Reserve Bank Board next meets on December 5. The November Consumer Sentiment survey highlights the weak and uneven conditions across Australia’s consumer sector. How this plays out for wider domestic demand in the context of strong population growth is something the Board will need to consider as it acts to ensure inflation returns to target.”

Australia NAB business confidence dips to -2, conditions resilient

In Australia, NAB reported a dip in Business Confidence for October, falling from 0 to -2. However, Business Conditions saw a slight improvement, rising from 12 to 13. Notably, trading conditions increased from 18 to 20, and profitability conditions improved from 9 to 12, while employment conditions slightly decreased from 9 to 8.

NAB Chief Economist Alan Oster commented, “Business conditions remain healthy, picking up in October and still well above average. Still, business confidence remained soft in the month, still well below average at -2 index points.” He highlighted the persistent gap of 10-15 index points between current conditions and the more forward-looking confidence indicator, emphasizing that “Businesses clearly remain cautious about the outlook for the economy despite the resilience we are seeing.”

The report also noted a slowdown in price and cost growth. Labour cost growth eased to 1.8% in quarterly equivalent terms, and purchase cost growth declined to 1.8%. Retail price growth remained stable at 1.9%, while overall price growth eased to 1.0%, marking the slowest rate since July 2020.

Oster added, “The Q3 CPI showed inflation had been persistent through the middle of the year and the survey suggests this remained the case heading into Q4. We still expect to see gradual moderation over time but it will be a protracted process, especially given the resilience of domestic demand thus far.”

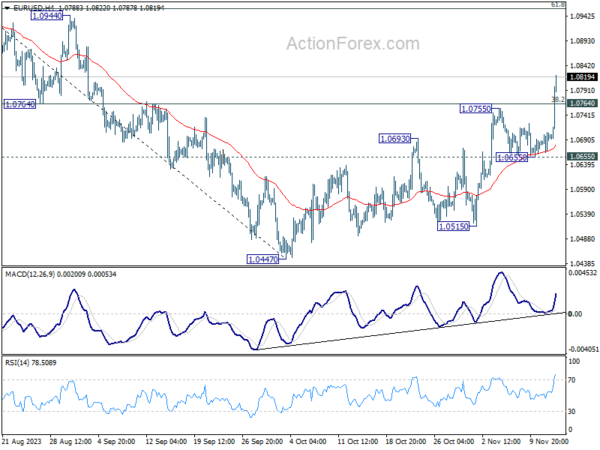

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0674; (P) 1.0690; (R1) 1.0715; More…

EUR/USD’s rebound from 1.0447 resumed by breaking through 1.0755 resistance and intraday bias is back on the upside. The strong break of 1.0764 cluster resistance (38.2% retracement of 1.1274 to 1.0447 at 1.0763) confirms that fall from 1.1274 has already completed. Intraday bias is back on the upside for 61.8% retracement at 1.0958 next. For now, near term outlook will stay bullish as long as 1.0655 support holds, in case of retreat.

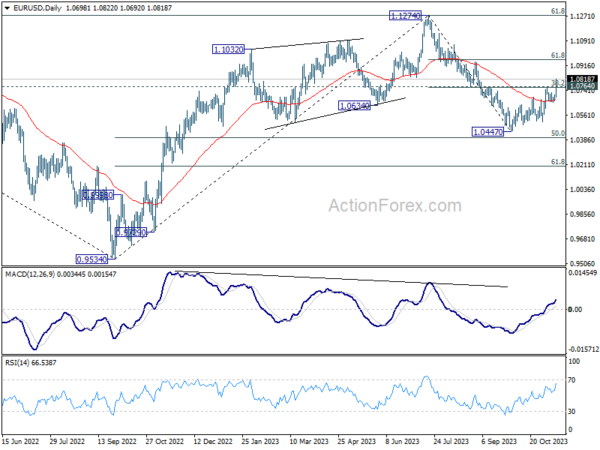

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is tentatively seen as the second leg. Hence while further rally could be seen, upside should be limited by 1.1274 to bring the third leg of the pattern. However, break of 1.0447 will resume the fall to 61.8% retracement of 0.9543 to 1.1274 at 1.0199.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Nov | -2.60% | 2.90% | ||

| 00:30 | AUD | NAB Business Conditions Oct | 13 | 11 | 12 | |

| 00:30 | AUD | NAB Business Confidence Oct | -2 | 1 | 0 | |

| 07:00 | GBP | Claimant Count Change Oct | 17.8K | 15.0K | 20.4K | |

| 07:00 | GBP | ILO Unemployment Rate (3M) Sep | 4.20% | 4.20% | 4.20% | |

| 07:00 | GBP | Average Earnings Including Bonus 3M/Y Sep | 7.90% | 7.40% | 8.10% | 8.20% |

| 07:00 | GBP | Average Earnings Excluding Bonus 3M/Y Sep | 7.70% | 7.70% | 7.80% | |

| 07:30 | CHF | Producer and Import Prices M/M Oct | 0.20% | 0.10% | -0.10% | |

| 07:30 | CHF | Producer and Import Prices Y/Y Oct | -0.90% | -1.00% | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q3 P | -0.10% | -0.10% | -0.10% | |

| 10:00 | EUR | Eurozone Employment Change Q/Q Q3 P | 0.30% | 0.20% | 0.20% | |

| 10:00 | EUR | Germany ZEW Economic Sentiment Nov | 9.8 | 4.9 | -1.1 | |

| 10:00 | EUR | Germany ZEW Current Situation Nov | -79.8 | -75.5 | -79.9 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Nov | 13.8 | 6.1 | 2.3 | |

| 13:30 | USD | CPI M/M Oct | 0.00% | 0.10% | 0.40% | |

| 13:30 | USD | CPI Y/Y Oct | 3.20% | 3.30% | 3.70% | |

| 13:30 | USD | CPI Core M/M Oct | 0.20% | 0.30% | 0.30% | |

| 13:30 | USD | CPI Core Y/Y Oct | 4.00% | 4.10% | 4.10% |