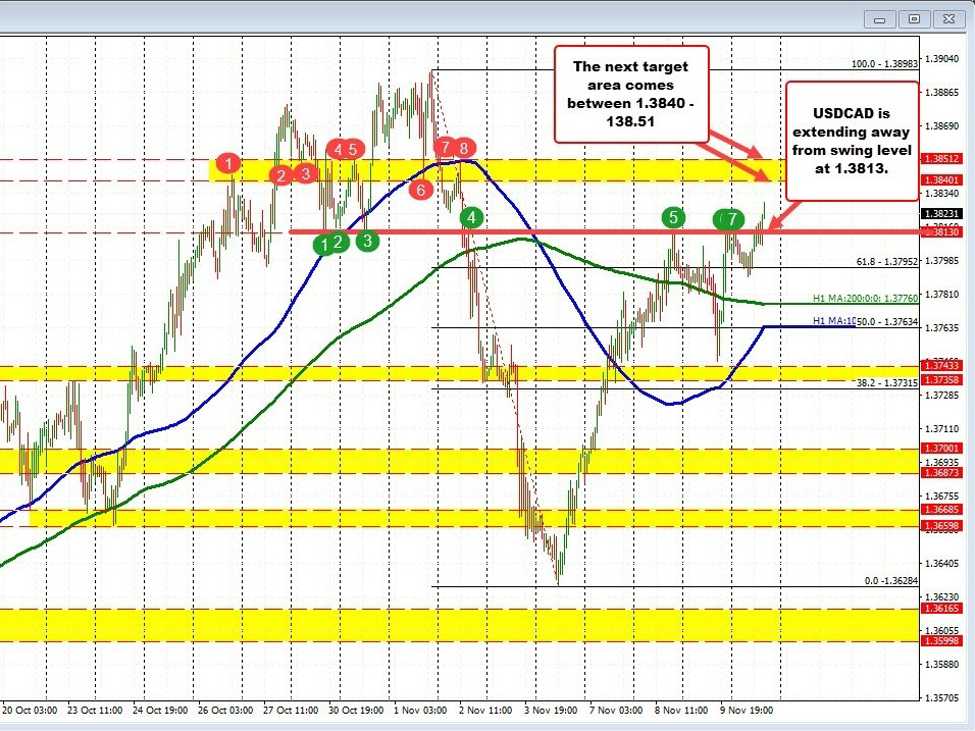

The USDCAD is extending higher on the day (see hourly chart below), and in the process is trading to new highs for the week as well. The high price in the USDCAD just reached 1.38292.

Looking at the hourly chart below, the pair is also extending away from a swing level near 1.3813. Looking at the hourly chart, that level was near lows on October 30 and October 31. On November 2, the price fell below that level on its way to the low price reached on Monday at 1.36284.

On Monday, the price started to rebound to the upside help by lower oil prices, but when the rally reached the 1.3813 level on Wednesday, sellers leaned as risk could be defined and limited. After a correction lower on Thursday, the price again snapped back higher to retest that level near the close of trading yesterday.

Today, the price in the London morning session traded above and below the level with little momentum in either direction. However, early North American trading is seeing more interest to the upside.

Staying above the 1.3813 level is now a close risk for intraday traders. On the top side, the 1.3840 – 1.38512 (see red numbered circles on the chart below) represents the next upside target.

USDCAD extend away from 1.3813 swing level

Taking a broader look at the daily chart below, the high prices going back to March reached up to 1.38602. That area also corresponds with swing highs going back to October 2022 (see red numbered circles 1 and 2 on the chart below). So we moved above the 1.3851 level on the hourly chart has additional resistance at 1.3860 going back in time. The high price from 2022 reached up to 1.39748. That was the highest level going back to May 2020.

USDCAD on the daily chart below