There’s a noticeable lack of a unifying theme in the forex markets today, largely attributed to an empty economic calendar across European and North American regions. Both Australian Dollar and British Pound are seeing a rebound from their recent downturns, particularly noticeable in currency crosses. However, the continuation of this momentum hinges significantly on impending economic data releases. Key reports to watch include Australian consumer and business confidence, along with UK employment data set to be unveiled tomorrow.

Dollar is trailing closely behind as the third strongest currency for the day. Meanwhile, Japanese Yen has seen a slight stabilization from its earlier steep selloff. However, Yen’s recovery is relatively modest and is confined to a select few currencies. The Japanese currency still seems poised to challenge its multi-decade low against Dollar, but market participants may reserve their major trading decisions on USD/JPY until release of US CPI data tomorrow.

Swiss Franc finds itself at the bottom of the performance chart today, facing additional downward pressure due to the resumed rally in EUR/CHF. Similarly, New Zealand Dollar and Canadian Dollar are also among the weaker performers, further weighed down by Aussie’s rebound against them. Euro, in contrast, presents a mixed picture, showing signs of vulnerability in several pairings except against Swiss Franc.

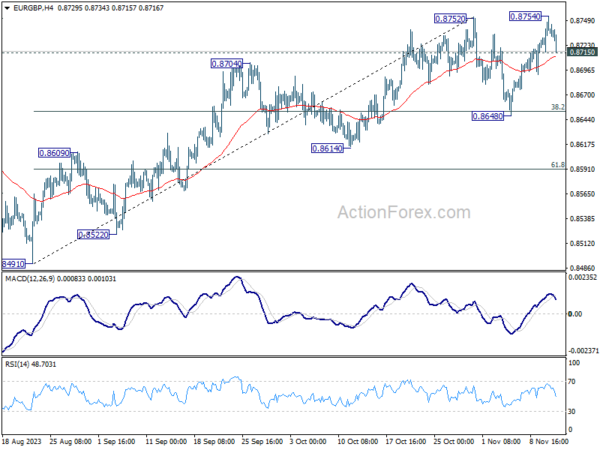

Technically, EUR/GBP is worth some attention in this quiet session. Firm break of 0.8715 minor support will argue that rebound from 0.8648 has completed after rejection by 0.8752 resistance. Fall from 0.8754 would then be seen as the third leg of the corrective pattern from 0.8752, and target 0.8648 support again. Nevertheless, in this case, strong support should emerge around 0.8648 to contain downside to complete the consolidation, and finally bring resumption of whole rise from 0.8491.

In Europe, at the time of writing, FTSE is up 0.63%. DAX is up 0.19%. CAC is up 0.29%. Germany 10-year yield is down -0.0221 at 2.697. Earlier in Asia, Nikkei rose 0.05%. Hong Kong HSI rose 1.30%. China Shanghai SSE rose 0.25%. Singapore Strait Times dropped -0.91%. Japan 10-year JGB yield rose 0.0192 to 0.877.

ECB’s de Guindos foresees temporary inflation rebound, December forecasts crucial for policy assessment

In a speech today, ECB Vice President Luis de Guindos said the central bank expects “a temporary rebound” in inflation in the coming months as base-effect drops out of calculations. However, he emphasized that ECB foresees the overall disinflationary process to continue over the medium term.

De Guindos highlighted the unpredictability surrounding energy prices due to geopolitical tensions and fiscal policy impacts, along with the potential upward pressure on food prices resulting from adverse weather events and the broader climate crisis.

Despite a marked decrease in inflation, de Guindos warned that it is expected to remain high for an extended period, with persistent domestic price pressures. “We will therefore ensure that our policy rates will be set at sufficiently restrictive levels for as long as necessary,” he affirmed.

Emphasizing the ECB’s data-dependent approach, de Guindos stated, “Our future decisions on policy rates will continue to be taken on a meeting-by-meeting basis.” He added that the ECB’s December meeting, armed with fresh macroeconomic projections and additional data, will be crucial for reassessing the inflation outlook and necessary policy actions.

Japan’s wholesale inflation eases to 0.8% yoy, continued downward trend

Japan’s corporate goods price index, a key indicator of wholesale inflation, exhibited a significant slowdown in October, underscoring a continued trend of easing price pressures.

The index increased by just 0.8% yoy, falling short of the anticipated 0.9% yoy and marking its first dip below 1% since February 2021. This latest figure also represents the 10th consecutive month of slowing wholesale inflation.

The deceleration in the CGPI can be largely attributed to decreases in the prices of specific commodities. Notably, costs for wood, chemical, and steel products experienced declines, reflecting the broader impact of reduced global commodity prices.

Export price index saw an uptick from 0.5% yoy to 1.0% yoy. Import price index showed a lesser decline, moving from -15.5% yoy to -12.5% yoy.

RBA’s Kohler warns of bumpy road ahead in tackling inflation

In a speech, Marion Kohler, Acting Assistant Governor of RBA, remarked that decline in inflation is expected to be a “more gradual process than previously thought.”

This outlook stems from the current economic environment characterized by “still-high level of domestic demand” and “strong labour” alongside other cost pressures. These factors contribute to the prediction that inflation will hover just below 3% by the end of 2025.

The Assistant Governor pointed out that the recent trend of declining inflation has primarily been “driven by lower goods price inflation.” In stark contrast, “domestically sourced inflation” – especially in the services sector – has shown resilience, being “widespread and slow to decline.”

Kohler also underscored the nuanced challenges in the next phase of controlling inflation, which she anticipates to be “more drawn out than the first.” This outlook aligns with experiences in other advanced economies that have faced similar inflationary patterns.

Furthermore, she cautioned about the potential for unforeseen challenges, citing the recent increase in fuel prices as an example of supply shocks that could unpredictably influence headline inflation.

Kohler emphasized the uncertain nature of the journey ahead in managing inflation, stating, “the road ahead could be bumpy.”

New Zealand BNZ services fell to 48.9, contraction with economic angst

New Zealand’s BusinessNZ Performance of Services Index experienced a notable dip in October, falling from 50.6 to 48.9, a level indicative of contraction in the sector. This decline also positions the index well below its long-term average of 53.5.

Activity and sales experienced a significant drop, moving from 50.9 to 47.4. There was also a downturn in employment, which decreased from 50.5 to 49.3. New orders and business fell as well,from 53.9 to 51.9. On a more positive note, stocks and inventories saw an increase, rising from 48.0 to 51.1, and supplier deliveries edged up slightly from 49.7 to 49.8.

Despite these declines, the proportion of negative comments in October decreased to 58.2%, a reduction from 61.8% in September and 63.9% in August, indicating a slight improvement in business sentiment.

BNZ Senior Economist Craig Ebert said that “combined, the PSI (48.9) and PMI (42.5) paint a picture of economic angst. This counsels caution around GDP for Q3, after it posted a surprising gain of 0.9% in Q2”.

EUR/USD Mid-Day Outlook

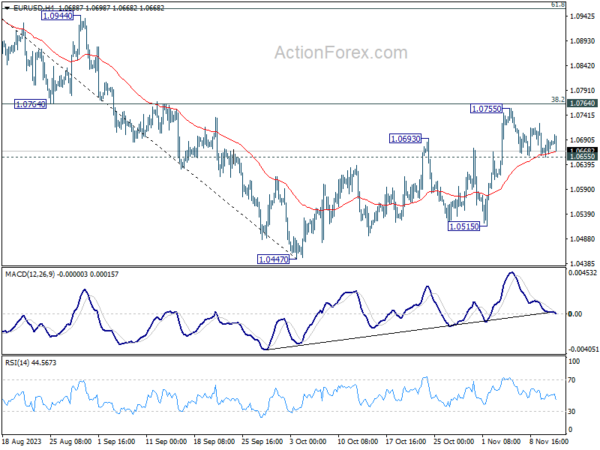

Daily Pivots: (S1) 1.0663; (P) 1.0678; (R1) 1.0700; More…

Intraday bias in EUR/USD stays neutral at this point. On the downside, break of 1.0655 minor support, and sustained trading below 55 4H EMA (now at 1.0664), will argue that the rebound from 1.0447 has completed with three waves up to 1.0755. That came after rejection by 1.0764 cluster resistance (38.2% retracement of 1.1274 to 1.0447 at 1.0763). In this case, intraday bias will be turned back to the downside for 1.0447/0515 support zone. Nevertheless, strong bounce from current level, followed by decisive break of 1.0764, will bring stronger rally to 61.8% retracement at 1.0958 next.

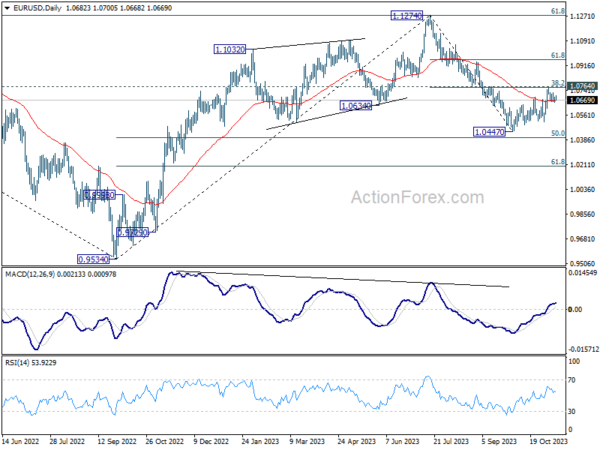

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is tentatively seen as the second leg. Hence while further rally could be seen, upside should be limited by 1.1274 to bring the third leg of the pattern. However, break of 1.0447 will resume the fall to 61.8% retracement of 0.9543 to 1.1274 at 1.0199.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PSI Oct | 48.9 | 50.7 | ||

| 23:50 | JPY | PPI Y/Y Oct | 0.80% | 0.90% | 2.00% | 2.20% |

| 06:00 | JPY | Machine Tool Orders Y/Y Oct P | -20.60% | -11.20% |