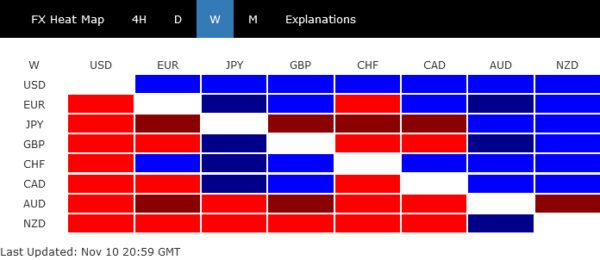

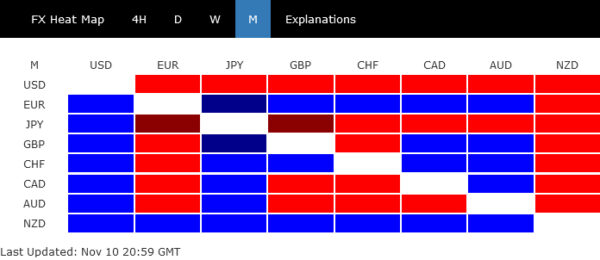

Dollar emerged as the best performer last week, fueled by hawkish remarks from Fed Chair Jerome Powell. The greenback’s surge raises questions: is this merely a recovery from recent losses, or the beginning of a new uptrend? While Dollar gains support, rising risk-on sentiment in the markets seems to limit its ascent. On the other hand, the potential for a bounce in treasury yields could bolster Dollar’s position. The tug-of-war between bullish and bearish forces could continue, and it remains uncertain which one will ultimately prevail.

Conversely, the Australian Dollar surprisingly ranked as the week’s weakest performer, despite RBA’s hawkish rate hike and thawing diplomatic relations with China. This unexpected turn could be attributed to growing concerns over China’s economic struggles, a sentiment echoed in the underperformance of Hong Kong stocks and Copper.

Elsewhere in the currency markets, Swiss Franc and the Euro closed the week as strong contenders, trailing closely behind Dollar in terms of performance. New Zealand Dollar didn’t fare much better than Aussie, ending the week as the second weakest, closely followed by Japanese Yen. British Pound and Canadian Dollar showed a mixed performance amidst these market dynamics.

Dollar rebounds on Fed Powell’s hawkish tone, risk sentiment and yields to guide next moves

Dollar emerged as the strongest currency, buoyed by Fed Chair Jerome Powell’s hawkish remarks. Despite this, the greenback stopped short of surpassing the previous week’s highs against major counterparts, and it remains the weakest performer for the month so far.

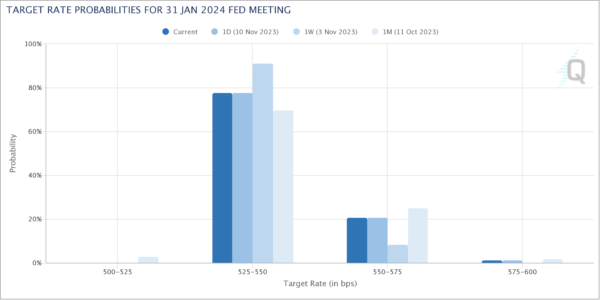

At an IMF event, Powell expressed doubt about the current monetary policy’s efficacy in reducing inflation to the Fed’s 2% target. In his word, “we are not confident that we have achieved such a stance.” His commitment to further tightening monetary policy, if necessary, coupled with caution about the unpredictable nature of inflation (“Inflation has given us a few head fakes”), underscored the Fed’s readiness to act.

Market reactions to Powell’s statement are evident in the adjustments of Fed funds futures. While the likelihood of a rate hike in December is still modest at 9.1%, expectations for January have surged to over 20%, marking a significant rebound from a mere 8.7% a week earlier.

Dollar index rebounded notably last week even though upside momentum was not very convincing. For now, DXY should still be extending the consolidation pattern from 107.34. Another dip cannot be ruled out. But as long as 38.2.% retracement of 99.57 to 107.34 at 104.37 holds, rise from 99.57 should still resume through 107.34 at a later stage. However, firm break of 104.37 will raise the chance of bearish reversal, or as a correction, drag DXY to 61.8% retracement at 102.53.

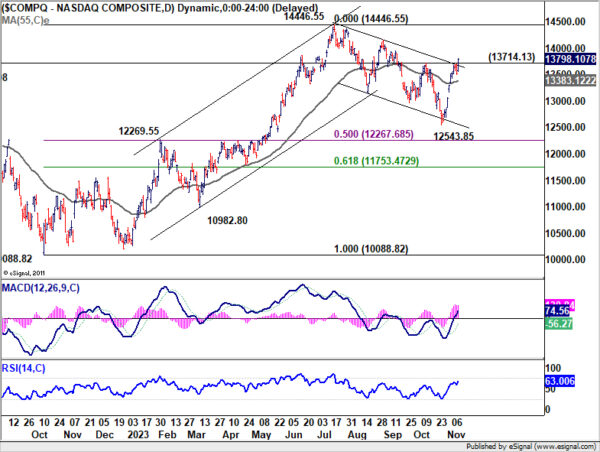

One unfavorable development for Dollar is the strengthening of risk-on sentiment in the US. After some hesitation, NASDAQ surged through 13714.13 resistance on Friday, as well as falling channel resistance. The development affirms the case that correction from 14446.55 has completed at 12543.85 already. For now, further rise is expected as long as 55 D EMA (now at 13383.12) holds. Retest of 14446.55 should be seen next.

On the other hand, stabilization in 10-year yield could give the greenback a helping hand. The pull back from 3.997 halted after drawing support. Break of 4.703 resistance would set up stronger rebound towards 4.997, as the second leg of the corrective pattern from there. In case of another fall, TNX should be able to draw strong support from 38.2.% retracement of 3.253 to 4.997 at 4.330, at least on first attempt.

Australian dollar’s unexpected tumble: hawkish RBA and China concerns weigh in

Australian Dollar faced a surprising downturn, becoming the worst performer among major currencies despite several seemingly positive developments. The decline commenced following RBA’s anticipated decision to hike cash rate by 25 bps to 4.35%. Adding to the hawkish tone, the Statement on Monetary Policy on Friday revised inflation projections upwards and projected stronger growth, hinting at a potential cash rate peak around 4.50% instead of 4.35%.

On the diplomatic front, Australian Prime Minister Anthony Albanese’s visit to China, the first by an Australian PM in seven years, marked a significant step towards stabilizing relations. The joint statement on climate change and trade, alongside the resumption of annual leader talks, were positive developments. Albanese’s invitation to Chinese President Xi Jinping and his reciprocal invitation for future visits underscored a thawing in bilateral relations.

However, Australian Dollar’s slump raises questions. While part of the decline can be attributed to US Dollar’s strength following Fed Chair Jerome Powell’s hawkish remarks, it doesn’t fully explain Australian Dollar’s underperformance against Canadian and New Zealand Dollars.

One key factor is the lingering concern over China’s economic recovery. Despite the IMF’s upward revision of China’s growth forecasts to 5.4% this year and 4.6% in 2024, investor confidence remained tepid. The Hang Seng Index’s weakness highlight the market’s skepticism.

Technically, HSI was once again rejected by 55 D EMA to close at 17203.26. The development suggests that medium term fall from 22700.85 is still in progress. Break of 16879.66 support will resume the decline to 100% projection of 22700.85 to 18044.85 from 20361.02 at 15705.02.

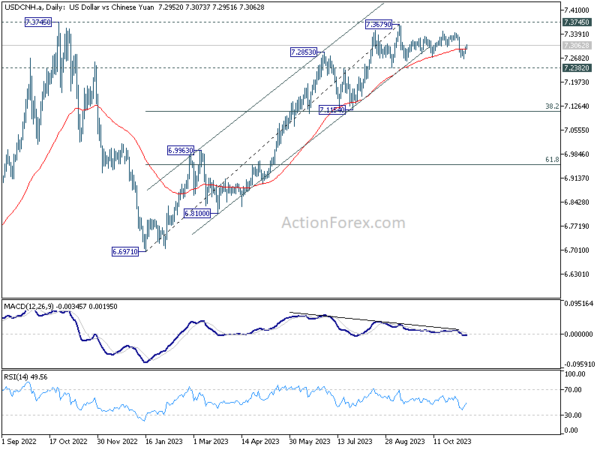

The off-shore Chinese Yuan’s struggle against US Dollar further illustrates the cautious sentiment. USD/CNH rebounded after dipping to 7.2661. The development argues that price actions from 7.3679 are merely a sideway consolidation pattern in the larger up trend from 6.6971. That is, another rally through 7.2679/3745 key resistance remains in favor.

Additionally, the late-week decline in copper prices reflecting broader concerns about global economic health and demand for commodities from China. Recovery from 3.502 could have already completed after failing to sustain above 55 D EMA. Retest of 3.502 could be seen next. Firm break there will resume the fall from 4.3556 to 100% projection of 4.3556 to 3.5387 from 4.0145 at 3.1976.

In the currency markets, AUD/NZD’s extended fall last week suggests that rebound from 1.0620 has already completed at 1.0942. While fall from 1.0942 could be just a leg in the medium term sideway pattern, deeper decline is expected as long as 1.0859 minor resistance holds, towards 1.0620 support.

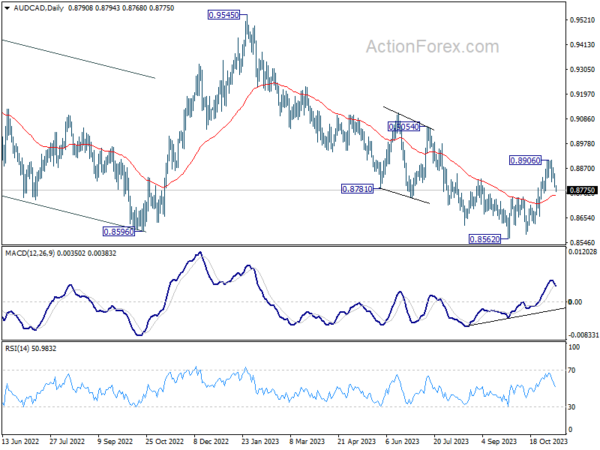

AUD/CAD’s decline last week confirmed short term topping at 0.8906. Immediate focus is now on 55 D EMA (now at 0.8752). Sustained break there will pave the way to retest 0.8562 low, with prospect of resuming larger down trend from 0.9545.

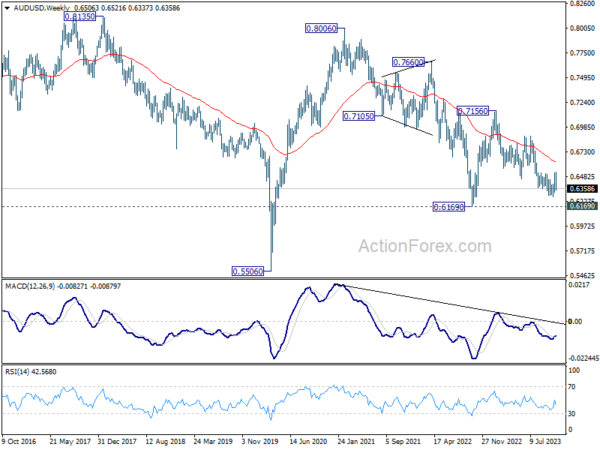

AUD/USD Weekly Report

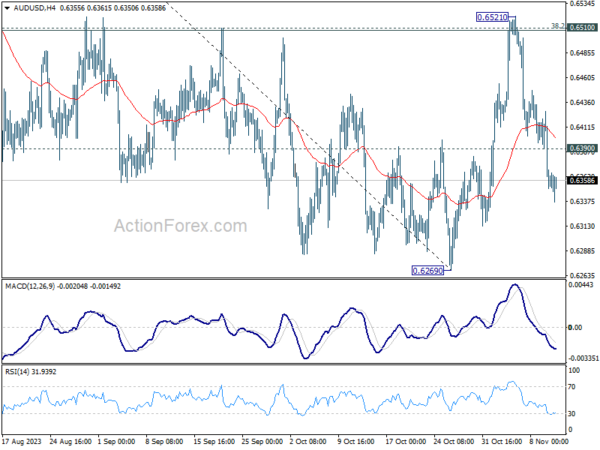

AUD/USD’s steep decline last week argues that rebound from 0.6269 has completed at 0.6521. Initial bias remains mildly on the downside this week for retesting 0.6269 low. On the upside, above 0.6390 minor resistance will turn intraday bias neutral first, and bring consolidations, before staging another fall.

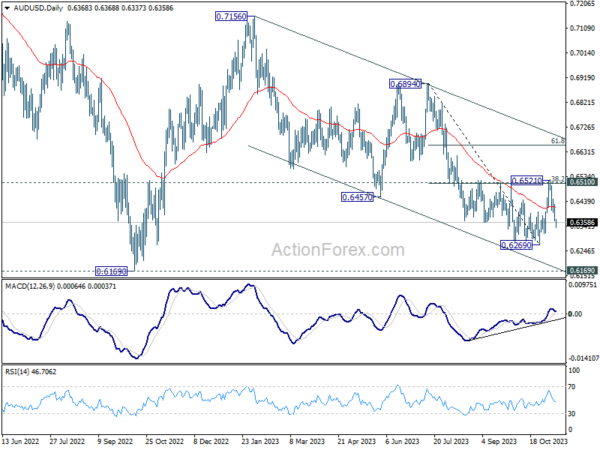

In the bigger picture, rejection by 0.6510 cluster resistance (38.2% retracement of 0.6894 to 0.6269 at 0.6508) keeps medium term outlook bearish. Fall from 0.7156 (2023 high) is still in progress. Break of 0.6269 will resume the down trend and target 0.6169 (2022 low). Nevertheless, firm break of 0.6521 will now indicate medium term bottoming, and bring stronger rebound.

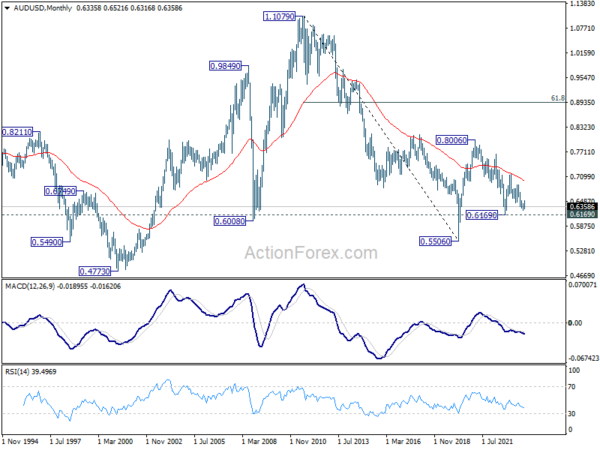

In the long term picture, the down trend from 1.1079 (2011 high) should have completed at 0.5506(2020 low) already. It’s unsure yet whether price actions from 0.5506 are developing into a corrective pattern, or trend reversal. But in either case, fall from 0.8006 is seen the second leg of the pattern. Hence, in case of deeper decline, downside strong support should emerge above 0.5506 to bring reversal.