As US session unfolds, the Dollar is showing signs of rally, buoyed by recovery in benchmark treasury yield. This modest uplift comes despite a general lack of direction owing to a sluggish risk sentiment across markets. Euro is losing momentum as its earlier recovery falters, whereas other European majors are also on the back foot. Commodity currencies seem to garner strength while Yen is mixed.

The market is bracing for potential volatility with key economic releases on the horizon. RBA’s Statement on Monetary Policy is poised to unveil new economic projections, which market participants will scrutinize for the economic outlook and indications of future policy direction. This comes after Australian Dollar faced selling pressure following the RBA’s rate hike earlier in the week.

In the UK, investors and BoE will be turning their attention to the upcoming GDP data to gauge the economic climate and evaluate the necessity of further interest rate adjustments. These forthcoming insights have the potential to catalyze movements in Sterling, which is presently in a wait-and-see mode alongside other major currencies.

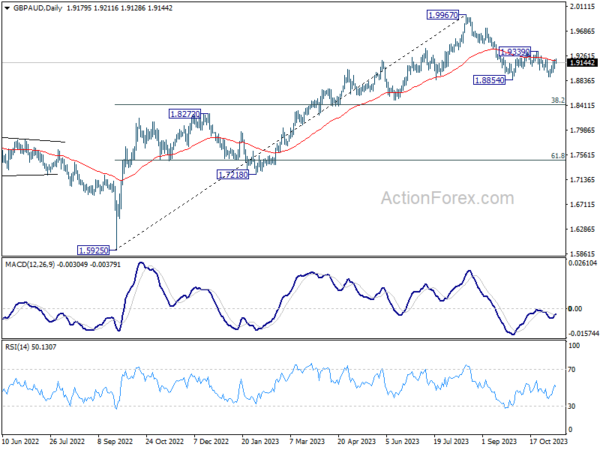

Technically, GBP/AUD is staying in the consolidation pattern above 1.8854. Some more sideway trading cannot be ruled out. But fall from 1.9967 is expected to continue after the consolidation completes. Break of 1.8854 will target 38.2% retracement of 1.5925 (2022 low) to 1.9967 at 1.8423.

In Europe, at the time of writing, FTSE is up 0.58%. DAX is up 0.57%. CAC is up 0.83%. Germany 10-year yield is up 0.0354 at 2.658. Earlier in Asia, Nikkei rose 1.49%. Hong Kong HSI dropped -0.33%. China Shanghai SSE rose 0.03%. Singapore Strait Times rose 0.18%. Japan 10-year JGB yield dropped -0.0072 to 0.842.

US initial jobless claims fell to 217k, above expectations

US initial jobless claims fell -3k to 217k in the week ending November 4, above expectation of 210k. Four-week moving average of initial claims rose 1.5k to 212k.

Continuing claims rose 22k to 1834k in the week ending October 28. Four-week moving average of continuing claims rose 32k to 1789k.

Fed’s Goolsbee cautions on long-term yield impact

In an interview with The Wall Street Journal, Chicago Fed President Austan Goolsbee emphasized the necessity for Fed to closely monitor long-term bond yields.

“A sustained rise in long-term rates can have a very substantial effect on real economic performance,” he warned.

In the ongoing debate on the future of interest rates, Goolsbee stated, “It’s too soon to say whether or when the central bank would turn its focus to lowering rates.”

Despite the challenging economic environment, Goolsbee projected an optimistic scenario: “The US economy can stay on the golden path in which inflation declines closer to the Fed’s 2% target without a significant rise in unemployment.”

ECB de Guindos: Growth more negative than projected, inflation align closely

ECB Vice President Luis De Guindos said in an interview that by holding interest rates steady “at their current level”, ECB anticipates a significant impact on taming inflation to target of 2%.

This comes as a positive sign for the markets that have seen inflation rates soar over the past year, with a peak above 10% that has since eased to 2.9%. With core inflation also showing signs of moderation, ECB’s tightening campaign seems to be bearing fruit.

However, de Guindos emphasized a “prudent and cautious” approach because of “risks around the outlook for inflation over the next few months.” This underlies ECB’s stance to consider interest rate decisions on a “meeting-by-meeting” basis, guided by unfolding economic data.

De Guindos also pointed out that “leading indicators point to the growth outlook being somewhat more negative than we previously projected.” Nonetheless, he believes that inflation may align closely with their September projections.

BoE’s Pill: Maintaining restrictive rates, not hikes, essential for tackling inflation

BoE Chief Economist Huw Pill highlighted today that the existing policy rate, deemed restrictive, is sufficient to dampen inflationary pressures without necessitating further hikes.

“Having established monetary policy in restrictive territory, it’s not the case that we need to raise rates in order to bear down on inflation,” he said in a speech to the Institute of Chartered Accountants in England and Wales.

“Sustaining rates at their current restrictive level will continue to bear down on inflation,” he affirmed “It is that maintaining of the restrictive stance that is key to achieving the inflation target.”

Pill also acknowledged the role of global economic developments in the inflation outlook but was keen to point out the influence of BoE’s actions. “That tightening of monetary policy is bearing down on inflation and contributing to this decline,” he stated.

Despite these measures, Pill expressed caution, noting that inflation, especially in the service sector, has displayed more tenacity than anticipated, without a “decisive turning point” in sight.

Moreover, wage growth is proving to be more persistent, signaling that it may take longer to align with the 2% inflation target than previously projected by models.

BoJ Ueda awaits wage trends before altering policy

In today’s parliamentary session, BoJ Governor Kazuo Ueda emphasized a cautious stance on Japan’s monetary policy, acknowledging the need for more evidence before making any adjustments.

“We expect trend inflation to gradually approach 2 percent. But we’d like to wait until we have more conviction that sustained achievement of our price target comes into sight,” Ueda said.

Highlighting the significance of wage trends, Governor Ueda noted, “Whether wage hikes will broaden and become embedded in society, firms begin to hike prices on prospects of rising wages, will be key to judging whether inflation target will be met sustainably.”

He reaffirmed the Bank’s current strategy: “Until then, we will maintain negative interest rates and the yield curve control framework.”

The Summary of Opinions from the BoJ’s October meeting, released separately, showed a notable stance from one member suggested optimism about wage growth, “It’s highly possible that wage growth to be agreed in next year’s base pay negotiations will exceed that agreed this year,” and added that “achievement of the BoJ’s price target is coming into sight.”

One member went further to suggest that the chances of meeting the inflation target have increased, proposing that “It’s therefore necessary for the BOJ to gradually adjust the degree of monetary easing down from its maximum level.”

Another member’s opinion highlighted that adjustments in yield controls are not just a mitigation of side-effects but also pave the way for future policy normalization.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 150.51; (P) 150.79; (R1) 151.25; More…

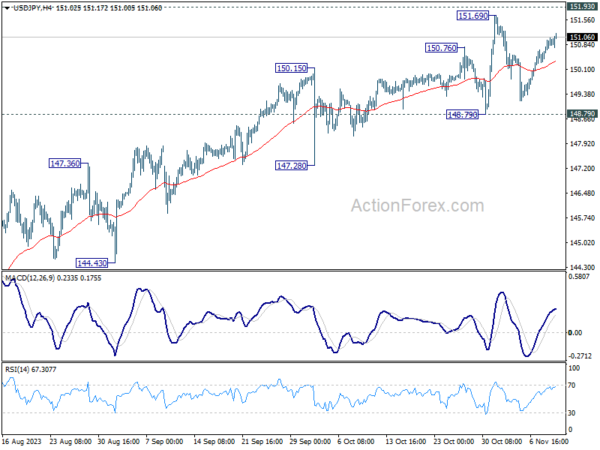

No change in USD/JPY’s outlook as consolidation from 151.69 is extending. Intraday bias stays neutral at this point. Further rally is expected as long as 148.79 support holds. Firm break of 151.69 high will resume larger up trend. However, decisive break of 148.79 will indicate rejection by 151.93 key resistance, and bring deeper fall through 147.28 support.

In the bigger picture, immediate focus is on 151.93 resistance (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will argue that rise from 127.20 has completed, and turn outlook bearish for 137.22 support and below. However, sustained break of 151.93 will confirm resumption of long term up trend. Next target will be 61.8% projection of 102.58 to 151.93 from 127.20 at 157.69.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 23:50 | JPY | Current Account (JPY) Sep | 2.01T | 2.27T | 1.63T | 1.50T |

| 00:01 | GBP | RICS Housing Price Balance Oct | -63% | -65% | -69% | |

| 01:30 | CNY | CPI Y/Y Oct | -0.20% | -0.20% | 0.00% | |

| 01:30 | CNY | PPI Y/Y Oct | -2.60% | -2.70% | -2.50% | |

| 05:00 | JPY | Eco Watchers Survey: Current Oct | 49.5 | 50.2 | 49.9 | |

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 13:30 | USD | Initial Jobless Claims (Nov 3) | 217K | 210K | 217K | 220K |