Like many pairs today, the NZDUSD has seen up-and-down price action.

For it, the pair fell in the Asian session, helped by weaker China data. The fall in the Asian session stalled just ahead of the 100-hour MA (blue line on the chart below). The run higher reached up to 0.5856, before tumbling in the US session.

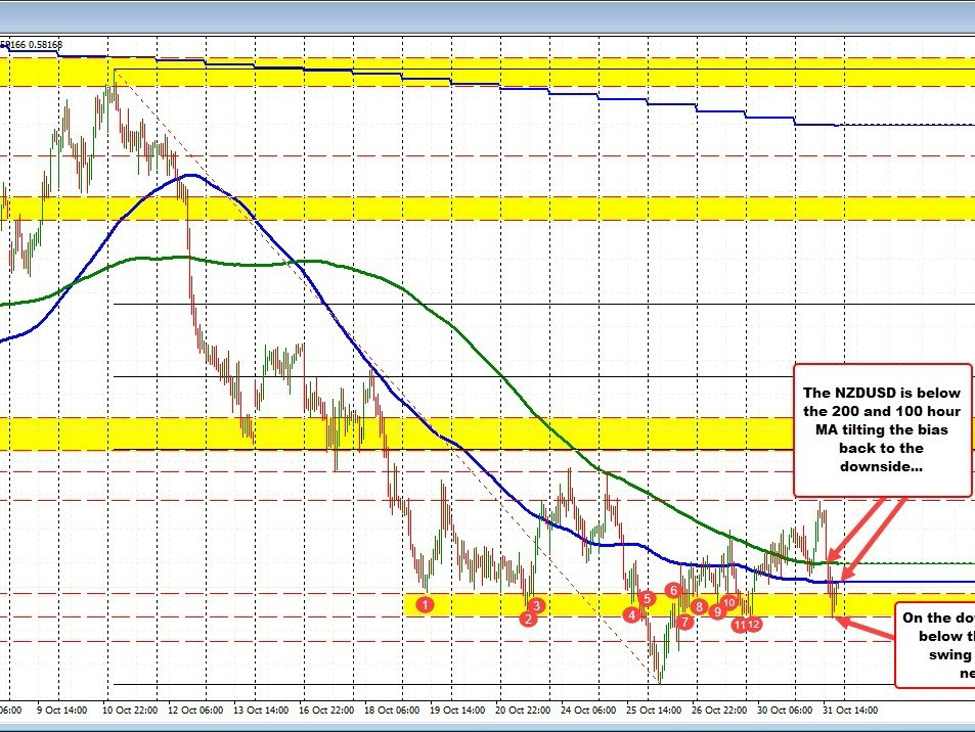

That move lower (higher USD) has now seen the price move below the 200-hour moving average of 0.58278 and the 100-hour moving average at 0.5819 . The low price reaches 0.5803 before bottoming. That low was within a PIP or 2 of the low from yesterday and the low from Friday’s trade, along with other swing levels going back to October 19 between 0.5803 and 0.5814 (see red number circles). The subsequent bounce back has been able to hold below the 100-hour moving average at 0.5819 (blue line in the chart below).

What next?

It would take a move back above the 100 and 200 hour moving averages to tilt the short/median-term technical bias back to the upside. Absent that, the bias remains more negative with the low price from last week at 0.57723 the next downside target.

Of note is that in the new trading day, the New Zealand (NZD) Employment Change for the quarter will be released with a growth of 0.4% for the quarter, which is below the prior quarter gain of 1.0%. The Unemployment Rate is expected at 3.9%, higher than the previous rate of 3.6%. That is the highest since Q3 2021.

NZDUSD back below 100/200 hour MA