Japanese Yen experienced a sharp decline following BoJ’s’s (BoJ) subtle adjustment in its language regarding the yield cap. This move has failed to meet market expectations, pushing Yen back below 150 mark against Dollar. Given this backdrop, there’s potential for Yen’s decline to extend past last week’s low, reflecting the broader market sentiment.

Amidst this, Australian and New Zealand Dollar also faced weakness, influenced by disappointing PMI data from China and the consequent impact on Hong Kong stock markets.

Conversely, Dollar has been exhibiting a resurgence, securing its spot as the strongest performing currency of the day so far, closely followed by Swiss Franc and Canadian Dollar. The Euro and Sterling present a mixed picture in the current trading environment.

However, this renewed vigor in Dollar might face some constraints for now. Market participants are likely to adopt a more cautious stance, reserving their major bets for the upcoming FOMC announcement tomorrow. That said, forthcoming releases today such as Eurozone’s CPI and GDP data, coupled with Canada’s GDP figures, hold the potential to induce significant market fluctuations.

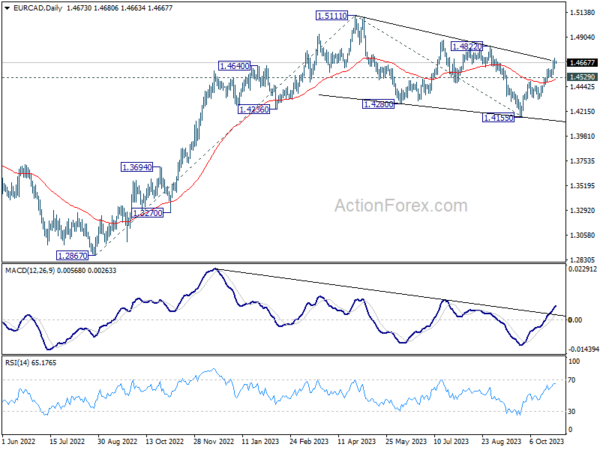

Technically, bullish outlook in EUR/CAD remains unchanged. Further rise is expected to 1.4822 resistance. Decisive break there should confirm that whole corrective fall from 1.5111 has completed with three waves down to 1.4155. Further rally should then be seen through 1.5111 to resume the larger rise from 1.2867. However, break of 1.4529 support will dampen this bullish view and mix up the outlook.

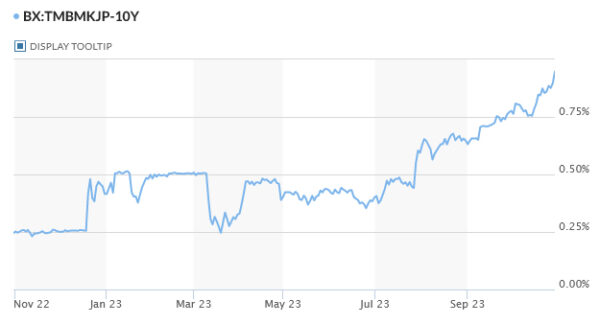

In Asia, at the time of writing, Nikkei is up 0.28%. Hong Kong HSI is down -1.77%. China Shanghai SSE is down -0.38%. Singapore Strait Times is down -0.02%. Japan 10-year JGB yield is up 0.0508 at 0.948. Overnight, DOW rose 1.58%. S&P 500 rose 1.20%. NASDAQ rose 1.16%. 10-year yield rose 0.030 to 4.875.

Yen feels the heat as BoJ’s yield cap redefinition underwhelms

Japanese Yen is facing renewed pressure following BoJ’s policy announcement, where expectations for significant changes were left largely unmet. Instead, the central bank introduced a minor tweak in the language concerning its yield cap, resulting in underwhelming market reactions. USD/JPY is back above 150 mark, after dipping to 148.79 overnight.

Under the Yield Curve Control framework, BoJ has maintained the short-term policy interest rate at -0.10%, while 10-year JGB yield target remains at around 0%. These decisions were reached unanimously. However, the central bank subtly altered its wording regarding the 10-year JGB yield cap, now referring to the 1.0% level as a “reference in its market operations.” This move is perceived as transforming the cap into a flexible upper boundary rather than a strict limit.

Adding to this, BoJ stated, “Given extremely high uncertainties over the economy and markets, it’s appropriate to increase flexibility in the conduct of yield curve control.” This sentiment was not universally shared, as Nakamura Toyoaki expressed dissent, suggesting that increasing flexibility should be contingent upon confirming a rise to firms’ earning power.

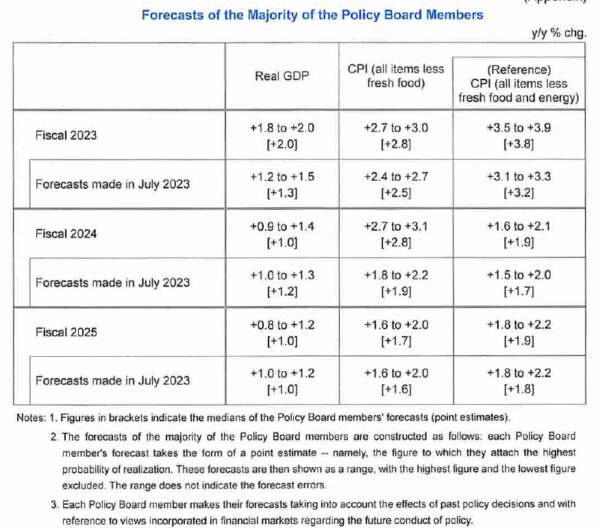

In a significant update, BoJ’s new economic projections reveal upgraded core inflation forecasts across the board, with a noteworthy jump from 1.9% to 2.8% for fiscal 2024.

Here’s a summary of the updated forecasts:

Core CPI Forecasts (July):

- Fiscal 2023: 2.8% (up from 2.5%)

- Fiscal 2024: 2.8% (up from 1.9%)

- Fiscal 2025: 1.7% (up slightly from 1.6%)

Core-Core CPI Forecasts:

- Fiscal 2023: 3.8% (up from 3.2%)

- Fiscal 2024: 1.9% (up from 1.7%)

- Fiscal 2025: 1.9% (up from 1.8%)

GDP Forecasts:

- Fiscal 2023: 2.0% (up from 1.3%)

- Fiscal 2024: 1.0% (down from 1.2%)

- Fiscal 2025: 1.0% (unchanged)

Japan’s industrial output lags behind expectations; retail sales see mixed results

Japan’s industrial production in September posted subdued growth, clocking in at only 0.2% mom, significantly below the anticipated rise of 2.5% mom. When compared year-on-year , the figures revealed a drop of -4.6% yoy. Furthermore, the output for the third quarter (July-September) saw a decline, registering at -1.3% compared to the preceding quarter. In terms of a seasonally adjusted index, the production at factories and mines was at 103.3, benchmarked against 2020 base of 100.

Feedback from manufacturers, as sourced by the Ministry of Economy, Trade and Industry, paints a mixed picture for the upcoming months. They project an increase in the seasonally adjusted output by 3.9% for October, followed by a decline of -2.8% in November.

Retail statistics for September also indicated a mix of growth and contraction. On a yearly basis, retail sales rose by 5.8% yoy, narrowly missing forecasted 5.9% yoy. However, assessing the data month-on-month reveals a slight decline of -0.1% mom in retail sales.

On the job front, there’s a glimmer of positive news. Unemployment rate experienced a marginal dip, moving from 2.7% to 2.6%, aligning with market expectations. The jobs-to-applicant ratio for September remained steady at 1.29, signifying that there were 129 job opportunities available for every 100 job seekers.

China’s official PMI indicates manufacturing back in contraction and non-Manufacturing slows

China’s economic pulse seems to have lost its rhythm, as indicated by the latest PMI figures for October. The official PMI Manufacturing dropped from 50.2 to 49.5, falling below the anticipated 50.4 mark. This downturn is not an isolated occurrence; the manufacturing sector has experienced contraction in six out of the ten months of 2023 so far.

In a similar vein, PMI Non-Manufacturing sector witnessed a decrease, moving from 51.7 to 50.6, which is also below the projected 51.8. Compounding these concerns is PMI Composite, which aggregates both manufacturing and non-manufacturing sectors. It fell from 52.0 to 50.7, registering its lowest reading since December 2022.

National Bureau of Statistics senior statistician Zhao Qinghe acknowledged these challenges in a statement. He noted, “China’s economic activity fell to an extent, and the foundation for a continued recovery still needs to be further solidified.”

NZ ANZ business confidence jumped to 23.4, inflation pressures remain

New Zealand’s ANZ Business Confidence for October showcased a significant rise, moving from 1.5 to a robust 23.4. This upbeat sentiment was mirrored in the Own Activity outlook, which climbed from 10.9 to 23.1.

A broader analysis of the report’s details reveals positive shifts across multiple components: Export intentions rose from -0.4 to 6.1, Investment intentions moved from a negative -4.1 to a positive 3.8, and Employment intentions took a jump from 1.2 to 5.6.

However, while these figures indicate growing optimism in business activities and prospects, inflation front remains a concern. Cost expectations reduced slightly from 78.6 to 76.0. Similarly, Pricing intentions saw a minor drop, moving from 47.1 to 46.3. Inflation expectations also experienced a negligible downtick, adjusting from 4.95% to 4.94%.

Reacting to these numbers, ANZ remarked, “Just as we thought that the rebound in activity indicators in the ANZ Business Outlook survey might be running out of steam, we’ve seen a marked jump across most.”

The bank also cautioned against hasty conclusions based on the current data, especially considering the potential disruptions from the election, suggesting a wait-and-watch approach: “we’ll see whether the newfound (relative) optimism persists over the next few months.”

On the inflation front, ANZ noted that, “inflation pressures are gradually waning in the big picture.” Despite this, the bank emphasized that significant progress in curbing inflation has been missing over recent months. The journey back to the inflation target remains substantial. “We continue to expect it’ll take at least one more OCR hike to get us there.”

BoC’s Macklem Sounds Inflation Alarm Amid Global Tensions

BoC Governor Tiff Macklem provided a sobering insight into Canada’s economic prospects during a parliamentary committee session overnight. Highlighting the central bank’s decision to maintain policy rate at 5.00% last week, Macklem emphasized the decision was taken to allow monetary policy “time to do its job.” However, he shared concerns that any reduction in inflation is “likely to be slow” and notably mentioned that “inflationary risks have increased.”

Despite expectations for inflation to slowly revert to 2% target by 2025, the Governor expressed apprehension, stating, “we’re worried that higher energy prices and persistence in underlying inflation are slowing progress.”

Macklem highlighted escalating global challenges that could further complicate Canada’s inflation trajectory. “Overall, inflationary risks have increased since July,” he noted. The recent forecast from the BoC projects inflation on a “higher path than we expected last summer.”

Additionally, Macklem pinpointed rising global tensions, specifically citing “the war in Israel and Gaza,” as factors potentially driving energy prices up and disrupting supply chains, which could, in turn, amplify inflation pressures worldwide.

Outlook for Canada’s economic growth also remains subdued, according to Macklem. “The economy has entered a period of weaker growth,” he stated. GDP growth is anticipated to linger below 1% over the next several quarters before a potential upturn in late 2024, with an optimistic projection of a rise to 2.5% in 2025.

Looking ahead

Eurozone CPI and CPI flash are the main focuses in European session. France GDP and consumer spending, Germany import price and retail sales, Italy GDP, and Swiss retail sales will be featured too.

Later in the day, Canada GDP is the highlight. US will release house price index, Chicago PMI and consumer confidence.

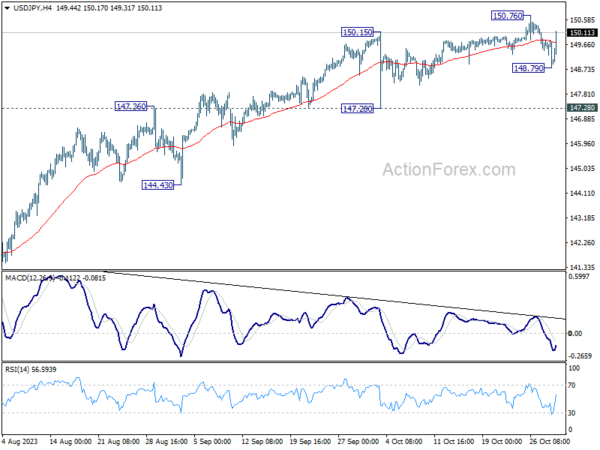

USD/JPY Daily Outlook

Daily Pivots: (S1) 148.63; (P) 149.24; (R1) 149.67; More…

USD/JPY rebounded strongly despite dipping to 148.79. Intraday bias remains neutral at this point. On the upside, break of 150.76 will resume larger rise from 127.20 to 151.93 high. On the downside, below 148.79 will bring deeper pull back. But still, overall outlook will stay bullish as long as 147.28 support holds.

In the bigger picture, while rise from 127.20 is strong, it could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will be the first sign that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Sep | -4.70% | -6.70% | -7.00% | |

| 23:30 | JPY | Unemployment Rate Sep | 2.60% | 2.60% | 2.70% | |

| 23:50 | JPY | Industrial Production M/M Sep P | 0.20% | 2.50% | -0.70% | |

| 23:50 | JPY | Retail Trade Y/Y Sep | 5.80% | 5.90% | 7.00% | |

| 00:00 | NZD | ANZ Business Confidence Oct | 23.4 | 1.5 | ||

| 00:30 | AUD | Private Sector Credit M/M Sep | 0.50% | 0.40% | ||

| 01:00 | CNY | NBS Manufacturing PMI Oct | 49.5 | 50.4 | 50.2 | |

| 01:00 | CNY | NBS Non-Manufacturing PMI Oct | 50.6 | 51.8 | 51.7 | |

| 03:28 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 05:00 | JPY | Housing Starts Y/Y Sep | -6.80% | -6.20% | -9.40% | |

| 05:00 | JPY | Consumer Confidence Index Oct | 35.7 | 35.1 | 35.2 | |

| 06:30 | EUR | France Consumer Spending M/M Sep | 0.60% | -0.50% | ||

| 06:30 | EUR | France GDP Q/Q Q3 P | 0.10% | 0.50% | ||

| 07:00 | EUR | Germany Import Price Index M/M Sep | 0.40% | 0.40% | ||

| 07:00 | EUR | Germany Retail Sales M/M Sep | 0.50% | -1.20% | ||

| 07:30 | CHF | Real Retail Sales Y/Y Sep | -1.20% | -1.80% | ||

| 09:00 | EUR | Italy GDP Q/Q Q3 P | 0.10% | -0.40% | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q3 P | 0.00% | 0.10% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Oct P | 3.10% | 4.30% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Oct P | 4.20% | 4.50% | ||

| 12:30 | CAD | GDP M/M Aug | 0.10% | 0.00% | ||

| 12:30 | USD | Employment Cost Index Q3 | 1.00% | 1.00% | ||

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Aug | 0.30% | 0.10% | ||

| 13:00 | USD | Housing Price Index M/M Aug | 0.50% | 0.80% | ||

| 13:45 | USD | Chicago PMI Oct | 44.7 | 44.1 | ||

| 14:00 | USD | Consumer Confidence Oct | 100.4 | 103 |

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending