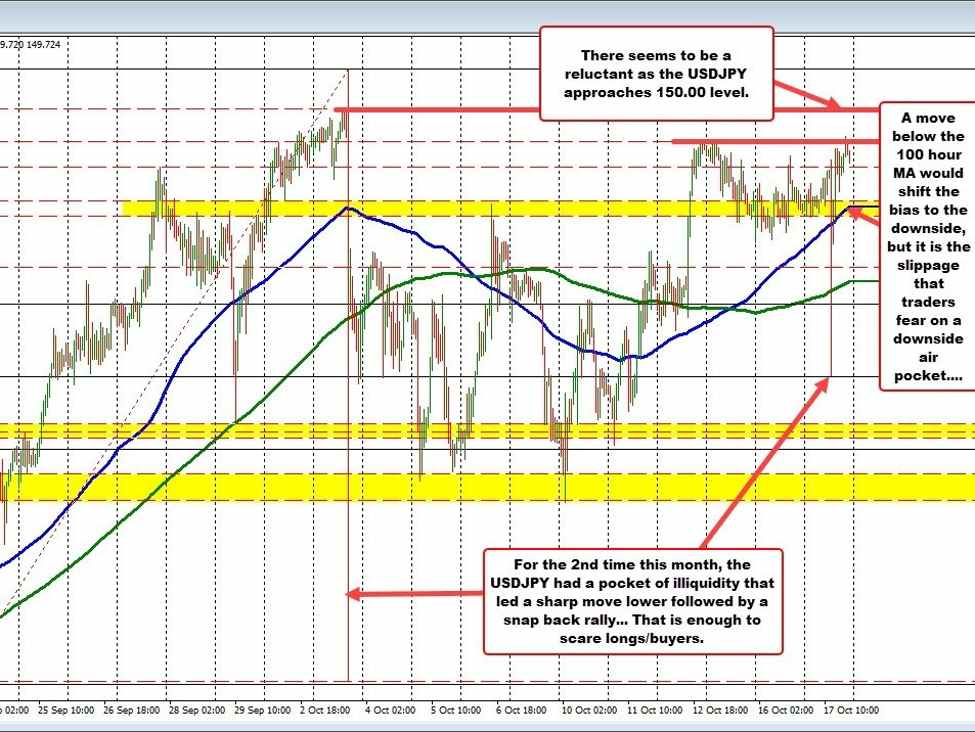

As US yields rise, the 2-year yield is up by 12 basis points at 5.218%, and the 10-year yield is up by 13.7 basis points at 4.846%, both on track to close at their highest levels since 2007. Despite the USDJPY’s recent upward movement, traders appear hesitant to approach the 150.00 level. The currency pair reached a high of 149.844 today, and is currently trading at 149.76.

Earlier today, just before the US trading session began, the pair touched 149.74 but quickly plunged to 148.738 in less than a minute. This sharp drop was triggered by reports suggesting that the Bank of Japan might raise inflation expectations. As a result of quick moves like that, there seems to be nervousness among long/buyer positions in the market, especially considering recent sharp declines, including one on October 3 that saw a 280-pip move.

So, despite stronger US retail sales data, higher yields and the memory of recent sharp declines, traders remain cautious. Higher interest rates and robust economic data aren’t alleviating these concerns.

Nevertheless, from a technical standpoint, breaking below the 100-hour moving average at 149.517 could define a significant level of risk or bias and serve as a stop-loss point for buyers. Traders who like the upside can consider that risk defining option.

However, if done, there is still potential for slippage. If caught in a tumble like seen on October 3 and even earlier today, that could be enough to discourage both long and short traders from active participation at all in the pair.

Remember, not playing is always an option for traders as well.