Yen is facing renewed selling pressure today as the development coincides a remarkable rebound in Nikkei and pullback in 10-year JGB yield. The notable rally in Nikkei, marking its largest single-day surge in nearly a year, is pivotal, signifying the potential of an extended risk-on sentiment in Japan that could correlate with a further depreciation of Yen.

Meanwhile, commodity currencies are not spared. Canadian, Australian, and New Zealand Dollar are also on the losing end, albeit their losses are contained within the previous day’s range. Euro, on the other hand, is notably gaining traction, outpacing both the Sterling and the Swiss Franc, as all European majors strength.

Dollar presents a mixed bag, restrained partly by a retreat in US benchmark yield. Market participants are likely adopting a wait-and-see approach, with the CPI data slated for release later in the week being a significant determinant of Dollar’s directional bias.

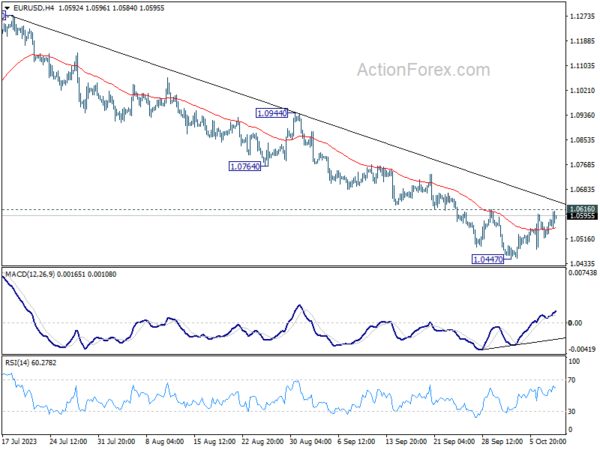

In the technical realm, EUR/USD will be in focus in the current session as recovery from 1.0447 extends. Firm break of 1.0616 will argue that the pair has already bottomed in the short term. Furthermore, sustained trading above the near term falling trend line will trigger stronger rally back to 1.0764 support turned resistance, even as a correction to the decline from 1.1274. If materializes, this could be accompanied by broad based decline in the greenback too, probably except versus Yen.

In Europe, at the time of writing, FTSE is up 1.63%. DAX is up 1.54%. CAC is up 1.47%. Germany 10-year yield is up 0.054 at 2.830. Earlier in Asia, Nikkei rose 2.43%. Hong Kong HSI rose 0.84%. China Shanghai SSE dropped -0.70%. Singapore Strait Times 1.03%. Japan 10-year JGB yield fell -0.0285 to 0.774.

Middle East strife indirectly spurs Nikkei to largest gain in 11 mths

Japan’s Nikkei index surged by 2.43% upon reopening after a long weekend, logging the largest single day gain in 11 months. Conventional wisdom might suggest that heightened geopolitical tensions typically dampen investor sentiment. However, the dynamics observed in the Japanese market unfold a contrasting narrative.

The ascendancy in Nikkei is attributed, in part, to significant gains witnessed in the oil sector. Oil explorer Inpex saw an impressive 8.6% spike, while Japan Petroleum Exploration soared by 10.7%. These gains align with the rally in oil prices globally, stimulated by the escalating conflict in the Middle East.

The unexpected positive response of Japanese stocks to the geopolitical unrest has fueled a debate among market observers. Some argue that the intensifying situation in the Middle East might lead to reconsideration on Fed’s policy path. There’s a burgeoning perspective that Fed might hold off on further rate hikes, given the potential economic uncertainties injected by the conflict.

Technically, today’s rebound in Nikkei argues that corrective pattern from 33772.89 (Jun high), could have completed with three waves down to 30487.67. That came after drawing support from 38.2% retracement of 25661.89 to 33772.89 at 30674.48. Next focus is 55 D EMA (now at 32149.24) Sustained trading above there will solidify this bullish case and target retesting 33772.89 high.

ECB’s Villeroy: We’re not at similar situation to Kippur War

In an interview with franceinfo radio, ECB Governing Council member Francois Villeroy de Galhau affirmed that the current interest rates, pegged at a historical high of 4% after ten consecutive hikes, are positioned at a “good level”. Furthermore, Villeroy added that the prevailing economic climate doesn’t warrant additional rate hikes.

However, Villeroy didn’t mince words when expressing his apprehensions about the escalating oil prices. The surge in prices this week can be attributed to potential disruptions in supply, catalyzed by the military confrontations between Israel Palestinian Islamist group Hamas. Such geopolitical tensions have historically influenced global oil prices. A notable instance from the past is the 1973 Yom Kippur War, which had a significant bearing on oil price dynamics.

Addressing this historical context, Villeroy remarked, “I don’t think that we are today in a similar situation (as the Kippur War) but we must of course remain very vigilant.” He went on to underscore that such events amplify the existing economic uncertainty.

Australian consumer sentiment ticks up to 82, but interest rates concerns linger

Australia’s Westpac Consumer Sentiment Index showed a positive move, climbing 2.9% from 79.7 to 82 in October. Despite the uptick, a score of 82 still paints a subdued picture, correlating with a decline in per capita spending.

One of the more pressing concerns for consumers remains the prospective upward movement in mortgage interest rates. The post-October RBA decision survey indicated that 63% of consumers anticipate mortgage interest rates to climb in the forthcoming year. This figure marks a substantial rise from 52.3% in September.

Notably, however, these numbers don’t match the heightened concerns recorded when RBA was in an active rate-hiking mode, where readings ranged between 70-80%. Meanwhile, optimism for a rate cut next year has dwindled; only 7% of consumers now hold that expectation, down from 15% the previous month.

The upcoming November 7 meeting of RBA is earmarked as a significant event, with a revised set of forecasts to accompany the Statement on Monetary Policy.

Westpac shared their viewpoint on the evolving situation: “While the RBA may need to revise its near-term forecasts for headline inflation up, on its own this will probably not be enough to trigger a further rate rise.”

The September quarter CPI, slated for release on October 25, is now in sharp focus. Westpac added, “If, however, there are further surprises in the September quarter CPI, due October 25, the next few meetings could be a little more live than the one in October.”

Australian NAB business confidence unchanged at 1, declining conditions and easing price pressures

Australia NAB Business Confidence for September remained stable at a level of 1. Meanwhile, a decline was observed in Business Conditions, which slid from 14 to 11. A deeper dive into the components reveals trading conditions receding from 19 to 16, profitability conditions from 14 to 8, and employment conditions registering a dip from 10 to 8.

Notably, growth in labor costs saw a deceleration, moving from a 3.2% quarterly rate down to 2.0%. Additionally, purchase costs experienced a slowdown from 2.9% to 1.8%. Both final product prices and retail prices exhibited moderated growth rates, with the former decelerating from 1.7% to 1.0% while the latter remained unchanged at 1.8%.

NAB Chief Economist Alan Oster remarked, “the economy has remained in reasonable shape through the middle of the year.” He went on to note the +1 index points underscores that firms are somewhat ambivalent regarding their future prospects, with views split evenly regarding the outlook.

However, there was a silver lining in the inflation scenario. Oster highlighted that “the survey showed some positive signs for inflation with cost pressures and price growth easing in the month.”

Even though the imminent Q3 CPI release is anticipated to reflect strong inflation for the quarter, Oster noted, “the September survey results suggest the momentum of some of the key cost pressures driving inflation may have started to step back in a welcome sign for the broader inflation outlook.”

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 148.22; (P) 148.73; (R1) 149.02; More…

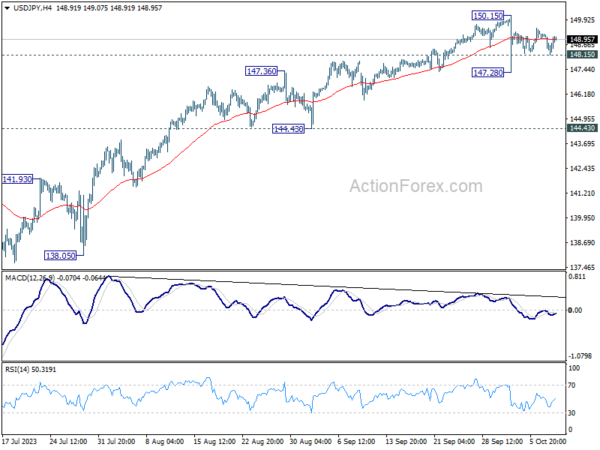

USD/JPY recovers further today but stays well below 150.15 resistance. Intraday bias remains neutral for the moment. Consolidation from 150.15 is still extending. On the downside, below 148.24 minor support will turn bias to the downside for another down leg through 147.28. But there is no confirmation of bearish trend reversal before firm break of 144.43 support. Another rally remains mildly in favor through 150.15 to retest 151.93 high.

In the bigger picture, while rise from 127.20 is strong, it could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will be the first sign that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Oct | 2.90% | -1.50% | ||

| 23:50 | JPY | Current Account (JPY) Aug | 1.63T | 2.41T | 2.77T | |

| 00:30 | AUD | NAB Business Conditions Sep | 11 | 13 | ||

| 00:30 | AUD | NAB Business Confidence Sep | 1 | 2 | ||

| 05:00 | JPY | Eco Watchers Survey: Current Sep | 49.9 | 53.2 | 53.6 | |

| 08:00 | EUR | Italy Industrial Output M/M Aug | 0.20% | -0.60% | -0.70% | -0.90% |

| 10:00 | USD | NFIB Business Optimism Index Sep | 90.8 | 91.5 | 91.3 | |

| 14:00 | USD | Wholesale Inventories Aug F | -0.10% | -0.10% |