Dollar, despite retracting some of its earlier gains, remains robust, demonstrating resilience as one of the week’s frontrunners. At the same time Yen and, to a lesser extent, Swiss Franc is showing strength too, underscoring the markets’ cautious stance. Meanwhile, commodity currencies are languishing at the lower echelons, with New Zealand Dollar marginally outperforming its Australian and Canadian counterparts. The developments align with this week’s risk-averse sentiment underscored by the decline in stocks, gold, and oil prices amid a spike in treasury yields.

Today, all eyes are fixed on US non-farm payroll data. This crucial economic indicator, along with next week’s CPI, is expected to significantly influence Fed’s assessment on the necessity of an additional rate hike. The influence of this data on the markets can be multifaceted. Still, in a scenario where job data outperforms expectations, we may see the strengthening of the case for sustained high interest rates—a development likely to exert pressure on stocks but provide impetus for the greenback.

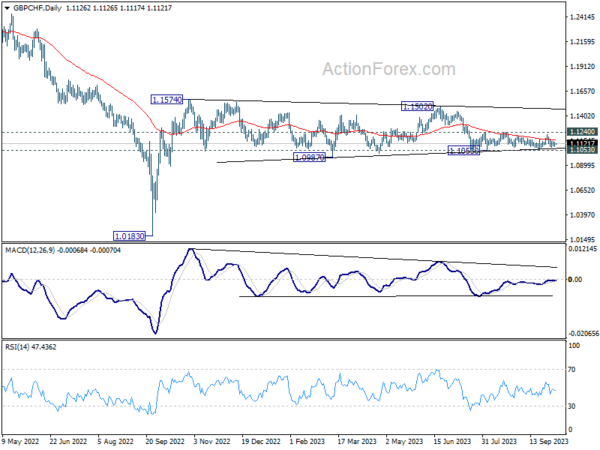

On the technical front, European majors continue to oscillate within a defined range against each other, yet there’s a burgeoning interest in Swiss Franc’s potential to capitalize on the amplifying risk aversion and break free from these ranges. In the context of GBP/CHF, the pair has been confined above 1.1053 since the onset of August, with a bearish inclination underscored by the ceiling imposed by 55 D EMA. Break of 1.1053 support would suggest resurgence of the descent from 1.1502. Additionally, decisive break below 0.9617 minor support in EUR/CHF could corroborate this trend. These dynamics, in conjunction with Dollar pairings, are worth monitoring before the weekly close.

In Asia, at the time of writing, Nikkei is up 0.04%. Hong Kong HSI is up 1.81%. Singapore Strait Times is up 0.45%. 10-year JGB yield is down -0.002 at 0.803. Overnight, DOW dropped -0.03%. S&P 500 dropped -0.13%. NASDAQ dropped -0.12%. fell -0.018 to 4.717.

US markets in anticipation: Non-Farm Payrolls to dictate direction

The global financial community is poised at the edge, eagerly awaiting US non-farm payroll data due today. This palpable sense of anticipation is evident as DOW is ensnared in sideways motion after crossing the crucial 33,000 psychological mark. Additionally, Dollar Index is retracing steps after touching its highest level in almost a year, and 10-year Treasury yield is cooling off from its pinnacle since 2007.

The upcoming data’s multifaceted nature, covering job growth, unemployment rates, and wage growth, complicates the prediction of market reactions. If these metrics present a disjointed picture, deciphering the market’s response becomes even trickier. Robust employment figures could potentially reinforce the prospect of an additional Fed rate hike before year’s end. However, a spike in Treasury yields, a byproduct of strong data, could, paradoxically, reduce the necessity for another move due to tightened financial conditions. Nevertheless, both scenarios would likely dampen stocks, and in a climate of risk aversion, bolster Dollar.

Today’s market expectations hinge on a 168k increase in headline non-farm payrolls growth for September, with an anticipated decline in the unemployment rate from 3.8% to 3.7%. Predictions also point towards a 0.3% mom rise in average hourly earnings, keeping the annual rate steady at 4.3% yoy.

However, other employment-related metrics present a mixed picture, notably the disappointing 89k growth shown by ADP private employment. On the brighter side, ISM Manufacturing employment index showed improvement 48.5 to 51.2, even as its services counterpart registered a dip from 54.7 to 53.4. The four-week average of initial jobless claims also saw a decrease from 229k to 209k.

Technically, NASDAQ has been in range trading since falling to 12963.16 late last month. Sustained break of 38.2% retracement of 10088.82 to 14446.55 at 12781.89 will strengthen the case that rise from 10088.82 has completed. That would also mean that the long term pattern from 16212.22 has already started third leg. Deeper fall would be seen to 61.8% retracement at 11753.47 next in the near term.

Nevertheless, strong rebound from current level, followed by sustained break of 55 D EMA (now at 13524.91) would argue that rise from 10088.82 is still intact. Another rally through 14446.55 would likely be seen before NASDAQ tops.

Japanese wages growth underwhelm as real income sinks for 17th mth

Subdued wage growth data in Japan is raising eyebrows, particularly at BoJ. An essential element for the central bank’s policy normalization is the establishment of a harmonious cycle between wage growth and prices. The recent figures, however, indicate that this equilibrium remains elusive.

In August, labor cash earnings in Japan rose by a meager 1.1% yoy. This increase, while consistent with the prior month, fell short of the anticipated 1.5% growth. Furthermore, base salary growth, although increasing to 1.6% yoy from the preceding month’s 1.4%, has yet to manifest signals of a robust and sustainable upward momentum.

The bright spot, perhaps, is the increase in overtime pay, which is often used as an indicator of business vibrancy, as 1.0% yoy ascent was observed, rebounding from July’s flat growth.

However, inflation-adjusted real wages continued their downward spiral for the 17th consecutive month. August’s real wages declined by -2.5% yoy, surpassing the projected -2.1% yoy dip. This trend starkly reveals that despite any increments, wages are struggling to keep up with the consistent price surges, placing added strain on the average consumer’s pocket.

Also released, household spending, a critical driver of economic activity, contracted by -2.5% yoy, a figure that, while better than the anticipated -4.3% yoy decline and an improvement from July’s -5.0% yoy reduction, still underscores constrained consumer expenditure.

Fed’s Barkin links yield surge to robust data, abundant supply

Richmond Fed President Thomas Barkin expressed a cautious stance yesterday, indicating it’s “too early to know if another rate increase would be needed this year.”

He further elaborated on the need for a wait-and-see approach, suggesting, “We have time to see if we’ve done enough or whether there’s more work to do.”

“The path forward depends on whether we can convince ourselves inflationary pressures are behind us or whether we see them persistent.” Alongside inflation, Barkin pinpointed the labor market as a pivotal area of focus.

Addressing the recent surge in Treasury yields, Barkin attributed it to an abundant fiscal issuance, indicating, “There’s a lot of fiscal issuance out there. That’s creating a lot of supply.” He also acknowledged the role of recent strong economic data in pushing the yields higher.

Fed’s Daly points to rising yields and diminishing need for rate hike

San Francisco Fed President Mary Daly weighed in on the implications of the recent spike in the benchmark 10-year Treasury note yield, which marked a 16-year peak at 4.8%.

“If financial conditions… remain tight, the need for us to take further action is diminished,” she said yesterday, adding that the role of the financial markets in this scenario, suggesting that “they’ve done the work.”

On the market’s response to rising bond yields, she observed a dip in probabilities for another hike at the upcoming November meeting. “To me, that says the markets are understanding how we think about things and they do have the reaction function in mind,” she elaborated.

Daly reiterated that continual observation of economic indicators, specifically a “cooling labor market” and inflation gravitating towards target, could justify steadiness in interest rates.

She elaborated that maintaining rates isn’t a passive stance but an “active policy action,” especially as declining inflation augments the restrictive impact of existing policy measures.

However, she also emphasized adaptability, hinting that should economic indicators such as growth and inflation not decelerate as expected, or if financial conditions become overly relaxed, Fed is prepared to raise rates until monetary policy achieves its desired restrictiveness. “We need to keep an open mind, and have optionality,” she underscored.

ECB’s Villeroy points to plateau in rates; dismisses need for rate hike

ECB Governing Council member Francois Villeroy de Galhau, in an interview with the German newspaper Handelsblatt published yesterday, weighed in on the current debate surrounding ECB’s interest rates. Stating his view clearly, Villeroy remarked, “Today, I think there’s no justification for an additional increase in the ECB rates.”

Rather than focusing on the peak in rates, Villeroy believes the dialogue should shift towards the concept of a rate “plateau.” In his words, “we’ll remain on this plateau as long as necessary.”

Villeroy also provided reassurance regarding the economic outlook of the Eurozone. Contrary to the hard landing fears that loomed last winter, he noted, “We are not facing the worst-case scenario.” Elaborating further, he added, “I believe our monetary policy can and should now aim for a soft landing for the euro zone: We’ll exit inflation, and we’ll probably do so without a recession.”

Commenting on the broader market sentiments, Villeroy observed that expectations, both in Europe and US, have historically been “a little too optimistic regarding a future rate cut.”

Elsewhere

Swiss unemployment rate and foreign currency reserves, Germany factory orders, France trade balance and Italy retail sales will be released in European session. Later in the day, Canada will also publish employment data.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3678; (P) 1.3731; (R1) 1.3759; More….

Despite edging higher to 1.3784, USD/CAD quickly retreated back into established range. Intraday bias remains neutral and some more consolidations could be seen. While deeper pull back cannot be ruled out, outlook will stay bullish as long as 1.3378 support holds. Above 1.3778 will resume the rally from 1.3091 and target 100% projection of 1.3091 to 1.3693 from 1.3378 at 1.3980.

In the bigger picture, current development revives the case that corrective pattern from 1.3976 (2022 high) has completed with three waves down to 1.3091. Decisive break of 1.3976 high will confirm resumption of up trend from 1.2005 (2021 low). Next target will be 61.8% projection of 1.2401 to 1.3976 from 1.3091 at 1.4064. This will now remain the favored case as long as 1.3378 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Aug | 1.10% | 1.50% | 1.30% | 1.10% |

| 23:30 | JPY | Overall Household Spending Y/Y Aug | -2.50% | -4.30% | -5.00% | |

| 05:00 | JPY | Leading Economic Index Aug P | 109 | 108.2 | ||

| 05:45 | CHF | Unemployment Rate Sep | 2.10% | 2.10% | ||

| 06:00 | EUR | Germany Factory Orders M/M Aug | 1.50% | -11.70% | ||

| 06:45 | EUR | France Trade Balance (EUR) Aug | -8.9B | -8.1B | ||

| 07:00 | CHF | Foreign Currency Reserves (CHF) Sep | 694B | |||

| 08:00 | EUR | Italy Retail Sales M/M Aug | 0.00% | 0.40% | ||

| 12:30 | USD | Nonfarm Payrolls Sep | 168K | 187K | ||

| 12:30 | USD | Unemployment Rate Sep | 3.70% | 3.80% | ||

| 12:30 | USD | Average Hourly Earnings M/M Sep | 0.30% | 0.20% | ||

| 12:30 | CAD | Net Change in Employment Sep | 28.0K | 39.9K | ||

| 12:30 | CAD | Unemployment Rate Sep | 5.60% | 5.50% |