British Pound emerged as the weakest link, facing headwinds following subpar construction data. Not far behind in performance was the Canadian Dollar, which felt the pressure from the ongoing plunge in oil prices. Dollar, while still in a commanding position, appears to be taking a pause, digesting its recent upticks. Contrastingly, Australian and New Zealand Dollars found some respite as the market’s risk aversion sentiment momentarily eased. Meanwhile, Euro, Swiss Franc, and Yen are all moving within a mixed range, with no clear directional bias discernible.

However, it’s crucial to underscore that today’s performance is likely transient, serving as brief consolidations rather than indicative of any established trends. Yen, though challenged to prolong its intervention-boosted rally, remains the top-performer. Dollar holds its ground as second, albeit with an air of caution as market participants await Non-Farm Payrolls release tomorrow. Aussie and Kiwi Dollars, despite today’s modest bounce-back, continue to languish at the bottom. Among European currencies, Sterling’s underperformance stands out.

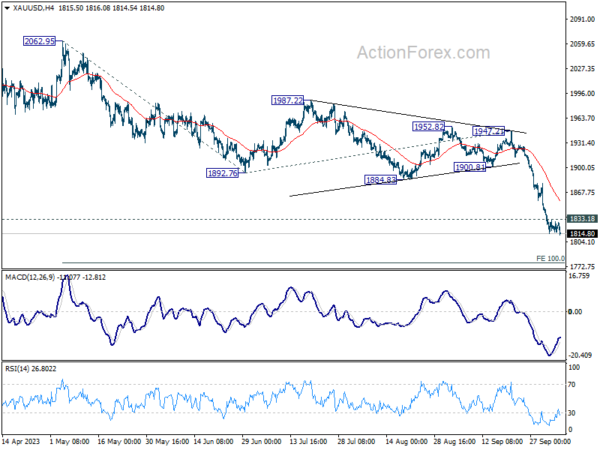

Technically, Gold is trying to resume recent decline in early US session. For now, further fall is expected as long as 1833.18 resistance holds. Next target is 100% projection of 2062.95 to 1892.76 from 1947.21 at 1777.02. However, break of 1833.18 resistance will bring a stronger corrective rebound first, before staging another decline.

In Europe, at the time of writing, FTSE is up 0.54%. DAX is flat. CAC is up 0.08%. Germany 10-year yield is up 0.001 at 2.924. Earlier in Asia, Nikkei rose 1.80%. Hong Kong HSI rose 0.10%. Singapore Strait Times rose 0.24%. Japan 10-year JGB yield dropped -0.003 to 0.805.

US initial jobless claims rose to 207k, below expectations

US initial jobless claims rose 2k to 207k in the week ending September 30, below expectation of 211k. Four-week moving average of initial claims dropped 2.5k to 209k.

Continuing claims dropped -1k to 1664k in the week ending September 23. Four-week moving average of continuing claims fell -5k to 1668k.

Canada records unexpected trade surplus in Aug as exports surge

Canada reported merchandise trade surplus of CAD 718m in August, marking its first monthly trade surplus since April. This comes after a deficit of CAD 437m in July and defies market expectations of a CAD -1.4B deficit.

Driving this positive turnaround, exports in August jumped by 5.7% mom, marking the most robust growth since October 2021. This surge was widespread, with gains registered in 7 of the 11 product sections.

Meanwhile, imports also witnessed a 3.8% mom uptick, with increments seen in 9 of the 11 product sections.

BoE survey shows business inflation expectations cool

BoE’s Decision Maker Panel survey for September indicating an anticipated ease in output price inflation, slowly easing CPI inflation expectation, and subtle nuances in wage growth predictions

A notable takeaway from the survey is the anticipated decline in output price inflation over the next year. Businesses foresee their year-ahead own-price inflation at 4.8%, a slight moderation from the 5.0% noted in the preceding three months to August. This decline hints at an expectation of easing price pressures, offering a counter-narrative to prevalent inflation concerns.

On the consumer front, one-year ahead CPI inflation expectations inched higher to 4.9% in September from 4.8% in August. However, a broader perspective reveals a decline, with the three-month moving average dipping by 0.3 percentage points to 5%. Looking further ahead, three-year CPI inflation expectations held steady at 3.2% in September, unaltered from August.

In the realm of wages, the anticipated year-ahead wage growth was static at 5.1% on a three-month moving average basis. September’s single-month reading did register a slight uptick to 5.2%, a 0.2 percentage point increment from August. However, these expectations are notably subdued compared to realised wage growth.

UK PMI construction dives to 45, sharp decline and worst since 2020

UK’s construction sector is experiencing a significant setback, as evidenced by the sharp fall in PMI Construction index to 45.0 in September, a level not seen since May 2020 and far below the anticipated 49.9.

The report shows a distinct contraction in the industry, with residential work plunging to an index of 38.1, indicating the steepest decline amongst all sectors. Civil engineering activity isn’t faring much better, posting a 45.7 index, while commercial building has shown some resilience, albeit still in the contraction zone at 47.7.

Tim Moore, Economics Director at S&P Global Market Intelligence, paints a grim picture of the current state of the sector. “Output levels declined across the UK construction sector for the first time in three months during September, and the latest downturn marked the worst overall performance since the early stages of the pandemic,” he stated.

The future outlook for the construction sector does not instill confidence. Moore points out that the survey’s forward-looking measures have remained somewhat pessimistic. “Order books decreased at an accelerated pace and business activity expectations eased to the lowest so far this year,” Moore explained. The decrease in project starts has led to an increase in sub-contractor availability, reaching levels not seen since the summer of 2009.

ECB’s Kazimir strongly believe that latest hike was last

ECB Governing Council member Peter Kazimir said today, “I strongly believe that our rate hike at the last meeting was the last one” The focus, he outlined, now shifts to the upcoming December and March forecasts, as “only real data can persuade us that we’re at the peak.”

Kazimir addressed inflation concerns, observing that, “We see the overall inflation and also core inflation on a downward trend, though this is lasting a bit longer than we’d wanted.” He further highlighted the ripple effects of past rate hikes, pointing out that they “have an increasingly significant impact on the real economy.”

Shedding light on the broader economic repercussions, he mentioned that “Financing conditions are tightening and are weakening demand for investments, in production and affecting overall economic growth.” With this context, Kazimir emphasized the urgency to manage inflation effectively and swiftly.

On the topic of ECB’s PPEP reinvestments, Kazimir treaded cautiously, suggesting the bank was “ready for debate” but reiterated the importance of maintaining balance. The topic of altering the balance sheet’s reduction pace will be broached only when the Council is confident further rate hikes won’t be necessary.

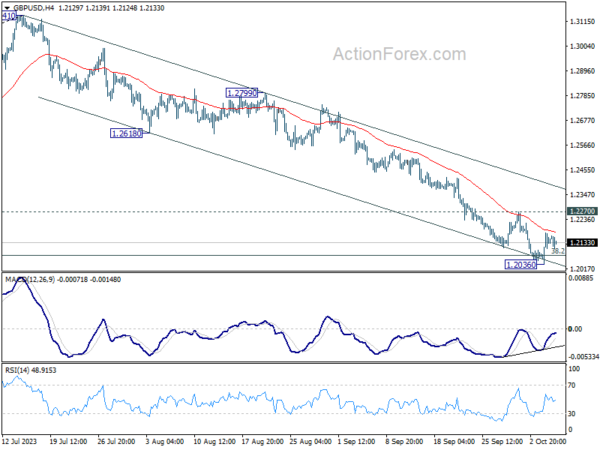

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2056; (P) 1.2116; (R1) 1.2196; More…

GBP/USD is staying in consolidation above 1.2036 and intraday bias remains neutral for the moment. Outlook will stay bearish as long as 1.2270 resistance holds. Break of 1.2026 will resume the fall from 1.3141. Sustained trading below 1.2075 fibonacci level would carry larger bearish implication, and target 1.1801 support next. On the upside, firm break of 1.2270 resistance will indicate short term bottoming, and turn bias back to the upside.

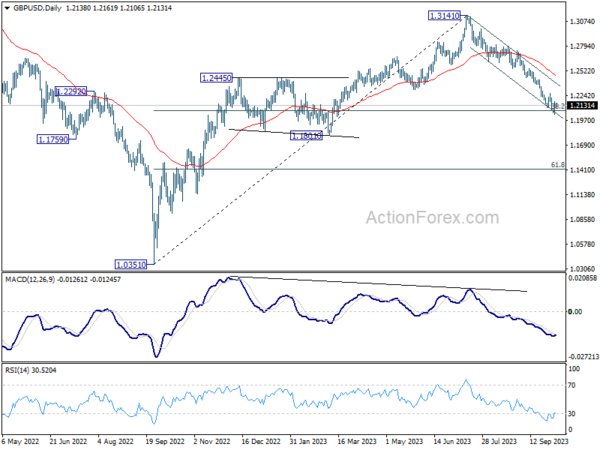

In the bigger picture, fall from 1.3141 medium term top could still be a correction to up trend from 1.0351 (2022 low) only. But risk of complete trend reversal is rising. Sustained break of 38.2% retracement of 1.0351 to 1.3141 at 1.2075 will pave the way to 61.8% retracement at 1.1417. For now, risk will stay on the downside as long as 55 D EMA (now at 1.2486) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Trade Balance (AUD) Aug | 9.64B | 8.61B | 8.04B | 7.32B |

| 06:00 | EUR | Germany Trade Balance (EUR) Aug | 16.6B | 14.3B | 15.9B | 16.0B |

| 06:45 | EUR | France Industrial Output M/M Aug | -0.30% | -0.40% | 0.80% | 0.50% |

| 08:30 | GBP | Construction PMI Sep | 45 | 49.9 | 50.8 | |

| 11:30 | USD | Challenger Job Cuts Y/Y Sep | 58.20% | 266.90% | ||

| 12:30 | USD | Initial Jobless Claims (Sep 29) | 207K | 211K | 204K | |

| 12:30 | USD | Trade Balance (USD) Aug | -58.3B | -65.1B | -65.0B | -64.7B |

| 12:30 | CAD | Trade Balance (CAD) Aug | 0.7B | -1.4B | -1.0B | -0.4B |

| 14:00 | CAD | Ivey PMI Sep | 50.8 | 53.5 | ||

| 14:30 | USD | Natural Gas Storage | 97B | 90B |