The global markets experienced a noticeable shift in momentum as major US stock indexes concluded with substantial gains overnight, and treasury yields took a step back. This favorable swing persisted into Asian trading hours, marked by a remarkable rebound in Hong Kong stocks. Australian Dollar has been on the upswing, further bolstered by Copper’s resurgence and a fresh wave of optimism concerning China’s economic recovery. While Australian Dollar shows significant strength, New Zealand Dollar showcases a slight edge in its gains. Conversely, improved market sentiments have pushed Dollar and Yen to lower, with European majors demonstrating mixed performance.

Investors are now shifting their focus towards today’s Eurozone CPI data, which holds significance in determining if ECB has truly concluded its tightening journey. Likewise, US PCE inflation will be in the spotlight to deduce if Fed will deliver another interest rate hike in the fourth quarter, as previously indicated by the dot plot. Canadian Dollar also anticipates GDP data, which could provide further clarity on its economy. Yet, some market participants may choose a more cautious stance, preferring to see what next week brings with the onset of a new quarter.

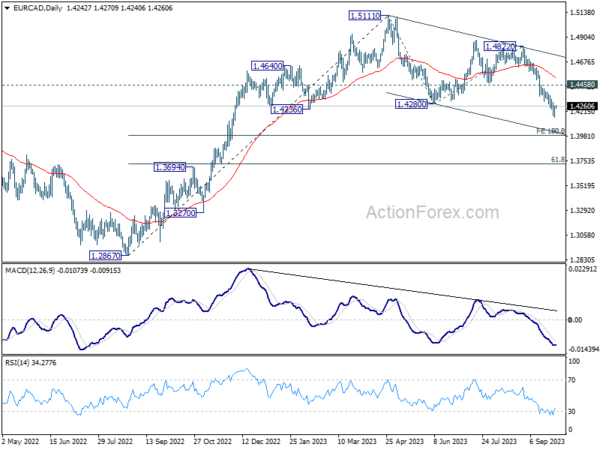

Technically, EUR/CAD recovered after dipping to 1.4155 yesterday. But surprise from today’s Eurozone CPI could trigger another way of selling. Current fall from 1.5111 is in progress and even as a corrective move, more downside should be seen to 100% projection of 1.5111 to 1.4280 from 1.4822 at 1.3991. This coincides with 50% retracement of 1.2867 to 1.5111 at 1.3989. In any case, outlook will stay bearish as long as 1.4458 resistance holds.

In Asia, at the time of writing, Nikkei is down -0.34%. Hong Kong HSI is up 2.62%. Singapore Strait Times is up 0.42%. Overnight, DOW rose 0.35%. S&P 500 rose 0.59%. NASDAQ rose 0.83%. 10-year yield dropped -0.029 to 4.597.

Fed’s Barkin: Path forward depends on inflationary pressures

Richmond Fed President Thomas Barkin highlighted the existing uncertainties surrounding the economic outlook in remarks made overnight. He stated, “The range of potential outcomes, to me, is still pretty broad,” emphasizing the unpredictability of the current economic situation.

Reflecting on the recent decision of Fed to maintain status quo on interest rates, he said, “That’s why I supported our decision to hold rates steady at the last meeting.”

“We have time to see if we’ve done enough, or whether there’s more work to be done,” he added.

“The path forward to me depends on whether we can convince ourselves inflationary pressures are behind us, or whether we see them persisting,” he said. Barkin further highlighted the significance of labor market developments in informing his perspective.

Japan’s industrial output flat in Aug, Tokyo inflation eases in Sep

Japan’s industrial output for August surprised by remaining steady month-on-month, outpacing expectations of a -0.8% mom decline. The seasonally adjusted index of production at factories and mines held its ground at 103.8, based on 2020 base of 100. Equally, index of industrial shipments ticked up by 0.1% to 103.2. In contrast, inventory index marked a -1.7% decrease to 104.6, registering the first decline in a quadrimestrial span.

The Ministry of Economy, Trade and Industry maintained a cautious tone on the economy’s direction, indicating that industrial output “fluctuated indecisively.” However, optimism is still present; the ministry’s poll suggests that manufacturers anticipate a 5.8% uptick in production for September, followed by a 3.8% rise in October.

On the retail front, August saw a 7.0% yoy surge in retail sales, surpassing anticipated 6.4% yoy. This momentum builds upon the month’s modest growth of 0.1% mom.

The labor market remained resilient, with the unemployment rate steadfast at 2.7%. The job offers-to-applicants ratio for August persisted at 1.29, unchanged from July.

Inflationary pressures seem to be cooling down. Tokyo’s core CPI for September, excluding food, dipped more than forecasted, from 2.8% yoy to 2.5% yoy , as opposed to the predicted 2.6% yoy. Headline CPI decreased slightly from 2.9% yoy to 2.8% yoy. Additionally, core-core CPI, which excludes both food and energy, retreated from 4.0% yoy to 3.8% yoy.

AUD/JPY and Copper soar on renewed China optimism

Australian Dollar experienced a significant surge in today’s Asian trading session, fueled in part by the vigorous rebound observed in Hong Kong stocks, the Chinese Yuan, and Copper prices. The rebound in stocks could attributed possible position adjustments after a tumultuous quarter in Hong Kong and China, and with the impending long holiday in China lasting until October 9. But there’s still a budding sentiment of optimism concerning China’s potential for economic recuperation.

A noteworthy comment from the International Monetary Fund has contributed to this optimism. The IMF recently expressed its observation yesterday of certain stabilization signs in China’s economy from the latest data sets. The institution holds a perspective that China could realistically achieve growth rate close to 5% this year. Looking forward, the IMF anticipates China’s GDP growth to decelerate to approximately 3.5% over a medium-term horizon. Nevertheless, this pace could experience a boost if China embarks on economic reforms.

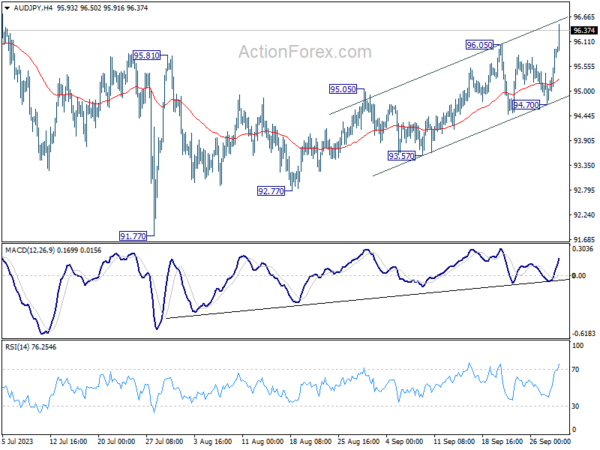

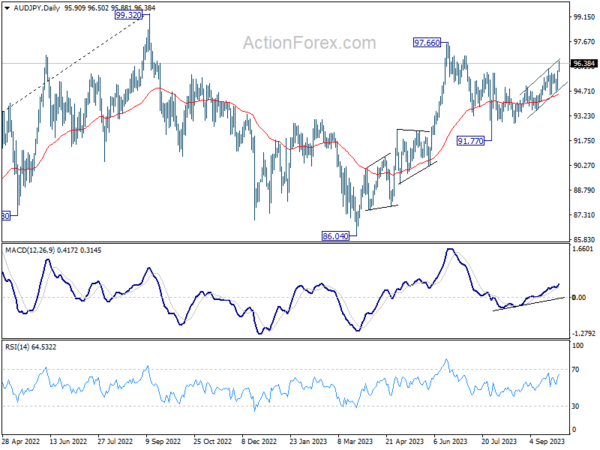

AUD/JPY has powerfully broken 96.05 resistance mark, which is indicative of resumption of its recent rise from the 92.77. However, the nature of the current rally doesn’t explicitly suggest it’s impulsive, maintaining an air of ambiguity around potential technical interpretations.

In one scenario, if price action from 91.77 serves as the second leg of the pattern originating from 97.66, then the peak of the current rally might be restricted by 97.66 resistance.

In another case, if the upswing from 91.77 is in continuation with the entire surge from 86.04, the climb could still be seen as the second leg of the pattern from the 2022 high of 99.32. As such, the upper boundary could be set by the 99.32 mark, even if 97.66 is surpassed.

So, upside potential appears to be limited for the medium term.

Turning to Copper, its robust rebound this week suggests that decline from 4.0145 might have culminated, completing three waves that bottomed at 3.6008. Sustained trading above 55 D EMA (now at 3.7540) would solidify this viewpoint, setting sights on 3.8762 resistance for validation.

For Australian Dollar to secure its foundational momentum, decisive break of 3.8762 resistance in Copper might be essential. Absent this, Aussie’s rebound might retain its corrective nature.

Looking ahead

Eurozone CPI is the main highlight in European session today. Other data include Germany import prices, retail sales and unemployment; France consumer spending; UK Q2 GDP final, mortgage approvals and M4 money supply; and Swiss KOF economic barometer.

Later in the day, Canada GDP will be a focus. US will also release personal income and spending, PCE inflation, goods trade balance and Chicago PMI.

EUR/AUD Daily Outlook

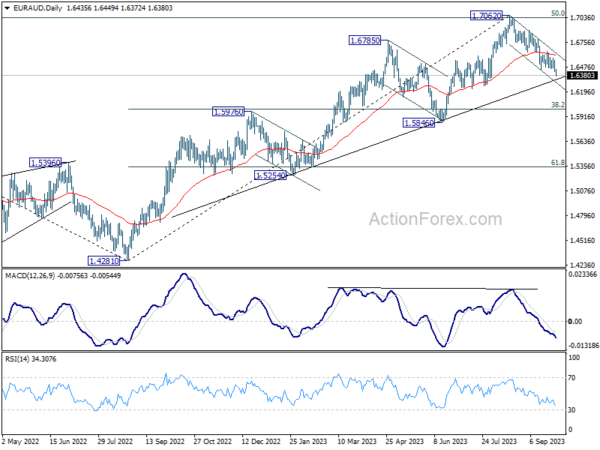

Daily Pivots: (S1) 1.6394; (P) 1.6474; (R1) 1.6519; More…

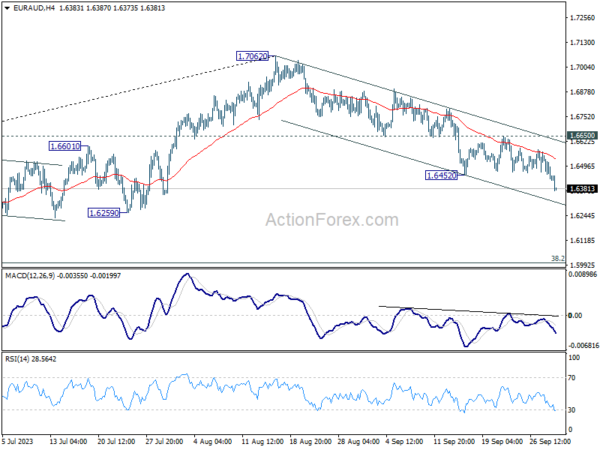

EUR/AUD’s fall from 1.7062 resumed by breaking through 1.6452 support. Intraday bias is back on the downside for 1.6000 fibonacci level, as a larger scale correction. On the upside, break of 1.6650 resistance is needed to indicate short term bottoming. Outlook, outlook will stay mildly bearish in case of recovery.

In the bigger picture, fall from 1.7062 is probably correcting whole up trend from 1.4281 (2022 low). Deeper decline would be seen to 38.2% retracement of 1.4281 to 1.7062 at 1.6000. Strong support should be seen there to bring rebound, at least on first attempt. This will remain the favored case as long as 1.6650 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Sep | 2.80% | 2.90% | ||

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Sep | 2.50% | 2.60% | 2.80% | |

| 23:30 | JPY | Tokyo CPI ex Food Energy Y/Y Sep | 3.80% | 4.00% | ||

| 23:30 | JPY | Unemployment Rate Aug | 2.70% | 2.60% | 2.70% | |

| 23:50 | JPY | Industrial Production M/M Aug P | 0.00% | -0.80% | -1.80% | |

| 23:50 | JPY | Retail Trade Y/Y Aug | 7.00% | 6.40% | 6.80% | 7.00% |

| 01:30 | AUD | Private Sector Credit M/M Aug | 0.40% | 0.30% | 0.30% | |

| 05:00 | JPY | Housing Starts Y/Y Aug | -9.4% | -8.90% | -6.70% | |

| 05:00 | JPY | Consumer Confidence Index Sep | 35.2 | 36.2 | 36.2 | |

| 06:00 | EUR | Germany Import Price Index M/M Aug | 0.50% | -0.60% | ||

| 06:00 | GBP | GDP Q/Q Q2 F | 0.20% | 0.20% | ||

| 06:00 | EUR | Germany Retail Sales M/M Aug | 0.50% | -0.80% | ||

| 06:00 | GBP | Current Account (GBP) Q2 | -14.0B | -10.8B | ||

| 06:30 | CHF | Real Retail Sales Y/Y Aug | -2.20% | |||

| 06:45 | EUR | France Consumer Spending M/M Aug | -0.40% | 0.30% | ||

| 07:00 | CHF | KOF Economic Barometer Sep | 90.5 | 91.1 | ||

| 07:55 | EUR | Germany Unemployment Change Aug | 14K | 18K | ||

| 07:55 | EUR | Germany Unemployment Rate Aug | 5.70% | 5.70% | ||

| 08:30 | GBP | Mortgage Approvals Aug | 48K | 49K | ||

| 08:30 | GBP | M4 Money Supply M/M Aug | 0.20% | -0.50% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Sep P | 4.50% | 5.20% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Sep P | 4.80% | 5.30% | ||

| 12:30 | USD | Personal Income M/M Aug | 0.40% | 0.20% | ||

| 12:30 | USD | Personal Spending Aug | 0.50% | 0.80% | ||

| 12:30 | USD | PCE Price Index M/M Aug | 0.50% | 0.20% | ||

| 12:30 | USD | PCE Price Index Y/Y Aug | 3.50% | 3.30% | ||

| 12:30 | USD | Core PCE Price Index M/M Aug | 0.20% | 0.20% | ||

| 12:30 | USD | Core PCE Price Index Y/Y Aug | 3.90% | 4.20% | ||

| 12:30 | USD | Goods Trade Balance (USD) Aug P | -91.2B | -90.9B | ||

| 13:45 | USD | Chicago PMI Sep | 47.6 | 48.7 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Sep F | 67.7 | 67.7 |