Dollar, although retaining its strength, is witnessing mild deceleration in upside momentum as US session starts. The spotlight now shines on any potential progress within the US Congress to prevent a partial government shutdown looming this Sunday. While the notion of a shutdown isn’t unfamiliar in the US, having occurred 14 times since 1981, this instance carries heightened significance. Moody’s recent warning accentuates this, indicating that a shutdown now could underline how escalating political divides are deteriorating the nation’s fiscal position.

Focusing on other currencies, Euro emerges as today’s frontrunner, with the Yen and Dollar trailing closely. On the other end of the spectrum, Canadian Dollar appears to be the most underwhelming performer, with Sterling and Aussie not faring much better. Swiss Franc and Kiwi present a mixed picture for the time being.

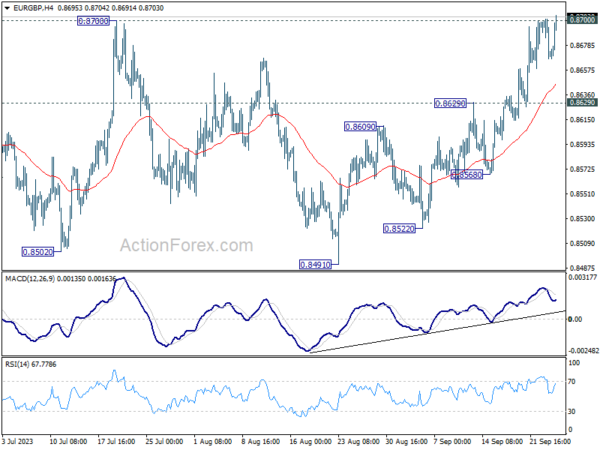

Technically, EUR/GBP is having another take on 0.8700 structural resistance today. Decisive break there will strengthen the case that whole corrective fall from 0.9267 has completed with three waves down to 0.8491. That would turn near outlook bullish for further rise to 0.8874/8977 resistance zone. Any upside acceleration in EUR/GBP could help cushion Euro’s decline against Dollar.

In Europe, at the time of writing, FTSE is up 0.21%. DAX is down -0.62%. CAC is down -0.66%. Germany 10-year yield is down -0.020 at 2.780. Earlier in Asia, Nikkei dropped -1.11%. Hong Kong HSI dropped -1.48%. China Shanghai SSE dropped -0.43%. Singapore Strait Times dropped -0.01%. Japan 10-year JGB yield rose 0.0150 to 0.746.

ECB’s Muller expects steady interest rates for the time being

ECB Governing Council member Madis Muller said today he does not anticipate any further hikes in interest rates for the time being.

The significant question is on the duration for which borrowing costs might remain at heightened levels. Expounding on this, he mentioned, “will depend on how the euro-area economy develops over the year and how the slowing of inflation plays out.”

Highlighting the current economic climate, Muller stated, “Right now, we see that the economic situation is relatively weak in the euro area as a whole.”

He, however, expressed a cautious optimism about the region’s economic future, noting the potential for modest improvements. ”

Looking forward, it could start improving slightly. If the recovery is slower, then that means smaller pressures in terms of inflation,” Muller added.

Japanese officials weigh in on Yen’s slide as it approaches 149 against Dollar

This week’s decline of Yen against Dollar, which seems poised to breach 149 mark, has brought remarks from Japanese officials into sharp focus. Market participants are keen to decipher indications of when Japan might transition from verbal caution to active intervention, even though it’s clear that Japan wouldn’t pre-announce such a move.

Finance Minister Shunichi Suzuki, reiterating his consistent position, stated today, “Foreign exchange rates should be determined by market forces, reflecting fundamentals.”

Suzuki emphasized that “Excessive volatility is undesirable,” and assured that the government is monitoring the currency fluctuations with a “high sense of urgency”. “We will respond as appropriate to excessive volatility without ruling out any options,” he added.

Echoing Suzuki’s sentiments, the newly appointed Economy Minister, Yoshitaka Shindo, stressed the significance of stable currency movements that mirror economic realities.

Pointing out the multifaceted impact of the Yen’s position, Shindo elaborated, “Weak Yen has various effects on economy such as raising import costs for consumers, improving competitiveness of exporters.”

With these comments, the stage is set for a heightened scrutiny of Japan’s potential interventions in the currency market. Market participants will no doubt remain vigilant to further remarks and actions by Japanese officials in the coming days.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 148.43; (P) 148.70; (R1) 149.15; More…

Intraday bias in USD/JPY remains on the upside for the moment. Current rise from 127.20 is in progress to retest 151.93 high. On the downside, however, firm break of 147.31 support will should confirm short term topping, and turn bias to the downside for 145.88 support and below.

In the bigger picture, while rise from 127.20 is strong, it could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by break of 137.22 support will indicate that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Aug | 2.10% | 1.80% | 1.70% | |

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Jul | -0.50% | -1.20% | ||

| 13:00 | USD | Housing Price Index M/M Jul | 0.10% | 0.30% | ||

| 14:00 | USD | Consumer Confidence Sep | 105.9 | 106.1 | ||

| 14:00 | USD | New Home Sales Aug | 700K | 714K |

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)