UPCOMING EVENTS:

- Monday: NZ

Services PMI, US NAHB Housing Market Index. - Tuesday: RBA

Meeting Minutes, Canada CPI, US Building Permits and Housing Starts. - Wednesday: PBoC

LPR, UK CPI, BoC Summary of Deliberations, FOMC Policy Decision. - Thursday: NZ

GDP, SNB Policy Decision, BoE Policy Decision, US Jobless Claims. - Friday: Japan

CPI, BoJ Policy Decision, UK Retail Sales, Canada Retail Sales, Flash PMIs

for AU, JP, UK, EZ, US.

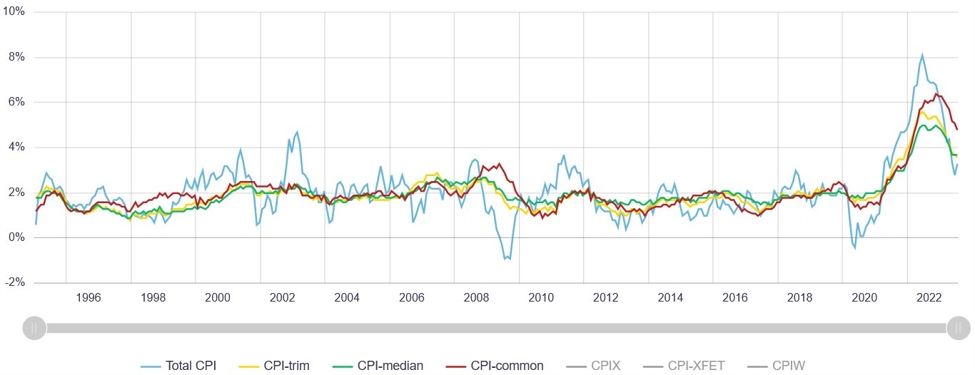

Tuesday

The Canadian Headline CPI Y/Y is expected

to tick higher to 3.8% vs. 3.3% prior, while the M/M reading is seen at 0.2%

vs. 0.6% prior. The BoC continues to complain about the slow disinflation in

the underlying measures, which beat expectations in the previous

months although they were lower than the

prior readings. There’s currently no consensus for the core measures but higher

figures would put the central bank in a tough position given the recent rise in

wage

growth.

Canada Inflation Measures

Wednesday

The UK Headline CPI Y/Y is expected to

increase to 7.1% vs. 6.8% prior, while the M/M reading is seen at 0.7% vs.

-0.4% prior. Such a big increase is due to higher energy prices with the

central banks more focused on the core measures at the moment. The UK Core CPI

Y/Y is expected at 6.8% vs. 6.9% prior, while the M/M figure is seen at an

uncomfortable 0.7% vs. 0.3% prior. This report is unlikely to change the

market’s pricing for this week’s BoE meeting where the central bank is expected

to hike by 25 bps, but it will influence the expectations for the next

meetings.

UK Core CPI YoY

The Fed is expected to hold rates steady

at 5.25-5.50% but the market’s focus will be on the Summary of Economic

Projections (SEP) and the Dot Plot to see if the central bank still sees the

need for another rate hike or it has reached its terminal rate already. As a

reminder, in the June

Dot Plot the Fed increased its terminal rate

projections by 50 bps to 5.6% from the previous 5.1% in March. The market

currently sees a 50/50 chance for another rate hike at the November meeting

given the strength in the economic data recently with rate cuts being priced

for Q3 2024.

Federal Reserve

Thursday

The SNB is expected to hold rates steady

at 1.75% given the weak economic data and both the headline and core inflation

measures being in the SNB’s 0-2% target band.

SNB

The BoE is expected to hike by 25 bps

bringing the bank rate to 5.50% with Dhingra being the usual dissenter. Recent

communication seems to be leaning more towards keeping interest rates high long

enough to let the tightening in the pipeline to come through. Nonetheless, the

central bank should keep all the options on the table given its inflation and

wage growth rates.

BoE

The US Jobless Claims beat expectations

once again the last

week as the labour market continues to

soften although it remains fairly tight. This week the consensus sees Initial

Claims at 225K vs. 220K prior and Continuing Claims at 1695K vs. 1688K prior.

US Initial Claims

Friday

The BoJ is expected to keep everything

unchanged with rates at -0.10% and YCC to target 10yr JGBs at 0% with a soft

cap at -/+0.50% and a hard cap at 1.00%. The yield on the 10yr recently spiked

to 0.70% following BoJ

Governor Ueda comments about a “quiet exit”

from NIRP if the data supports such a move. The BoJ, of course, intervened by

buying unlimited amount of JGBs last week as they already repeated many times

that they will do so if the pace of the moves is too fast. Moreover, the wage

growth data continues to point to a slowdown, and this is something that the

BoJ watches very carefully.

BoJ

The Flash PMIs are usually big market

movers as they are the most important leading indicators we have. The market

should focus on the Eurozone and the US PMIs, with the latter likely to have a

bigger impact on global markets depending on the outcome. The US Manufacturing

PMI is expected to match the prior reading at 47.9, while the Services PMI is

seen lower at 50.3 vs. 50.5 prior.

PMI