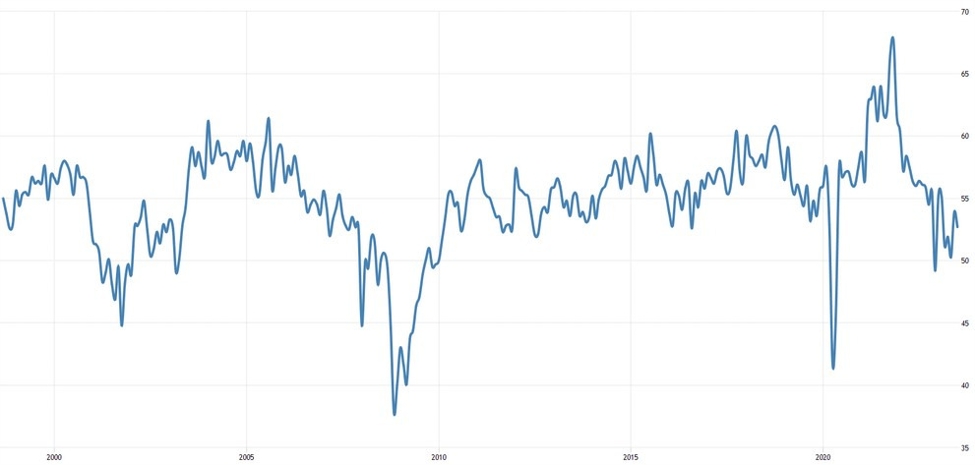

US ISM Services PMI

Details:

- employment index 54.7 versus 50.7 prior

- new orders index 57.5 versus 55.0 prior

- prices paid index 58.9 versus 56.8 prior

- new export orders 62.1 versus 61.1 prior

- imports 52.3 versus 52.3 prior

- backlog of orders 41.8 versus 52.1 prior

- inventories 57.7 versus 50.4 prior

- supplier deliveries 48.5 versus 48.1 prior

- inventory sentiment 61.5 versus 56.6 prior.

This is a surprise, especially with the S&P Global PMI weakening off just before this. The takeaway here may be that while the retail segment is sliding, the broader services sector is still strong.

Comments in the report:

- “Restaurant sales and traffic trends remain positive year over year

and compared to pre-pandemic (levels). Hiring is stable, with quality

employees available. New California regulations in July included

(municipal) minimum wage hikes and implementation of Proposition 12 (a

farm animal health and welfare legislation), resulting in much higher

pork prices.” [Accommodation & Food Services] - “Sales on a national level have been strong. Commodity material

prices remain stable, and we are finding areas for cost reductions.

Material availability has returned to pre-COVID-19 levels.”

[Construction] - “While labor costs continue to soften, costs of pharmaceuticals and

supplies remain stubbornly high, negatively impacting operating margins.

Supply chains are operating consistently, though some categories of

supply remain constrained. Patient volumes and revenues were down

slightly (for the month) but appear to be rebounding as back-to-school

season approaches. Forecast remains cautiously optimistic.” [Health Care

& Social Assistance] - “The supply chain challenges affect a portion of our buys, as they

include products and components made outside of the U.S. and are subject

to shipping delays and issues. The prices of materials and other

products have slightly increased. Distribution of some direct materials

has been altered due to a key supplier financial issue.” [Management of

Companies & Support Services] - “Steady oil and gas production and sales volume. Declining commodity prices seem to have bottomed out.” [Mining]

- “The summer slowdown is similar to those in recent years due to

vacations. Third-quarter projections are close to expectation.

Inflationary costs are mostly in fuel and fuel-related commodities,

having an adverse effect on profits.” [Professional, Scientific &

Technical Services] - “Prices have settled. Warnings of a possible recession in 2024 are

not being taken very seriously by top management. The same experts

warned that the country would be in a recession by now. Our general

feeling is that the (Federal Reserve’s) strategy for taming inflation

and building a soft landing for the economy is working better than

expected. The city has proposed reducing its municipal tax for the

fiscal year beginning October 1.” [Public Administration] - “Overall conditions seem quite good, although there is definite

slowdown in residential construction driven by rapidly increasing

interest rates.” [Real Estate, Rental & Leasing] - “Business activity continues to be lower year over year, but we are meeting the year-to-date forecast.” [Retail Trade]

- “Utility contractors in high demand.” [Utilities]

This article was originally published by Forexlive.com. Read the original article here.