Markets:

- Gold flat at $1940

- US 10-year yields up 8.8 bps to 4.18%

- WTI crude oil up $2.25 to $85.88

- S&P 500 up 0.1%

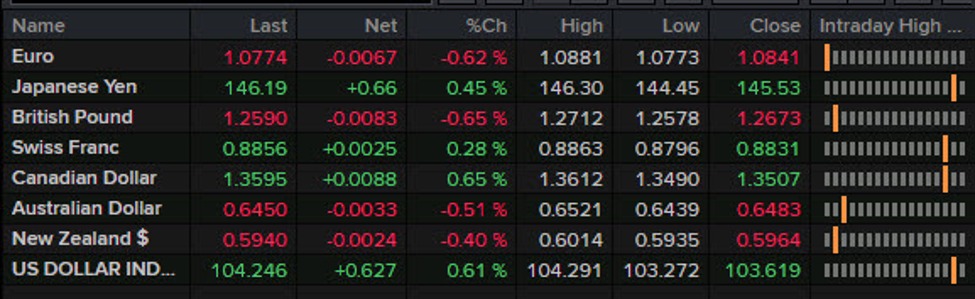

- USD leads, CAD lags

The initial market reaction to the non-farm payrolls report was about what you would expect — USD selling, bonds bid — but then it got complicated. The initial moves reversed and bonds sold off, leading to a strong bid in the US dollar. The moves grew increasingly aggressive with USD/JPY slumping to 144.45 then soaring to 146.16 — nearly 180 pips.

The dollar roared elsewhere as well with EUR/USD tumbling to levels just above the August lows. That wiped out what had been a promising rally this week for the euro bulls.

Cable rose to 1.2713 on the US jobs report then dropped 1.2580 before trading sideways into the US long weekend.

The only currency with a relatively straightforward move was CAD as a poor GDP report sank the loonie initially and then USD strength did the rest. The result was a 90-pip rise in USD/CAD to 1.3600, also wiping out some decent progress that had been made earlier in the week.

The big question left to answer is: Why the sudden jump in bond yields on what was a dovish jobs report? Some pointed to modest strength in the ISM survey along with the energy price rise but that’s hardly compelling. Other talk centers around rate lock selling and I can’t help but wonder if Chinese bond sellers were looking for liquidity. There isn’t an easy answer and the long weekend along with the turn of the calendar were also cited.

The lack of a clear explanation puts the US dollar rally on a shaky foundation. We’ll have to sort it out next week — enjoy the weekend.