Euro falls broadly today together with other European majors. Some might point to the expected slowdown in Eurozone core inflation in August as a factor. But indeed headline inflation was steady from the prior month, above expectations. Comments from ECB officials were also hawkish. Traders are probably just squaring positions ahead of tomorrow’s US non-farm payroll, after failing to push Dollar lower. Talking about the greenback, there is no clear reaction to PCE inflation data which came in as expected.

For now, Yen is the strongest one for the day, riding on the decline in benchmark yields in US, Germany and UK. Australian Dollar is the second strongest, followed by Canadian Dollar. Euro is the worst, followed by Swiss Franc and Sterling. Dollar is mixed in the middle.

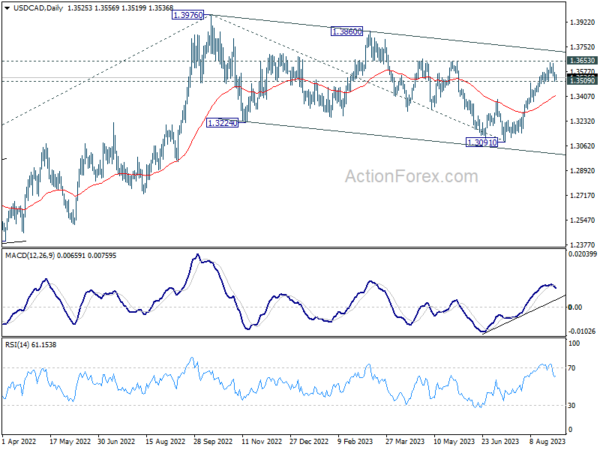

Technically, USD/CAD is holding above 1.3509 minor support, and further rise is in favor. The corrective pattern from 1.3976 should have completed at 1.3091 already. Firm break of 1.3653 resistance will target 1.3860 and then 1.3976. However, break of 1.3509 will dampen this view, and bring deeper pull back to 55 D EMA first. Given that US NFP and Canada GDP will be featured tomorrow, the pair would likely unveil the next move soon.

In Europe, at the time of writing, FTSE is up 0.20%. DAX is up 0.73%. CAC is up 0.04%. Germany 10-year yield is down -0.0462 at 2.502. Earlier in Asia, Nikkei rose 0.88%. Hong Kong HSI dropped -0.55%. China Shanghai SSE dropped -0.55%. Singapore Strait Times rose 0.41%. Japan 10-year JGB yield dropped -0.0085 to 0.647.

US PCE price index rose to 3.3% yoy, core PCE up to 4.2% yoy

US personal income edged up by 0.2% mom, or USD 45.0 billion, missing the anticipated 0.3% increase. The modest gain in income primarily reflected an uptick in compensation, which was partially offset by a decline in personal current transfer receipts.

Conversely, personal spending outperformed expectations, registering a 0.8% mom rise, or an increase of USD 144.6 billion, compared to the projected 0.7%. This growth was predominantly driven by a USD 102.7 billion expansion in spending on services and a USD 41.9 billion increase in goods expenditure.

PCE price index and Core PCE price index (excluding food and energy), both rose 0.2% mom, matching market expectations. The components within the inflation basket displayed a mixed pattern, with prices for goods falling by -0.3% and prices for services rising by 0.4%. Additionally, food prices saw a modest increment of 0.2%, while energy prices edged up by 0.1%.

On a year-over-year basis, PCE price index climbed from 3.0% yoy to 3.3% yoy, while Core PCE price index ascended from 4.1% to 4.2%, both in alignment with market predictions. A disaggregated look at the year-over-year data reveals that prices for goods dropped by -0.5%, and prices for services surged by 5.2%. Meanwhile, food prices increased by 3.5%,and energy prices dipped by a notable -14.6%.

US initial jobless claims dropped to 228k

US initial jobless claims dropped -4k to 228k in the week ending August 26, slightly above expectation of 227k. Four-week moving average of initial claims rose 250 to 237.5k.

Continuing claims rose 28k to 1725k in the week ending August 19. Four-week moving average of continuing claims rose 8k to 1704k.

Fed Bostic said policy restrictive enough, warns against unnecessary economic pain

In a set of prepared remarks, Atlanta Fed President Raphael Bostic noted emphasizing that the current restrictive stance is appropriate. He urged for a cautious and patient approach, warning against the potential for “unnecessary economic pain” if the Fed tightens policy too aggressively.

Importantly, Bostic clarified that his endorsement for a patient approach should not be interpreted as support for easing monetary policy in the near term. He stated, “that does not mean I am for easing policy any time soon.”

He argued that Fed must remain “resolute” in keeping policy tight until it is clear that inflation is moving towards the 2% target within a reasonable time frame. “I believe policy is already restrictive enough to get us there,” he added.

Eurozone CPI holds steady at 5.3%, core CPI slows to 5.3%

In August, Eurozone’s CPI defied market expectations by remaining unchanged at a 5.3% yoy, contrary to anticipated slowdown to 5.1% yoy. Core inflation, which excludes energy, food, alcohol, and tobacco, did slow down, but only to match expectations, declining from 5.5% yoy to 5.3% yoy.

A breakdown of the main components contributing to Eurozone’s inflation rate reveals a mixed bag. Food, alcohol, and tobacco are expected to register the highest annual rate in August at 9.8%, albeit lower than the 10.8% seen in July. Services come next, slipping slightly from 5.6% to 5.5%, followed by non-energy industrial goods which also dipped from 5.0% to 4.8%. Notably, energy costs seem to have eased their downward trend, registering at -3.3% compared to -6.1% in the previous month.

ECB accounts: Diverging views on the need of a Sep hike

ECB released account of its monetary policy meeting held on July 26-27, shedding light on the deliberations among the policymakers.

According to the minutes, all members supported the 25 basis point rate increase. Nevertheless, some members expressed a preference initially for not raising key ECB interest rates further, citing risks of stronger-than-anticipated transmission of rate hikes into the economy.

Interestingly, the account captured diverging views on the necessity for another rate hike in September. On one side, it was argued that if inflation did not decline as swiftly as expected, interest rates would need to be adjusted further to ensure a timely return to the 2% target.

On the other side, some members posited that the September ECB staff projections could potentially show a downward revision in the inflation path, making another rate hike in September unnecessary.

ECB Holzmann: We could do another hike or two

ECB Governing Council member Robert Holzmann said he has yet to make a decision about the upcoming September meeting but pointedly did not rule out the possibility of an interest rate hike.

“We are not yet at the highest level; it could be that we do another hike or two,” Holzmann commented, offering a glimpse into his thoughts on the current stance of ECB monetary policy.

However, Holzmann also put forth a scenario that could lead to an earlier-than-expected easing of rates. “If we were to move this year to above 4% … and inflation comes down, then we could be able, perhaps, to change it already to lower rates in 2024. If that’s not the case, we’ll have to wait for 2025,” he said.

ECB Schnabel: Underlying price pressures remain stubbornly high

ECB Executive Board member Isabel Schnabel said in a speech that despite decline in headline inflation, largely due to unwinding of previous supply-side shocks, “underlying price pressures remain stubbornly high,” with domestic factors now becoming the main drivers of inflation.

Given this backdrop, Schnabel emphasized the necessity of maintaining “sufficiently restrictive monetary policy” to steer inflation back to target. She advocated for a data-dependent approach, stating that the bank will continually assess whether current policy is effective in ensuring “a sustained and timely return of inflation to our 2% target.”

To guide this assessment, Schnabel pointed to the need for a comprehensive risk analysis that looks beyond baseline inflation forecasts. This approach accounts for an “exceptionally large degree of uncertainty” in medium-term inflation projections, with risks on both the upside and downside.

Upside risks include stronger-than-expected growth in unit labor costs, firmer corporate pricing power, and the potential for new adverse supply-side shocks. Conversely, downside risks include possibility that impact of current monetary policy may become more pronounced over the medium term.

Notably, Schnabel also raised the issue of real risk-free rates, which have declined recently as investors reassess their expectations for economic growth and inflation. She warned that this decline could potentially “counteract” the ECB’s efforts to control inflation effectively.

BoE Pill: Current emphasis on sufficiently restrictive policy for sufficiently long

In a speech in South Africa today, BoE Chief Economist Huw Pill underscored the importance of seeing “the job through” to ensure a “lasting and sustainable return of inflation to the 2% target,” highlighting the critical balance the bank must strike as it’s now in the territory of restrictive policy.

Pill acknowledged the perils of “doing too much,” and “inflicting unnecessary damage on employment and growth”.

Nevertheless, the present emphasis, he noted, is on maintaining “sufficiently restrictive” policy for “sufficiently long” to assure a sustainable return to the inflation target, echoing the language used in the MPC’s last statement.

Japan’s industrial production slips -2% in Jul, but retail sales resilient

Japan’s industrial production took a hit in July, falling by a worse-than-expected -2.0% mom, versus consensus forecast of -1.4% mom. The seasonally adjusted production index stumbled to 103.6, based on 2020 base of 100.

Production was primarily pulled down by substantial drops in electronic parts and devices, which declined -by 5.1% mom. Also, production machinery output shrank by -4.8% mom, with semiconductor manufacturing equipment segment plunging a stark 16.4% mom. However, not all was grim. Production of automobiles showed a modest uptick of 0.6% mom, attributed to the easing of supply chain bottlenecks.

A Ministry of Economy, Trade, and Industry official remarked that the slump in output across various sectors was largely due to diminishing domestic and overseas orders. Consequently, METI has revised its assessment of industrial output from “showing signs of moderately picking up” to “fluctuated indecisively.”

Despite the grim industrial landscape, manufacturers surveyed by METI are optimistic, projecting a 2.6% rise in output for August and a 2.4% increase in September.

In contrast to the industrial sector’s lackluster performance, retail sales exhibited considerable strength. Sales surged 6.8% yoy in July, beating expectations of a 5.4% yoy increase. This marks the 17th consecutive month of expansion since March 2022. Additionally, retail sales increased 2.1% mom in July, recovering from a -0.6% mom decline in the previous month.

BoJ Nakamura: Achievement of 2% inflation isn’t in sight yet

In a marked contrast to fellow BoJ board member Naoki Tamura’s recent remarks, Toyoaki Nakamura, known for his dovish stance, stressed the need for a more cautious approach towards tightening Japan’s monetary policy. Speaking at an event, Nakamura noted, “Sustainable and stable achievement of our 2% inflation isn’t in sight yet. We therefore need more time before shifting to monetary tightening.”

Nakamura emphasized the necessity for “close scrutiny of conditions and cautious decision-making” when it comes to modifications in Japan’s ultra-loose monetary policy. He further cited weakening economic signs in China and potential ripple effects of aggressive US interest rate hikes as risks clouding Japan’s economic outlook.

Interestingly, Nakamura was the sole dissenting voice last month against the BoJ’s decision to loosen its grip on yield curve control, underscoring his position as the board’s most dovish member. His comments are in stark contrast to those of board member Naoki Tamura, who expressed optimism yesterday that BoJ could have sufficient data by the first quarter of 2024 to assess whether the 2% inflation target could be met sustainably.

NZ ANZ business confidence rose to -3.7, the worst could be over

New Zealand’s ANZ Business Confidence index showed a marked improvement in August, rising from -13.1 to -3.7. The data suggests a positive shift in the economic outlook among New Zealand businesses. Own Activity Outlook also jumped from a tepid 0.8 to a robust 11.2.

Several other sub-indicators within the report signaled optimism. Export intentions rose from 1.5 to 7.5, indicating that businesses are more confident about overseas demand. Investment intentions climbed from -3.3 to -1.3, suggesting that companies are less hesitant about capital expenditures. Employment intentions also saw a notable uptick, moving from -1.6 to 4.6, pointing to potential job market expansion.

On the inflationary front, businesses appear to be less worried. Cost expectations decreased from 80.6 to 75.3, pricing intentions fell from 48.1 to 44.0, and inflation expectations eased marginally from 5.14 to 5.06. This cooling in inflationary pressure might be a welcome sign for both the market and RBNZ.

In their commentary, ANZ stated: “Many firms appear to have been pleasantly surprised at how well demand has held up, considering; and the Reserve Bank has stopped raising the OCR (Official Cash Rate), (while reserving the right to change their minds), which may be creating a sense that the worst is over.”

China’s PMI manufacturing edges up to 49.7, fifth month in contraction

China’s official PMI Manufacturing for August rose slightly to 49.7, surpassing market expectations of 49.5. Despite the increment, this marks the fifth consecutive month that the metric is below the 50-threshold, signaling a contraction in the manufacturing sector.

Key sub-indexes within the PMI data painted a mixed picture. Production sub-index saw improvement, rising from 50.2 in July to 51.9 . Similarly, the gauge for new orders nudged up to 50.2 from 49.5. On the downside, new export orders sub-index stayed low at 46.7, though it was slightly up from 46.3 , marking its fifth consecutive month in contraction territory.

Manufacturers’ business expectations did see some improvement, rising from 55.1 to 55.6, indicating a slight uptick in future outlook despite current headwinds.

Zhao Qinghe, a senior official from China’s National Bureau of Statistics, commented on the situation. “The survey results show that insufficient market demand is still the main problem that enterprises are facing, and the foundation for the recovery and development of the manufacturing industry needs to be further consolidated,” he said.

Meanwhile, PMI Non-Manufacturing fell from 51.5 to 51.0, missing market expectations of 51.1, although it still remains in the expansionary territory above 50.

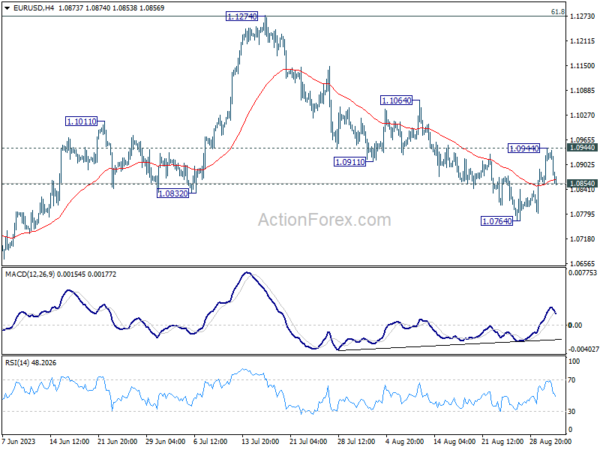

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0870; (P) 1.0908; (R1) 1.0960; More…

Intraday bias in EUR/USD stays neutral first as today’s dip is contained by 1.0854 minor support so far. On the downside, break of 1.0854 will bring retest of 1.0764 low first. Break there will resume larger fall from 1.1274 to 1.0609/34 cluster support next. On the upside, however, break of 1.0944 resistance will argue that the corrective fall from 1.1274 has completed with three waves down to 1.0764. Further rally would then be seen to 1.1064 resistance for confirmation.

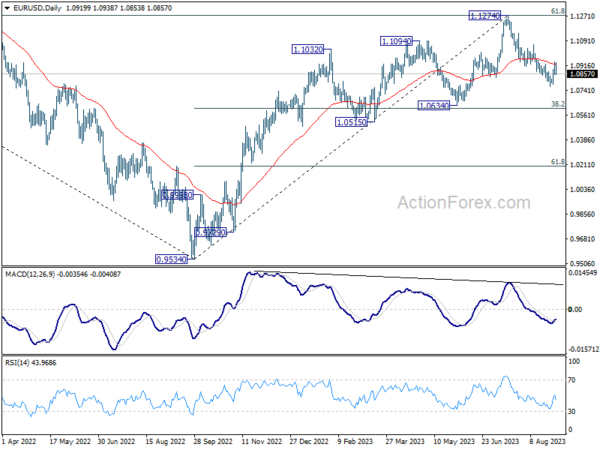

In the bigger picture, fall from 1.1274 medium term top is seen as a correction to up trend from 0.9534 (2022 low). Deeper decline would be seen to 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609). Strong support could be seen there, at least on first attempt, to bring rebound. Yet, medium term outlook will be neutral for now, as long as 1.1274 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Jul P | -2.00% | -1.40% | 2.40% | |

| 23:50 | JPY | Retail Trade Y/Y Jul | 6.80% | 5.40% | 5.90% | |

| 01:00 | NZD | ANZ Business Confidence Aug | -3.7 | -13.1 | ||

| 01:00 | CNY | NBS Manufacturing PMI Aug | 49.7 | 49.5 | 49.3 | |

| 01:00 | CNY | Non-Manufacturing PMI Aug | 51 | 51.1 | 51.5 | |

| 01:30 | AUD | Private Capital Expenditure Q2 | 2.80% | 1.10% | 2.40% | 3.70% |

| 05:00 | JPY | Housing Starts Y/Y Jul | -6.70% | -0.80% | -4.80% | |

| 06:00 | EUR | Germany Retail Sales M/M Jul | -0.80% | 0.30% | -0.80% | -0.20% |

| 06:45 | EUR | France Consumer Spending M/M Jul | 0.30% | 0.30% | 0.90% | |

| 06:45 | EUR | France GDP Q/Q Q2 | 0.50% | 0.50% | 0.50% | |

| 07:55 | EUR | Germany Unemployment Change Jul | 18K | 10K | -4K | |

| 07:55 | EUR | Germany Unemployment Rate Jul | 5.70% | 5.60% | 5.60% | |

| 08:00 | EUR | Italy Unemployment Jul | 7.60% | 7.40% | 7.40% | 7.50% |

| 09:00 | EUR | Eurozone Unemployment Rate Jul | 6.40% | 6.40% | 6.40% | |

| 09:00 | EUR | Eurozone CPI Y/Y Aug P | 5.30% | 5.10% | 5.30% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Aug P | 5.30% | 5.30% | 5.50% | |

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:30 | CAD | Current Account (CAD) Q2 | -6.6B | -11.1B | -6.2B | |

| 12:30 | USD | Initial Jobless Claims (Aug 25) | 228K | 227K | 230K | 232K |

| 12:30 | USD | Personal Income M/M Jul | 0.20% | 0.30% | 0.30% | |

| 12:30 | USD | Personal Spending Jul | 0.80% | 0.70% | 0.50% | |

| 12:30 | USD | PCE Price Index M/M Jul | 0.20% | 0.20% | 0.20% | |

| 12:30 | USD | PCE Price Index Y/Y Jul | 3.30% | 3.30% | 3.00% | |

| 12:30 | USD | Core PCE Price Index M/M Jul | 0.20% | 0.20% | 0.20% | |

| 12:30 | USD | Core PCE Price Index Y/Y Jul | 4.20% | 4.20% | 4.10% | |

| 13:45 | USD | Chicago PMI Aug | 44.1 | 42.8 | ||

| 14:30 | USD | Natural Gas Storage | 20B | 18B |

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending