Dollar is facing accelerated selloff following the release of disappointing ADP private employment data, which showed deceleration in both job and pay growth. Although the employment numbers were by no means dismal, the cooling job market is being perceived as a positive development by Fed and market participants. This perception stems from the notion that slower job market could potentially ease the need for further monetary tightening. Subsequently, benchmark US Treasury yields tumble, indicating reduced expectations for more interest rate hikes.

As Dollar weakens, a fierce competition is shaping up among other major currencies, notably Euro, Sterling, Aussie, and Kiwi. Currently, Australian dollar has an edge, but Euro could mount a challenge, especially as the market anticipates Eurozone CPI flash report due tomorrow. The data will likely serve as a critical test for the common currency’s resilience.

From a technical standpoint, Gold is capitalizing on Dollar’s weakness. The precious metal’s rally from 1884.84 extends further today. Immediate attention is now on the trend line resistance, currently situated at 1948.07. Sustained break above this level would bolster the argument that entire correction from 2062.95 has concluded with a three-wave drop down to 1884.83. Further rally would then be seen to 1987.22 resistance for confirmation. For now, further rise will remain in favor as long as 1923.19 minor support holds, in case of retreat.

In Europe, at the time of writing, FTSE is up 0.35%. DAX is down -0.06%. CAC is up 0.14%. Germany 10-year yield is up 0.029 at 2.541. Earlier in Asia, Nikkei rose 0.33%. Hong Kong HSI dropped -0.01%. China Shanghai SSE rose 0.04%. Singapore Strait Times dropped -0.09%. Japan 10-year JGB yield rose 0.0093 to 0.656.

US ADP jobs grew only 177k, wages growth slowed further

August’s US ADP Private Employment report showed a lower-than-expected gain of 177k jobs, falling short of the consensus forecast of 205k. The data, which is often viewed as a precursor to the official non-farm payrolls report, painted a nuanced picture of the American labor market.

By sector, goods-producing sectors added 23k jobs, while service-providing sectors accounted for 154k new positions. By establishment size, small companies added 18k jobs, medium-sized companies contributed 79k, and large companies rounded out the additions with 83k.

Compounding the modest employment gains was a noticeable slowdown in wage growth. For those staying in their current roles, the year-over-year pay increase was 5.9%, marking the weakest growth since October 2021. Meanwhile, job changers experienced a deceleration in pay growth to 9.5%.

Nela Richardson, chief economist at ADP, provided context for these numbers. “This month’s figures are consistent with the pace of job creation before the pandemic,” she said. “After two years of exceptional gains tied to the recovery, we’re moving toward more sustainable growth in pay and employment as the economic effects of the pandemic recede.”

Also released, goods trade deficit widened to USD -91.2B in July, versus expectation of USD -90.0B. Q2 GDP growth was revised down to 2.1%.

Eurozone economic sentiment deteriorates across the board

Eurozone Economic Sentiment Indicator (ESI) witnessed a drop from 194.5 to 93.3 in August, casting a dark shadow over the economic outlook of the bloc. Nearly all sectoral confidence indicators fell, with industry confidence sliding from -9.3 to -10.3, services from 5.4 to 3.9, retail trade from -4.5 to -5.0, and construction from -3.6 to -5.2. Employment Expectations Indicator (EEI) also showed a decline from 103.4 to 102.1, while the Economic Uncertainty Indicator (EUI) dipped from 21.3 to 20.0.

Similarly, EU-wide ESI fell modestly from 93.5 to 92.9, and its EEI from 102.7 to 101.7. EUI also registered a decline from 20.7 to 19.7. Breaking down the ESI numbers by individual countries, sentiment deteriorated in France -by 2.5 points, in Germany by -2.4 points, and in Italy by -1.1 points. Conversely, sentiment improved in Spain by 1.5 points and in Poland by 1.2 points, while the sentiment in the Netherlands remained almost unchanged, up by just 0.2 points.

Swiss KOF falls to 91.1, signals sluggish economy ahead

Swiss KOF Economic Barometer, a leading indicator for the Swiss economy, declined from 92.1 to 91.1 in August, missing market expectation of 91.3. The barometer continues to hover below the average mark, signaling that Swiss economy is likely to face challenging conditions in the near term.

According to KOF, almost all sectoral indicators contributed to the lower reading except for construction and domestic consumption, which exhibited slight positive developments.

The most notable downturn in sentiment was observed in the services sector, affecting both real and financial services. This was closely followed by export-oriented businesses, as well as the hotel and restaurant industries.

Australian CPI eases more than expected to 4.9% in July

Australia’s monthly CPI for July registered a deeper than expected slowdown, easing from 5.4% yoy to 4.9% yoy. Analysts had forecasted a milder decline to 5.2% yoy. The underlying inflation measures also indicated a deceleration. CPI excluding volatile items such as holiday travel came in at 5.8% yoy, down from 6.1% yoy. The trimmed mean CPI, which is often regarded as a more accurate reflection of inflationary pressures, slowed from 6.0% yoy to 5.6% yoy.

A closer look at the inflation contributors reveals a mixed picture. Housing costs remained a significant upward pressure, climbing 7.3% on an annual basis. Food and non-alcoholic beverages followed closely, rising by 5.6% yoy. However, this was offset by substantial price falls in other areas. Automotive fuel costs dropped by -7.6%, while fruit and vegetable prices declined by -5.4%, thus tempering the overall July increase.

The latest CPI data comes on the heels of yesterday’s hawkish comments from incoming RBA Governor Michele Bullock, who emphasized that her first priority is still to maintain a focus on bringing inflation back down to target. Today’s lower-than-expected inflation figures might lend some flexibility to RBA’s policy approach, but with sectors like housing and food still exhibiting strong price pressures, the central bank’s task appears far from straightforward.

BoJ’s Tamura eyes next Q1 for decisive inflation data for policy shifts

BoJ board member Naoki Tamura offered insights into the timeline for potentially phasing out the central bank’s ultra-accommodative stance. he signaled that by the first quarter of 2024, BoJ could gather sufficient data to evaluate whether the 2% inflation target could be sustainably achieved.

“It’s appropriate at this stage to sustain monetary easing, and earnestly scrutinize wage and price developments,” Tamura said, adding that he is hopeful for “further clarity” on the inflation target “around January through March next year” through wage and price data available by that time.

Tamura anticipates that Japan’s inflation could slow down for the time being, only to moderately accelerate later. This coincides with his expectation of high wage growth in the next year’s spring wage negotiations.

Tamura emphasized that the “biggest key to monetary policy outlook is whether Japan achieves a positive cycle of rising wages and inflation.”

EUR/USD Mid-Day Outlook

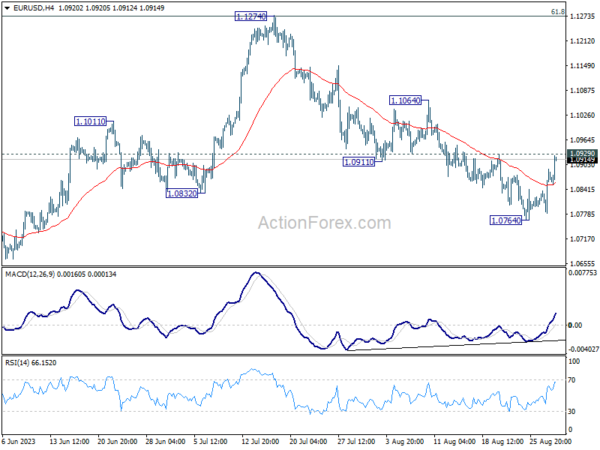

Daily Pivots: (S1) 1.0810; (P) 1.0851; (R1) 1.0920; More…

Immediate focus is now on 1.0929 resistance in EUR/USD. Firm break there will argue that the corrective fall from 1.1274 has completed with three waves down to 1.0764. Further rally would then be seen to 1.1064 resistance for confirmation. Meanwhile, rejection by 1.0929 will retain near term bearishness. Break of 1.0764 will resume the decline to 1.0609/34 cluster support next.

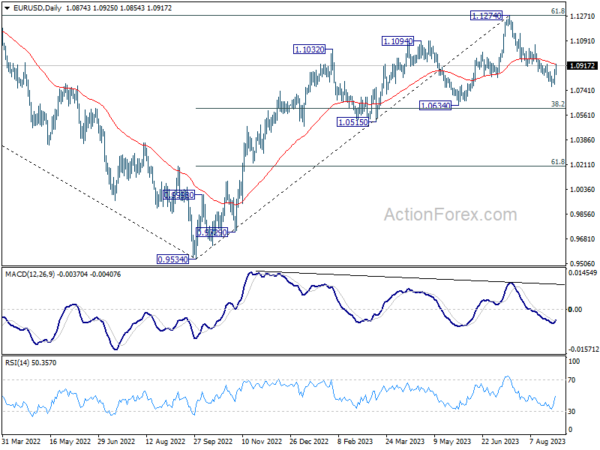

In the bigger picture, fall from 1.1274 medium term top is seen as a correction to up trend from 0.9534 (2022 low). Deeper decline would be seen to 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609). Strong support could be seen there, at least on first attempt, to bring rebound. Yet, medium term outlook will be neutral for now, as long as 1.1274 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Jul | -5.20% | 3.50% | 3.40% | |

| 01:30 | AUD | Monthly CPI Y/Y Jul | 4.90% | 5.20% | 5.40% | |

| 01:30 | AUD | Building Permits M/M Jul | -8.10% | -0.50% | -7.70% | -7.90% |

| 05:00 | JPY | Consumer Confidence Index Aug | 36.2 | 37.5 | 37.1 | |

| 06:00 | EUR | Germany Import Price Index M/M Jul | -0.60% | -0.20% | -1.60% | |

| 07:00 | CHF | KOF Economic Barometer Aug | 91.1 | 91.3 | 92.2 | 92.1 |

| 08:00 | CHF | Credit Suisse Economic Expectations Aug | -38.6 | -32.6 | ||

| 08:00 | EUR | Eurozone Economic Sentiment Indicator Aug | 93.3 | 93.9 | 94.5 | |

| 08:00 | EUR | Eurozone Industrial Confidence Aug | -10.3 | -9.8 | -9.4 | -9.3 |

| 08:00 | EUR | Eurozone Services Sentiment Aug | 3.9 | 4.2 | 5.7 | 5.4 |

| 08:00 | EUR | Eurozone Consumer Confidence Aug F | -16 | -16 | -16 | |

| 08:30 | GBP | Mortgage Approvals Jul | 49K | 52K | 55K | |

| 08:30 | GBP | M4 Money Supply M/M Jul | -0.50% | 0.10% | -0.10% | |

| 12:00 | EUR | Germany CPI M/M Aug P | 0.30% | 0.30% | 0.30% | |

| 12:00 | EUR | Germany CPI Y/Y Aug P | 6.10% | 6.00% | 6.20% | |

| 12:15 | USD | ADP Employment Change Aug | 177K | 205K | 324K | 371K |

| 12:30 | USD | GDP Annualized Q2 P | 2.10% | 2.40% | 2.40% | |

| 12:30 | USD | GDP Price Index Q2 P | 2.00% | 2.20% | 2.20% | |

| 12:30 | USD | Goods Trade Balance (USD) Jul P | -91.2B | -90.0B | -87.8B | |

| 12:30 | USD | Wholesale Inventories Jul P | -0.10% | 0.20% | -0.50% | |

| 14:00 | USD | Pending Home Sales M/M Jul | -0.40% | 0.30% | ||

| 14:30 | USD | Crude Oil Inventories | -2.2M | -6.1M |

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)