In a relatively uneventful trading day, the notable standout is the rally in the USD/JPY currency pair, which has now reached its highest level this year. The bullish momentum for Dollar against Yen raises questions about whether traders are positioning themselves ahead of crucial employment and inflation data set to be released from the US this week. An upside surprise in either of these indicators could add fuel to expectations for another Fed rate hike this year, even if not as soon as September. Meanwhile, Japanese Yen is facing some headwinds following a higher-than-expected unemployment rate in Japan, which has undoubtedly put some pressure on the currency.

On the flip side, despite hawkish comments from incoming RBA Governor Michele Bullock, Australian Dollar is showing signs of weakness. Its near-term recovery appears to be stalling, raising prospects for further downside. Market participants will closely watch the upcoming monthly CPI data from Australia to gauge the currency’s direction. New Zealand Dollar trails as the third weakest for the day, while Swiss Franc and Canadian Dollar claim spots as the second and third strongest currencies, respectively. Both Euro and Sterling are delivering a mixed performance.

On the technical front, focus will shift to whether the U.S. Dollar’s rally can gain broader momentum. Key levels to keep an eye on include a temporary low of 1.076 in EUR/USD, 1.2546 in GBP/USD, and a temporary top of 0.8874 in USD/CHF. Simultaneous break of these levels could firmly set the Dollar’s tone leading into the highly anticipated non-farm payroll report due on Friday.

In Europe, at the time of writing, FTSE is up 1.44%. DAX is up 0.20%. CAC is up 0.27%. Germany 10-year yield is down -0.0114 at 2.571. Earlier in Asia, Nikkei rose 0.18%. Hong Kong HSI rose 1.95%. China Shanghai SSE rose 1.20%. Singapore Strait Times rose 0.29%. Japan 10-year JGB yield dropped -0.0210 to 0.647.

RBA Bullock sets eyes on inflation, signals possibility of further rate hikes

Incoming RBA Governor Michele Bullock made clear her primary focus would be tackling the country’s persistently high inflation. As Bullock prepares to take the helm of RBA on September 18, replacing her current role as deputy governor, her comments carry considerable weight for markets and policymakers alike.

“My first priority is to keep very focused on inflation. Inflation is still too high in Australia. It is coming down and we’re forecasting it to continue to come down, but it’s still too high,” said Bullock.

While she stopped short of providing a timeline for how long interest rates may remain elevated, Bullock did hint at the possibility of additional hikes in the future.

“I’m reluctant to give any sort of predictions on how long interest rates might have to stay high. In Australia’s case, all I can say is that we might have to raise interest rates again, but we’re watching the data very carefully,” she said.

Additionally, Bullock clarified that rate-setting decisions would, for the time being, be made on a “month-by-month” basis until at least next year.

German consumer sentiment slides to -25.5, dashing hopes for a late-year recovery

Consumer sentiment in Germany continues to languish as the GfK Consumer Sentiment Index for September slipped to -25.5, missing market expectations of -24.3 and marking a decline from last month’s -24.6.

“The consumer sentiment is currently not showing a clear trend, neither downward nor upward – and that at a very low level overall,” stated Rolf Bürkl, consumer expert at GfK.

Adding to the gloom, Bürkl warned, “The chances that consumer sentiment can sustainably recover before the end of this year are dwindling more and more.”

He cited “persistently high inflation rates, especially for food and energy supplies,” as the main obstacles hindering any meaningful advance in consumer sentiment.

The sub-components of the index painted an equally disheartening picture. Economic expectations in August plummeted from 3.7 to a worrying -6.2, marking the lowest level since last December’s -10.3. Meanwhile, income expectations saw a significant drop from -5.1 to -11.5. The propensity to buy, another crucial sub-index, also declined, falling from -14.3 to -17.0.

Japan’s unemployment rate up to 2.7%, first rise in four months

Japan’s job market showed unexpected signs of weakening in July, as the unemployment rate rose to 2.7%, defying expectations of remaining steady at June’s 2.5% level. This marks the first uptick in unemployment in four months. The data reveals that the number of employed workers decreased by -100k during the month, while the ranks of those without jobs swelled by 110k.

Adding to the concern, jobs-to-applicants ratio—a leading indicator of labor market health—dipped to 1.29 in July from 1.30. This is the third consecutive monthly decline, counter to median economist forecasts that predicted the ratio would remain flat. These figures indicate that there were only 129 job openings for every 100 applicants, a metric that is closely watched for signs of labor market tightness or slack.

USD/JPY Mid-Day Outlook

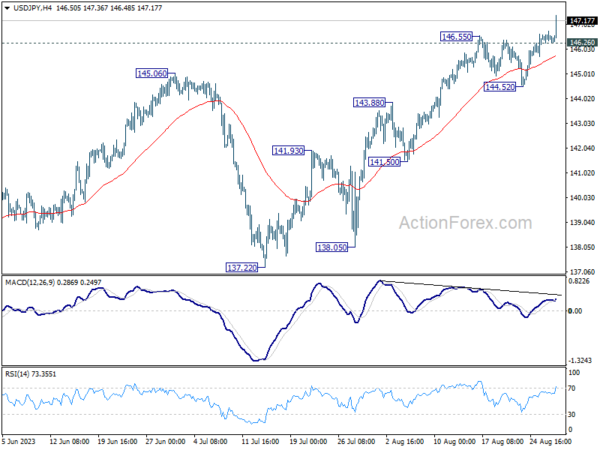

Daily Pivots: (S1) 145.83; (P) 146.30; (R1) 146.52; More…

USD/JPY’s rally accelerates to as high as 147.63 today so far. The strong break of 61.8% projection of 129.62 to 145.06 from 137.22 at 146.76 indicates solid underlying momentum. Intraday bias stays on the upside, and the rise from 127.20 should target a test on 151.93 high. On the downside, below 146.26 minor support will turn intraday bias neutral first. But near term outlook will remain mildly bullish as long as 144.52 support holds.

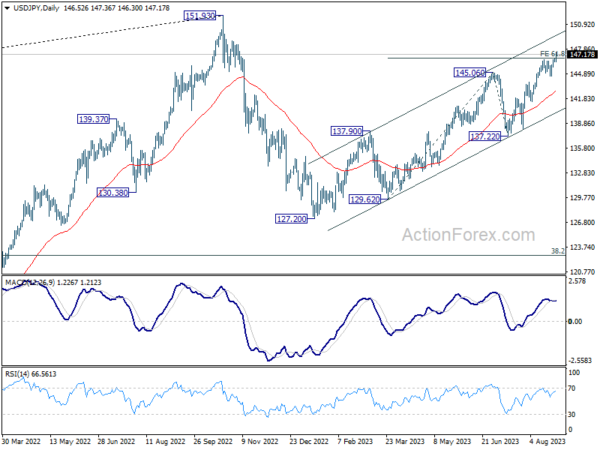

In the bigger picture, overall price actions from 151.93 (2022 high) are views as a corrective pattern. Rise from 127.20 is seen as the second leg of the pattern and could still be in progress. But even in case of extended rise, strong resistance should be seen from 151.93 to limit upside. Meanwhile, break of 137.22 support should confirm the start of the third leg to 127.20 (2023 low) and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Jul | 2.70% | 2.50% | 2.50% | |

| 06:00 | EUR | Germany Gfk Consumer Sentiment Sep | -25.5 | -24.3 | -24.4 | -24.6 |

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Jun | -1.50% | -1.70% | ||

| 13:00 | USD | Housing Price Index M/M Jun | 0.20% | 0.70% | ||

| 14:00 | USD | Consumer Confidence Aug | 116.5 | 117 |

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading