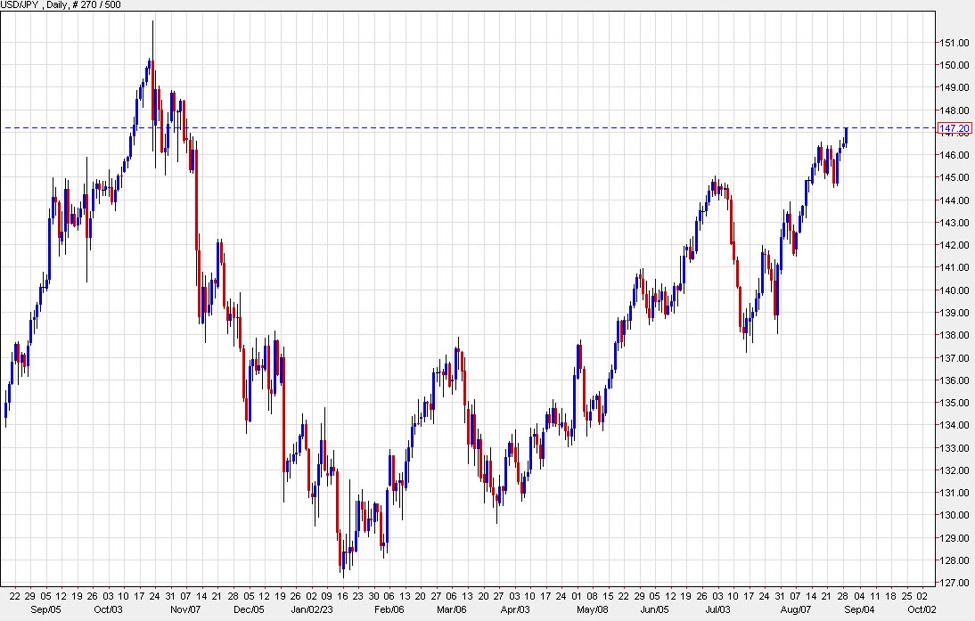

USDJPY up 66 pips

USD/JPY is breaking out and the dollar is breaking out more broadly. Treasury yields fell in Asia and early in Europe but they have turned higher now with 10s at 4.22% from a low of 4.17%.

That has set off significant moves throughout the forex market, with the dollar gaining 20-40 pips on various crosses. For AUD/USD, it’s been a straight line down to 0.6414 from 0.6454 just two hours ago.

Yesterday was a holiday in the UK and that may have kept some dollar orders out of the market. Those are going through now and ahead of data on US house prices, consumer confidence, JOLTS and a 7-year Treasury auction.

So far, equities aren’t contributing to risk aversion with S&P 500 futures down just 4 points but given the backdrop, look for equities to add to the dollar bid.

Moreover, the USD/JPY chart above highlights a lack of resistance up to 150.00.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading