Asian equities witnessed an upswing today, buoyed by China’s announcement of several initiatives aimed at enticing investors back into the market. Among these measures, the decision to trim the stamp duty on stock transactions and a more gradual roll-out of initial public offerings captured investors’ attention. Adding to the positive sentiment was the unexpected move by regulators to impose restrictions on share sales by major stakeholders of companies whose share prices have plunged below IPO or net asset values. Additionally, regulators have tweaked the margin ratios for leveraged trades, a move that took many by surprise.

On the forex front, Australian Dollar experienced an uptick, bolstered by a revival in risk appetite and further supported by the upbeat retail sales data. New Zealand Dollar and Sterling followed closely, staking their positions as the next strongest currencies. Conversely, Dollar and Yen are trailing the pack for the day. Euro, Swiss Franc, and Canadian Dollar are mixed.

Despite these dynamics, overall market fluctuations remain on the restrained side. Traders are poised with anticipation for the array of high-caliber economic releases set to be unveiled later this week. Among these, US non-farm payrolls, Eurozone’s CPI flash estimates, and China’s PMIs are particularly in the limelight.

Technically, while AUD/JPY is one of the top movers for the day, it’s actually still bounded in familiar range established since last week. For now, further decline will remain in favor as long as 94.92 minor resistance holds. Break of 92.77 support should resume whole fall from 97.66 high through 91.77 support. Nevertheless, break of 94.92 will now be a sign of bullish reversal and turn focus to 95.81 structural resistance.

In Asia, Nikkei closed up 1.73%. Hong Kong HSI is up 1.12%. China Shanghai SSE is up 1.02%. Singapore Strait Times is up 0.98%. Japan 10-year JGB yield is up 0.0016 at 0.662.

BoJ Ueda: Underlying inflation is still a bit below our target

In the face of mounting economic uncertainties, BoJ Governor Kazuo Ueda provided insights on Japan’s monetary stance and the regional economic dynamics. Bank of Japan, despite witnessing annual inflation of 3.1% in July, anticipates softening of this rate towards year-end.

Speaking on Saturday at the Jackson Hole Symposium, Ueda remarked, “We think that underlying inflation is still a bit below our target,” subsequently justifying their persistence with the current monetary easing framework by stating, “This is why we are sticking with our current monetary easing framework.”

Despite the inflationary indicators, health of Japan’s domestic demand remains a focal point for the central bank. Ueda highlighted that domestic demand appears to maintain a “healthy trend,” but swiftly added a caveat: “although that’s something that needs to be checked with” Q3 data.

Addressing the wider Asian economic landscape, Ueda did not mince his words, labeling China’s recent economic deceleration a “disappointment,” and highlighting July’s data as skewing “on the weak side.” Diving deeper into China’s challenges, he pinpointed, “The underlying problem appears to be the adjustment in the property sector and the spillover to the rest of the economy.”

However, it’s not all gloomy on the horizon. Ueda acknowledged the US economy’s resilience, noting its “relative strength” as a potential counterbalance, offering “some offset” to Japan amidst regional economic fluctuations.

Fed Mester: Another hike needed as timing crucial in taming inflation

Cleveland Fed President Loretta Mester indicated her support for another rate hike, albeit with flexibility on its exact timing. “It doesn’t necessarily have to be September, but I think this year,” she commented on Saturday.

Mester’s focus was clear: Fed needs to bring inflation down to 2% target by the end of 2025. “The longer we let inflation remain above 2%, we’re building in a higher and higher price level,” she stressed, adding, “that’s why timely matters to me.”

Mester acknowledged that her stance in June favored rate cuts in the latter half of 2024. However, this could be subject to revision at the upcoming September rate-setting meeting, in light of the current inflation dynamics.

“I’m going to have to reassess that because, again, it’s going to be, how quickly do you think inflation is moving down?” she mused. “I do not want to be in a position of prematurely loosening policy.”

Australia retail sales rose 0.5% mom in Jul, but underlying growth subdued

Australia’s retail sales turnover for July showed a 0.5% mom increase, reaching AUD 35.38B, surpassing anticipated 0.3% mom rise. When compared to figures from July 2022, turnover has risen by 2.1% yoy.

Commenting on the rebound, Ben Dorber, ABS head of retail statistics, noted, “The rise in July is a partial reversal of last month’s sharp decline in turnover.” He attributed the June dip to “weaker-than-usual end of financial year sales.”

However, Dorber cautioned against interpreting July numbers as a sign of robust retail health. Elaborating on the sector’s underlying momentum, he stated, “While there was a rise in July, underlying growth in retail turnover remained

Supporting this perspective, Dorber pointed out the lack of substantial movement in the trend terms: “In trend terms, retail turnover was unchanged in July and up only 1.9 per cent compared to July 2022, despite considerable price growth over the year.”

US jobs, Eurozone inflation, and China

As the curtain rises on a crucial week for global financial markets, a myriad of economic data awaits interpretation. Whether it’s gauging the job market and prices pressures in the US, assessing Eurozone’s inflationary pulse, or understanding the ripples of China’s property market turmoil, every piece of data promises to be a significant piece in puzzle, which might chart the course for the remainder of the year.

From the US, eyes are keenly set on PCE inflation data and non-farm payrolls. July’s core PCE is anticipated to show a marginal uptick, and there is an impending sense of a slowdown in job and wage growth, as indicated by the forthcoming NFP report. Although the market is largely leaning towards a pause from Fed in September, Chair Jerome Powell’s recent emphasis on combating inflation at the Jackson Hole symposium cannot be ignored. Unexpected leaps in inflation or employment data might further fuel speculations about an additional rate hike from Fed this year. Moreover, ISM Manufacturing and consumer confidence metrics are also in the spotlight.

Turning to Eurozone, release of August CPI flash estimates is predicted to exhibit a slight deceleration in both headline and core inflation. ECB President Christine Lagarde has adeptly sidestepped signaling her plan in September. However, the hawkish sentiment seems to be resonating louder among ECB members in recent times. Should the data align with market forecasts, this could solidify expectations of an impending rate increase. The next steps for ECB remain uncertain, contingent heavily on the future economic projections.

Down under, Australia’s monthly CPI release is under the magnifying glass. A split opinion exists on whether the existing 4.10% stands as the peak for the tightening cycle. With the expectations leaning towards a more stringent stance, all eyes will be on RBA Gov-Designate Michelle Bullock, whose insights could offer some direction.

Lastly, in the heart of Asia, China’s PMI data will be closely scrutinized. Amidst ongoing supply chain realignment across the continent, hopes for a significant recovery in the manufacturing sector seem dim. The larger quandary revolves around the recent turbulence in China’s real estate sector and its ripple effects on the service industry. August’s PMI figures could shed light on these developments and are expected to profoundly influence risk markets across Asia.

Here are some highlights for the week:

- Monday: Australia retail sales; Eurozone M3 money supply.

- Tuesday: Japan unemployment rate; Germany Gfk consumer sentiment; US house price index, consumer confidence.

- Wednesday: New Zealand building permits; Australia monthly CPI, building approvals; Japan consumer confidence; Germany import prices, CPI flash; Swiss KOF economic barometer, Credit Suisse economic expectations; UK M4 money supply, mortgage approvals; US ADP employment, GDP revision, goods trade balance; wholesale inventories, pending home sales.

- Thursday: Japan industrial production, retail sales, housing starts; New Zealand ANZ business confidence; China PMIs; Germany retail sales, unemployment; Swiss retail sales; France consumer spending; Eurozone CPI flash, unemployment rate, ECB meeting accounts; Canada current account; US jobless claims, personal income and spending, PCE inflation, Chicago PMI.

- Friday: Japan capital spending, PMI manufacturing final; China Caixin PMI manufacturing; Swiss CPI, PMI manufacturing; Eurozone PMI manufacturing final; UK PMI manufacturing final; Canada GDP, PMI manufacturing; US non-farm payrolls, ISM manufacturing, construction spending.

GBP/USD Daily Outlook

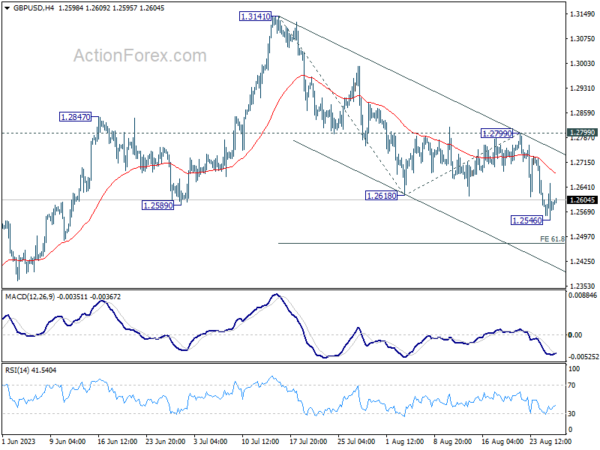

Daily Pivots: (S1) 1.2535; (P) 1.2594; (R1) 1.2641; More…

Intraday bias in GBP/USD is turned neutral first with today’s recovery. But near term outlook stays mildly bearish as long as 1.2799 resistance holds. Below 1.2546 will resume whole fall from 1.3141 to 61.8% projection of 1.3141 to 1.2618 from 1.2799 at 1.2476. Firm break there could prompt downside acceleration to 100% projection at 1.2276.

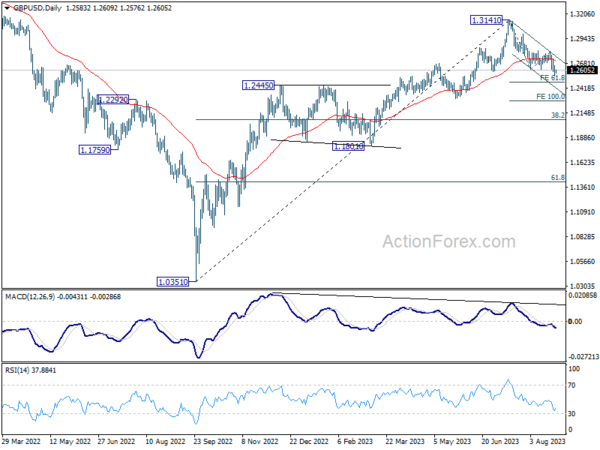

In the bigger picture, for now, fall from 1.3141 medium term top is seen as a correction to up trend from 1.0351 (2022 low). Deeper decline would be seen to 38.2% retracement of 1.0351 to 1.3141 at 1.2075. Strong support would be seen there to bring rebound on first attempt. But outlook will be neutral at best as long as 1.3141 resistance holds, and consolidation from there is set to extend, until further development.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Retail Sales M/M Jul | 0.50% | 0.30% | -0.80% | |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Jul | 0.00% | 0.60% |