Dollar exhibits renewed vigor in the early US trading hours, marking broad-based gains. While today’s data showcased robust initial jobless claims and a mixed bag for durable goods orders, these don’t seem to be the primary catalysts fueling the Dollar’s ascent. A more plausible driver is the resurgence of treasury yield, with the 10-year yield reclaiming territory above 4.2% mark. The tech-heavy NASDAQ is also poised for an upbeat opening, bolstered by Nvidia’s impressive post-market earnings release from the prior day. However, DOW futures tell a more muted tale.

As the day progresses, Canadian Dollar is tailing the US counterpart, as the day’s second-best performer. Euro trails close behind. At the other end of the spectrum, Kiwi and Aussie languish, with Sterling also underperforming. The Japanese Yen and Swiss Franc exhibit a mixed performance, failing to set a clear direction.

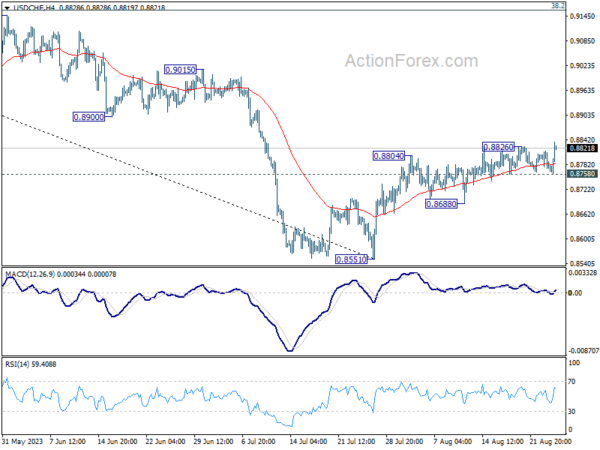

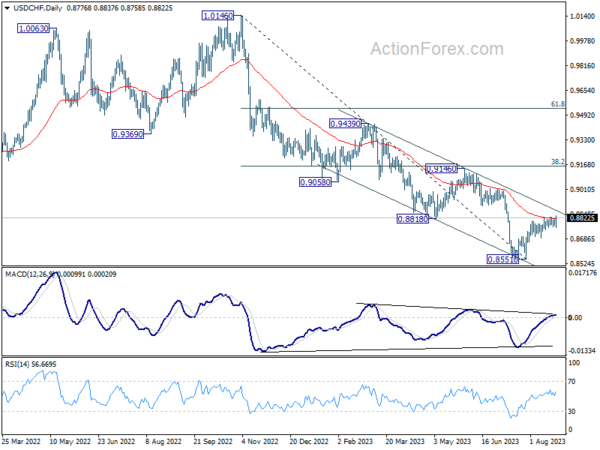

Technically, USD/CHF’s break of 0.8826 temporary top suggest that rebound form 0.8851 is resuming. Focus will be on whether EUR/USD and GBP/USD would follow by breaking through 1.0801 and 1.2613 temporary lows. Also, USD/CHF could be marching back to 146.55 resistance too. Break of all these level together will confirm underlying bullish momentum in the greenback. However, such a rally may hinge on hawkish insights from Fed Chair Jerome Powell and fellow attendees at the Jackson Hole Symposium.

In Europe, at the time of writing, FTSE is up 0.25%. DAX is up 0.06%. CAC is up 0.14%. Germany 10-year yield is up 0.0030 at 2.524. Earlier in Asia, Nikkei rose 0.87%. Hong Kong HSI rose 2.05%. China Shanghai SSE rose 0.12%. Singapore Strait Times rose 0.21%. Japan 10-year JGB yield dropped -0.0284 to 0.649.

US durable goods orders down -5.2% as transport equipment fell -14.2%

US durable goods orders dropped -5.2% mom to USD 285.9B in July, worse than expectation of -4.0% mom. Ex-transport orders rose 0.5% mom to USD 187.2B, above expectation of 0.2% mom. Ex-defense orders dropped -5.4% mom to USD 270.9B. Transportation equipment fell -14.2% mom to USD 98.7B.

US initial jobless claims down -10k to 230k

US initial jobless claims fell -10k to 230k in the week ending August 19, better than expectation of 241k. Four-week moving average of initial claims rose 2k to 238k.

Continuing claims dropped -9k to 1702k in the week ending August 12. Four-week moving average of continuing claims rose 6k to 1697k.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8763; (P) 0.8790; (R1) 0.8806; More….

USD/CHF’s break of 0.8826 suggest that rebound from 0.8551 is resuming, and intraday bias is back on the upside. Sustained trading above 0.8818 support turned resistance will carry larger bullish implication, and target 0.9146 cluster resistance next. On the downside, below 0.8758 support will turn bias back to the downside for 0.8688 support instead.

In the bigger picture, a medium term bottom could be in place at 0.8551 already, on bullish convergence condition in D MACD. Sustained trading above 0.8818 support turned resistance will bring further rise to 0.9146 cluster resistance (38.2% retracement of 1.0146 to 0.8551 at 0.9160), even as a correction. Nevertheless, break of 0.8851 will resume the down trend from 1.0146 instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 12:30 | USD | Initial Jobless Claims (Aug 18) | 230K | 241K | 239K | |

| 12:30 | USD | Durable Goods Orders Jul | -5.20% | -4.00% | 4.60% | |

| 12:30 | USD | Durable Goods Orders ex Transportation Jul | 0.50% | 0.20% | 0.50% | |

| 14:30 | USD | Natural Gas Storage | 36B | 35B |