Japanese Yen is feeling the heat once again, buckling under the surge in major European and US benchmark yields. Notably, yield on Japan’s 10-year JGB did jump, closing 0.655 today. However, this level has acted as a formidable ceiling for a while, even in the wake of BoJ’s recent allowance hike to 1% last month. With this backdrop, Yen appears poised to challenge and possibly break recent support levels against its European counterparts and Dollar.

Elsewhere in the currency markets, Dollar finds itself in the dubious distinction of being one of the day’s laggards just after Yen, with Australian and New Zealand dollars closely tailing. In stark contrast, Canadian Dollar emerges as the top performer for the day, likely buoyed by the uptick in oil prices. Swiss Franc clinches the second spot, with Euro closely on its heels, while the Sterling presents a more ambivalent picture.

Technically, EUR/JPY’s strong rally today argues that pull back from 159.32 has completed. Firm break of 159.32 will resume larger up trend to 61.8% projection of 139.05 to 157.99 from 151.39 at 163.09. At the same time, break of 186.45 resistance in GBP/JPY and 146.55 in USD/JPY would further confirm Yen’s downside momentum.

In Europe, at the time of writing, FTSE is up 0.23%. DAX is up 0.50%. CAC is up 0.87%. Germany 10-year yield is up 0.0558 at 2.681. Earlier in Asia, Nikkei rose 0.37%. Hong Kong HSI dropped -1.82%. China Shanghai SSE dropped -1.24%. Singapore Strait Times dropped -0.63%. Japan 10-year JGB yield closed up 0.0245 to 0.655.

Bundesbank: Germany economy to stagnate, inflation to stay above 2%

In its latest monthly report, Bundesbank paints a sobering picture of the German economy, which remains ensnared in a weak phase. Key factors hampering growth include tepid foreign demand combined with escalating financing costs. The bank foresees the economic output remaining largely stagnant for the summer quarter.

Yet, it’s not all gloom. Bundesbank highlights several silver linings. Stable employment conditions paired with robust wage hikes amidst decreasing inflation rates are expected to stimulate private consumption, continuing its recovery trajectory. This, in turn, offers a promising uplift for the service sector.

Nevertheless, the manufacturing sector poses significant concerns. Weak industrial production, attributed to a continued slump in demand for industrial goods, threatens to stymie the nation’s broader economic progress. Interestingly, the report underscores that the recent recovery in demand is predominantly driven by large orders, typically characterized by extended processing times. In the absence of these large-scale orders, demand, both domestically and internationally, would plummet more precipitously.

Peering into the future, Bundesbank’s experts anticipate declining inflation rate in the autumn, largely influenced by dropping energy prices. On the flip side, the institution projects wage growth to persistently remain strong, extending beyond 2023. This dynamic of robust wage growth amid other economic pressures is pinpointed as a primary factor likely to keep the inflation rate hovering above the 2 percent mark for an extended duration.

China cuts 1-yr LPR moderately, keeps 5-yr LPR unchanged

In a somewhat anticipated move, China’s PBoC made a cut to its one-year loan prime rate by 10bps, settling it at 3.45%. This is a slight deviation from the 15bps reduction that the majority of economists had forecasted. What stands out is that this marks the second reduction in this rate in just a span of three months.

However, eyebrows were raised when PBOC decided to keep its five-year LPR — the benchmark for most mortgages in the country — steady at 4.2%. This move defied expectations of a 15 bps cut by many market watchers. The unaltered five-year LPR is being read by many as a signal of Chinese banks’ hesitancy to compromise their rate differential margin. Such reluctance throws into sharp relief potential concerns about the effective transmission of PBOC’s policy decisions into the broader market landscape.

Furthermore, it stirs up conversations about the central bank’s capability to invigorate the property sector and the broader economy through monetary easing strategies. This narrative is all the more potent given that this decision on the one-year LPR came on the heels of an unexpected reduction in PBOC’s medium-term policy rate just a week earlier. To give specifics, PBOC had reduced the one-year medium-term lending facility rate by 15 basis points, bringing it down to 2.50% from its previous 2.65%.

Considering these rate adjustments, many financial experts are now projecting more proactive measures from the PBOC in the forthcoming months. This may encompass further rate trims as well as potential reductions in the reserve requirement ratio for banks.

NZ exports down -14% yoy in Jul, imports down -16% yoy, China leads the falls

July 2023 has been a challenging month for New Zealand’s trade scenario, as the island nation witnessed a steep fall in both goods exports and imports. Data released depicted a substantial decline, with exports plunging by NZD -890m or -14% yoy, concluding at NZD 5.5B. Concurrently, imports saw a -16% yoy decline, falling NZD -1.2B to settle at NZD 6.6B for the month. This decrease in trade volumes culminated in a monthly trade deficit of NZD -1.1B. This significantly overshadows market expectations of NZD -0.05B.

Zooming in on the country-by-country trade details, China conspicuously led the downturn in both exports and imports. New Zealand’s exports to the Asian giant dipped by -24% yoy, translating to a decline of NZD -407m while imports reduced by a staggering NZD -427m, down -25% yoy.

However, not all trade relations showed a contraction. Australia the US emerged as silver linings, with their exports experiencing an upward trajectory. Exports to Australia saw an 8.9% yoy growth, adding NZD 59m to the tally, and US followed suit with a 16% yoy rise, upping the figure by NZD 105m.

Yet, as New Zealand engaged with its other major trade partners, the news wasn’t all positive. European Union and Japan both registered a decrease in exports, declining by -16% yoy (NZD -73m) and -21% yoy (NZD -84m) respectively. On the import front, while USA and South Korea posted a rise of 24% (NZD 166m) and 18% (NZD 71m), both European Union (up 1.9% yoy) and Australia (down -2.7% yoy) experienced mixed results.

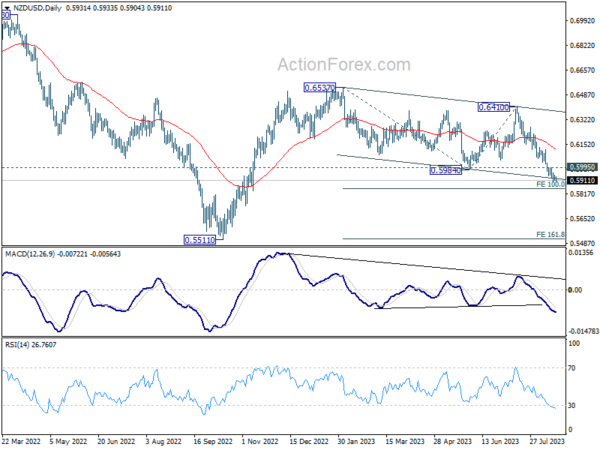

NZD/USD pressing channel support, could it bounce from here?

In recent weeks, the antipodean currencies have encountered turbulent waters, contending for the title of the month’s poorest performers. Reserve Banks of both Australia and New Zealand are widely perceived to have reached the peaks of their ongoing tightening cycles. In contrast, ECB and BoE (and less certainly Fed) seem poised for further rate hikes. Also, the broader sentiment, underpinned by belief that global interest rates may remain elevated longer than previously anticipated, has notably dampened risk appetites.

However, recent economic concerns stemming from China have played a pivotal role in the accelerated depreciation of these currencies in the last fortnight. China’s less-than-stellar economic recovery post its stringent Covid lockdowns, coupled with looming deflation risks and challenges in its property and finance sectors, have further intensified the pressure on the antipodean currencies. Additionally, PBoC milder than anticipated rate cut today further dampened sentiments towards these currencies.

Technically speaking, however, there is prospect of a near term bounce in NZD/USD, given that it’s now pressing a medium term channel support on oversold condition. Break above 0.5995 resistance will trigger a rebound to 55 D EMA (now at 0.6117). However, deeper decline and firm break of 100% projection of 0.6537 to 0.5984 from 0.6410 at 0.5857 could prompt downside acceleration to 161.8% projection at 0.5515, which is close to 0.5511 long term support (2022 low).

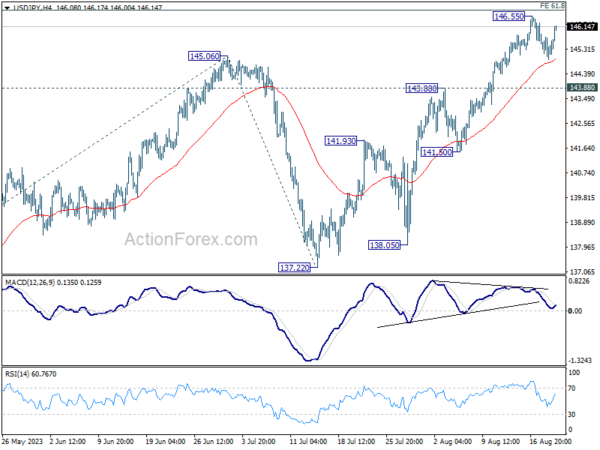

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 144.92; (P) 145.40; (R1) 145.87; More…

USD/JPY recovered ahead of 55 4H EMA but stays below 146.55 temporary top. Intraday bias remains neutral first. On the upside, sustained break of 61.8% projection of 129.62 to 145.06 from 137.22 at 146.76 will pave the way to retest 151.93 high. However, considering bearish divergence condition in 4H MACD, firm break of 143.88 resistance turned support will be a sign of reversal, and turn bias back to the downside for 55 D EMA (now at 141.92).

In the bigger picture, overall price actions from 151.93 (2022 high) are views as a corrective pattern. Rise from 127.20 is seen as the second leg of the pattern and could still be in progress. But even in case of extended rise, strong resistance should be seen from 151.93 to limit upside. Meanwhile, break of 137.22 support should confirm the start of the third leg to 127.20 (2023 low) and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Jul | -1107M | -50M | 9M | -111M |

| 23:01 | GBP | Rightmove House Price Index M/M Aug | -1.90% | -0.20% | ||

| 06:00 | EUR | Germany PPI M/M Jul | -1.10% | -0.20% | -0.30% | |

| 06:00 | EUR | Germany PPI Y/Y Jul | -6.00% | -5.10% | 0.10% | |

| 12:30 | CAD | New Housing Price Index M/M Jul | -0.10% | 0.00% | 0.10% |