- Euro pierces the 1.0900 hurdle vs. the US Dollar.

- Stocks in Europe keeps the negative performance so far.

- EUR/USD looks supported around the 1.0860 for the time being.

- The USD Index (DXY) meets initial resistance near 103.60.

- EMU trade deficit shrank more than expected in June.

- Philly Fed index surprises to the upside in August.

The Euro (EUR) now manages to pick up pace and stage a marked comeback against the US Dollar (USD), encouraging EUR/USD to trespass the key 1.0900 hurdle following the earlier drop top six-week lows around 1.0860 on Thursday.

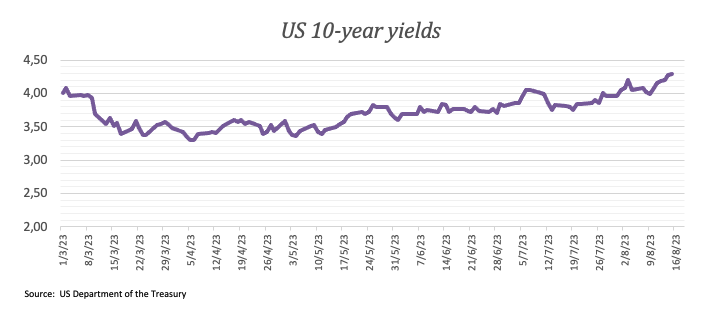

Meanwhile, the Greenback sees its early upside evaporate and forces the USD Index (DXY) to challenge the 103.00 neighbourhood, coming all the way down after hitting multi-week peaks near 103.60 during early trade. The corrective decline in the US Dollar comes in tandem with the continuation of the strong upward trend in US yields in the 10-year/30-year segment of the curve.

In the meantime, EUR/USD seems to have left behind the initial pessimism after investors’ interpretation of the FOMC Minutes, where the prevailing sentiment among most participants is that due to the inflation-related risks, there might be a need to further increase interest rates.

Looking at the broader context of monetary policy, the discussion around the Federal Reserve’s stance of maintaining a tighter policy for an extended period seems to have been revived. This is in response to the resilience displayed by the US economy, despite some easing in the labour market and lower inflation readings in recent months.

Within the European Central Bank’s realm (ECB), internal disagreements among its Council members regarding the continuation of tightening measures after the summer period are causing renewed weakness that is impacting the Euro negatively.

As for the euro schedule, the Balance of Trade figures in the broader euro area showed a deficit of €2.36B June, less than initially projected

On the US calendar, weekly Initial Jobless Claims rose by 239K in the week to August 12 and the Philly Fed Manufacturing Index improved above estimates to 12 in August. Later in the NA session, the Conference Board’s Leading Index for July will close the daily docket.

Daily digest market movers: Euro reclaims 1.0900 and beyond

- The EUR gathers upside traction and surpasses 1.0900 vs. the USD.

- Concerns surrounding the Chinese economy weigh on sentiment.

- The Australian jobs report disappoint expectations in July.

- Norges Bank hiked its policy rate by 25 bps to 4.00%, as expected

- The Greenback loses momentum following Initial Claims and Philly index.

Technical Analysis: Euro now looks at 1.0950

EUR/USD rebounds from the 1.0860 region and manages well to set aside fears of a deeper decline at least in the very near term.

In case of further losses, EUR/USD could retest the July low of 1.0833 (July 6) ahead of the significant 200-day SMA at 1.0787, and eventually the May low of 1.0635 (May 31). Deeper down, there are additional support levels at the March low of 1.0516 (March 15) and the 2023 low at 1.0481 (January 6).

Occasional bullish attempts, in the meantime, are expected to meet initial hurdle at the August high at 1.1064 (August 10) prior to the weekly top at 1.1149 (July 27). If the pair clears the latter, it could alleviate some of the downward pressure and potentially visit the 2023 peak of 1.1275 (July 18). Once this region is surpassed, significant resistance levels become less prominent until the 2022 high at 1.1495 (February 10), which is closely followed by the round level of 1.1500.

Furthermore, the positive outlook for EUR/USD remains valid as long as it remains above the important 200-day SMA.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.