Dollar’s spirited rally attempt faced a swift halt as major US stock indices recorded gains, positively influencing broader market sentiment. Following that, Asian markets are poised, with China’s unexpected rate cut effectively counterbalancing the dampening effects of discouraging economic data. As a result, commodity currencies, including Australian Dollar, saw a resurgence.

Notably, the Aussie weathered the potentially negative implications of the recent RBA minutes. Contrarily, both Yen and Euro trended on the softer side, with the former overlooking promising GDP numbers, and the latter appearing susceptible, especially when pitted against other Europeans and commodity currencies.

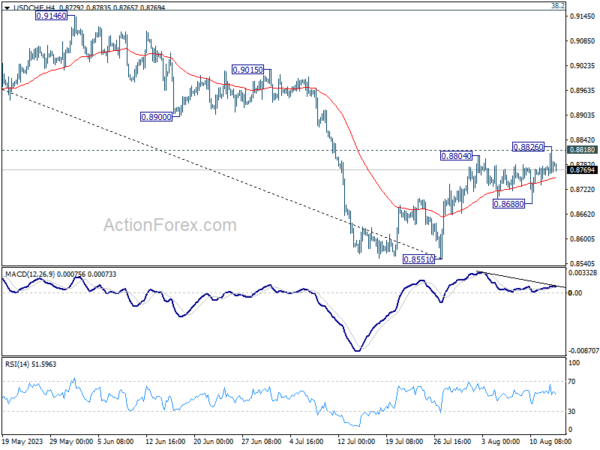

Technically, USD/CHF was quickly knocked down after a brief breach of a key structural resistance at 0.8818. The overall bullish momentum for the greenback is not confirmed yet. Indeed, deeper decline in USD/CHF and break of 0.8688 support will confirm rejection by 0.8818. That would maintain bearishness in the pair and argues that larger down trend from 1.0146 is ready to resume through 0.8551 low.

Should this scenario unfold, it could be an indicator of the return of dominance of Dollar bears, hinting at a widespread selloff. On the flip side, sustained break of 0.8818 mark in USD/CHF could be indicative of a more prolonged Dollar buying spree.

In Asia, at the time of writing, Nikkei is up 0.90%. Hong Kong HSI is down -0.80%. China Shanghai SSE is down -0.29%. Singapore Strait Times is up 0.10%. Japan 10-year JGB yield is up 0.0070 at 0.626. Overnight, DOW rose 0.07%. S&P 500 rose 0.58%. NASDAQ rose 1.05%. 10-year yield rose 0.016 to 4.184.

China: Unexpected rate cut by PBOC aligns with disheartening July economic data

In an unexpected decision that took markets by surprise, PBoC announced a cut in key policy rates for the second time in a span of three months, just an hour before the release of July economic data that broadly fell short of market expectations.

PBOC lowered the rate on its one-year medium-term lending facility loans – valued at CNY 401B – to financial institutions by 15bps to 2.50% from the previous 2.65%. This significant move indicates the possibility of a reduction in China’s benchmark loan prime rate in the upcoming week.

A closer look at the economic metrics for July reveals concerns. Industrial production grew at 3.7% yoy, underperforming against the anticipated 4.3% yoy and marking a slowdown from the 4.4% yoy of the previous month. Similarly, retail sales saw increase of just 2.5% yoy, lagging behind projected 4.2% yoy and decelerating from 3.1% yoy. This rate marks the slowest growth pace in sales since the decline observed in December 2022. Furthermore, fixed asset investment growth, year-to-date year-on-year, was recorded at 3.4%, falling short of 3.8% expectation.

Urban unemployment rate witnessed a slight increase, moving from 5.2% to 5.3%. Notably, NBS did not provide the usual age breakdown of unemployment figures. The spokesperson mentioned the suspension of youth unemployment data attributing it to societal and economic changes, and highlighted an ongoing reassessment of its data collection methodology. It’s worth noting that in June, the youth unemployment rate (for ages 16-24) reached a record high of 21.3%

NBS also said in a statement, “We must intensify the role of macro policies in regulating the economy and make solid efforts to expand domestic demand, shore up confidence and prevent risks.”

Japan’s Q2 GDP grew 6% annualized, external demand drives growth

Japan witnessed a stellar performance in its Q2 GDP, registering a growth of 1.5% Qoq, a figure that comfortably surpassed the anticipated 0.8% qoq rise. In annualized terms, growth clocked in at 6.0%, notably higher than expected 3.1%. This rapid expansion marked the quickest pace since the October-December period of 2020 and signifies the third consecutive quarterly growth.

A significant driver of this growth was a 3.2% surge in exports during the quarter. The rejuvenation in external demand, particularly net exports, added a substantial 1.8% to the quarter’s growth. The auto exports sector reaped benefits from the alleviation of supply disruptions, while a consistent uptick in international tourists bolstered the economy. On the flip side, imports dipped by -4.3% as energy and COVID vaccine imports declined.

A closer look at the domestic sector unveils a few challenges. Private consumption, a sector that constitutes over half of the economy, contracted by -0.5% on a quarterly basis. This resulted in domestic demand cutting -0.3% from growth. The mounting prices of regular commodities affected consumer spending negatively. Furthermore, sales of durable goods took a hit, which overshadowed the robust demand for services.

In terms of capital investment, the growth remained tepid, registering just a 0.03% increase. However, it’s noteworthy that this was buoyed by spending related to software, marking its second successive quarter of rise.

RBA sees credible path back to inflation target with interest rate at present level

In the minutes from RBA’s August 1 meeting, board members weighed the decision between raising cash rate by 25bps or maintaining its unchanged.

The board’s inclination to hold the rate steady was rooted in their belief that prior tightening measures were “working as intended.” Despite the full effects not yet being evident in the data, there were important signs, as “consumption had already slowed significantly”, “labour market might be at a turning point”, and “inflation was heading in the right direction”.

The board observed a “credible path back to the inflation target with the cash rate staying at its present level.” This assessment seemed to be “broadly in line with the staff’s central forecasts.” Solidifying their position, members collectively agreed that the reasons to “leave the cash rate unchanged at this meeting was the stronger one.”

Meanwhile, they also acknowledged that “further tightening of monetary policy might be required” to consistently meet inflation goals. Such decisions will be driven by data trends and ongoing risk assessments.

Looking ahead

UK employment, Swiss PPI and Germany ZEW economic sentiment are the main focuses in European session. Later in the day, Canada CPI and US retail sales will take center stage.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6460; (P) 0.6482; (R1) 0.6509; More…

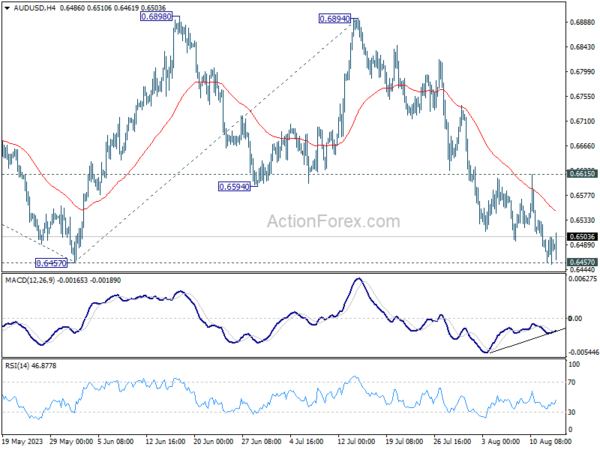

AUD/USD recovered quickly after breaching 0.6457 support briefly. Intraday bias is turned neutral first with 4H MACD crossed above signal line. on the downside, decisive break of 0.6457 support will confirm resumption of whole fall from 0.7156. Next target is 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195. Nevertheless, firm break of 0.6615 minor resistance will indicate short term bottoming, and turn bias back to the upside for stronger rebound.

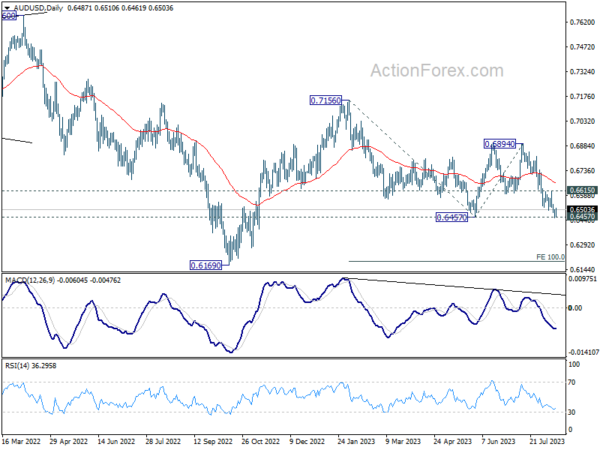

In the bigger picture, the down trend from 0.8006 (2021 high) could still be in progress. Break of 0.6457 will affirm this bearish case. Further break of 0.6169 will target 61.8% projection of 0.8006 to 0.6169 to 0.7156 at 0.6021. This will now remain the favored case as long as 0.6894, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q Q2 P | 1.50% | 0.80% | 0.70% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 P | 3.40% | 3.80% | 2.00% | |

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 01:30 | AUD | Wage Price Index Q/Q Q2 | 0.80% | 1.00% | 0.80% | |

| 02:00 | CNY | Industrial Production Y/Y Jul | 3.70% | 4.30% | 4.40% | |

| 02:00 | CNY | Retail Sales Y/Y Jul | 2.50% | 4.20% | 3.10% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Jul | 3.40% | 3.80% | 3.80% | |

| 04:30 | JPY | Industrial Production M/M Jun F | 2.4% | 2.00% | 2.00% | |

| 06:00 | GBP | Claimant Count Change Jul | 25.7K | |||

| 06:00 | GBP | ILO Unemployment Rate (3M) Jun | 4.00% | 4.00% | ||

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Jun | 6.90% | |||

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Jun | 7.40% | 7.30% | ||

| 06:30 | CHF | Producer and Import Prices M/M Jul | 0.20% | 0.00% | ||

| 06:30 | CHF | Producer and Import Prices Y/Y Jul | -0.50% | -0.60% | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment Aug | -15 | -14.7 | ||

| 09:00 | EUR | Germany ZEW Current Situation Aug | -63 | -59.5 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Aug | -12 | -12.2 | ||

| 09:00 | EUR | EU Economic Forecasts | ||||

| 12:30 | CAD | Manufacturing Sales M/M Jun | -2.10% | 1.20% | ||

| 12:30 | CAD | CPI M/M Jul | 0.30% | 0.10% | ||

| 12:30 | CAD | CPI Y/Y Jul | 3.00% | 2.80% | ||

| 12:30 | CAD | CPI Media Y/Y Jul | 3.70% | 3.90% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Jul | 3.50% | 3.70% | ||

| 12:30 | CAD | CPI Common Y/Y Jul | 5.00% | 5.10% | ||

| 12:30 | USD | Empire State Manufacturing Index Aug | -0.3 | 1.1 | ||

| 12:30 | USD | Retail Sales M/M Jul | 0.40% | 0.20% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Jul | 0.40% | 0.20% | ||

| 12:30 | USD | Import Price Index M/M Jul | 0.20% | -0.20% | ||

| 14:00 | USD | Business Inventories Jun | 0.20% | 0.20% | ||

| 14:00 | USD | NAHB Housing Market Index Aug | 56 | 56 |