Dollar surges broadly today, breaking through near term support against Euro, 145 handle against Yen, as well as near high of the year against Chinese Yuan. Worries over China’s property, as well as finance sector are weighing heavily down on sentiment. But Swiss Franc and Yen are not benefiting much from risk aversion as in early US session. Indeed, European majors are trading as the worst performers for now, while commodity currencies are trying to recover. That’s a development that warrants more monitoring.

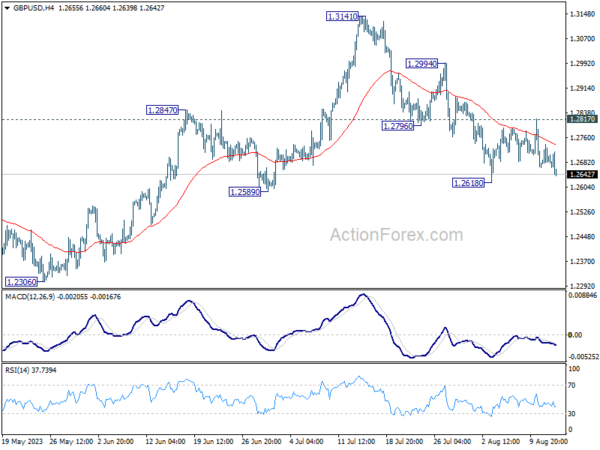

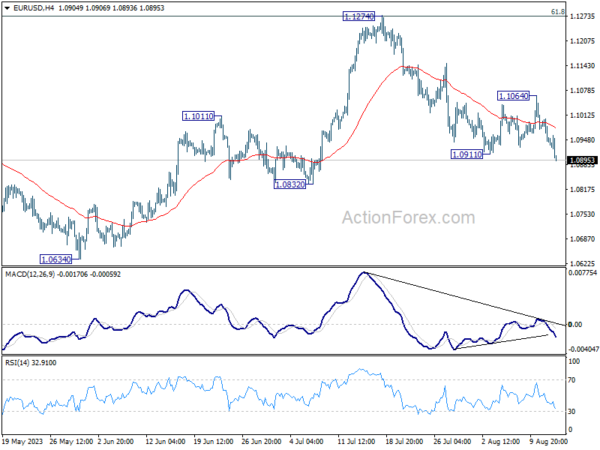

Technically, both EUR/USD has taken out 1.0911 support while USD/CHF broke 0.8804 resistance. Both developments indicate resumption of Dollar’s rebound. A focus is now on when GBP/USD would follow by breaking through 1.2618 support to resume the fall from 1.3141. The imminent question though revolves around tomorrow’s UK job data – could this potentially breathe life into the Pound, triggering a rebound?

In Europe, at the time of writing, FTSE is down -0.42%. DAX is up 0.30%. CAC is down -0.04%. Germany 10-year yield is up 0.0034 at 2.629. Earlier in Asia, Nikkei dropped -1.27%. Hong Kong HSI dropped -1.58%. China Shanghai SSE dropped -0.34%. Singapore Strait Times dropped -1.41%. Japan 10-year JGB yield rose 0.0296 to 0.619.

Chinese Yuan nosedives to year low amid deepening property sector concerns

The Chinese Yuan nosedived to its lowest mark this year, echoing growing anxieties that spread from the real estate domain to the financial sector. Fueling this downturn, JPMorgan Chase & Co. rang alarm bells today, highlighting heightened liquidity strains for debt-ridden developers and their non-bank stakeholders. This follows a notable hiccup by a subsidiary of Zhongzhi Enterprise Group Co., which stands among China’s premier private wealth management entities. The said unit stumbled in ensuring timely payments across multiple products.

These defaults in the trust sector could potentially trigger a detrimental cycle impacting the onshore debt of privately-owned enterprise developers. The escalating apprehensions regarding potential developer defaults have soured the investment climate. Consequently, trust entities may either find it challenging or may express reluctance in rolling over existing products tied to real estate.

USD/CNH’s break of 7.2853 resistance confirms resumption of whole rally from 6.6971 (Jan low). Purely technically speaking, current rise should target 7.3745 resistance first (2022 high), and then 61.8% projection of 6.8100 to 7.2853 from 7.1154 at 7.4091. However, market watchers are most intrigued by a looming question: When will China’s authoritative bodies intervene to arrest the Yuan’s descent?

Japan in Spotlight: Q2 GDP, Nikkei, and Yen dynamics garner attention

Investor attention is set to pivot towards Japan’s Q2 GDP data in the upcoming Asian session. Preliminary forecasts project a qoq growth of 0.8%, translating to an annualized expansion of 3.1%. In today’s trading, Nikkei took a significant hit, sliding by -1.27% or -413.7 points, largely influenced by bearish sentiments rooted in China’s property sector. Meanwhile, Yen showed signs of wavering post an initial surge, setting the stage for a keen watch on its reaction, as well as Nikkei’s, to the impending GDP figures.

After some initial volatility following BoJ’s adjustment on YCC on July 28, Nikkei has weakened notably. Technically, it’s now pressing 55 D MEA and looks vulnerable to deeper decline. Nevertheless, Overall price actions from 33772.89 are just viewed as a corrective move to the long term up trend only, as also supported by the structure. Hence, even in case of a deeper pull back, strong support should be seen from 38.2% retracement of 25661.89 to 33772.89 to contain downside. Meanwhile, strong rebound from current level, would bring retest of 33772.89 high.

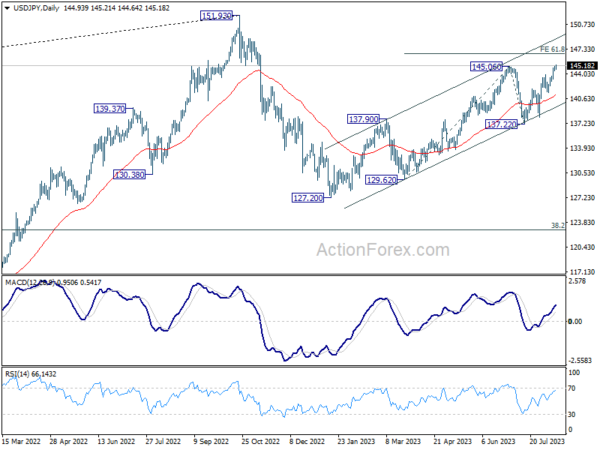

Meanwhile, Yen continued to weaken after brief post-BoJ spike, with USD/JPY breaking through 145 handle today. Market chatter suggests a potential pushback by Ministry of Finance in the 145-148 range, though tangible signs of intervention remain absent. Yet it’s a wait-and-watch game to discern if Japan would act beyond the 145 mark. Nevertheless, technically, 61.8% projection of 129.62 to 145.06 from 137.22 at 146.76 doe present a resistance to overcome.

NZ BNZ services plunges down to 47.8, deepening contraction as activity dives

New Zealand’s service sector, as gauged by the BusinessNZ Performance of Services Index, experienced a marked decline in July, descending from 49.6 to a worrying 47.8. This latest reading is not only the lowest since January 2022 but also trails the long-term average of 53.5 significantly.

A detailed analysis of the index highlights concerning trends. The activity component has sharply dropped from 50.9 to 39.6, marking its worst performance since August 2021 and setting a gloomy record. Specifically, this month’s reading stands as the worst non-lockdown related reading on record since 2007. New orders within businesses have taken a substantial hit, plummeting from 50.4 to 43.8.

Meanwhile, employment showed a marginal decrease, moving from 49.1 to 49.0. On a brighter note, stocks or inventories observed an increase, jumping from 47.2 to 54.0, with supplier deliveries also ticking up from 51.0 to 52.1.

BusinessNZ’s Chief Executive, Kirk Hope, said. “The further fall into contraction during July also saw another lift in the proportion of negative comments,” he remarked, drawing attention to the sharp increase in negative feedback, which escalated to 67% from 55.6% in June and 49.4% in May.

Hope continued, “Overall, negative comments received were strongly dominated by a general downturn in the economic conditions/slowing economy, as well as ongoing increased costs.”

BNZ Senior Economist, Doug Steel, weighed in on the data, highlighting a distressing pattern. “The results all point to a sharp drop in demand in July, significantly accelerating the slowing trend that had been evident for many months,” he said.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0926; (P) 1.0965; (R1) 1.0988; More…

Break of 1.0911 support indicates resumptions of fall from 1.1274. Intraday bias in EUR/USD is back on the downside for 1.0832 support. Sustained trading below there will target 1.0609/34 cluster support. On the upside, break of 1.1064 resistance is needed to indicate completion of the fall. Otherwise, outlook will stay cautiously bearish in case of recovery.

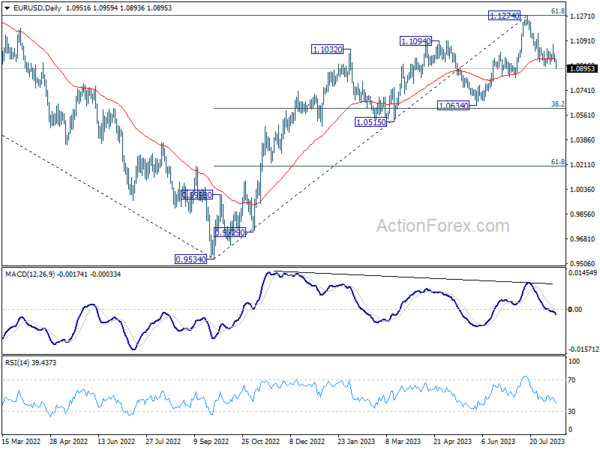

In the bigger picture, a medium term top could be formed at 1.1274, after failing to break through 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 decisively, on bearish divergence condition in D MACD. Sustained trading below 55 D EMA (now at 1.0966) will bring deeper correction to 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609). Strong support could be seen there, at least on first attempt, to set the range for consolidation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Jul | 47.8 | 50.1 | 49.6 | |

| 06:00 | EUR | Germany Wholesale Price Index M/M Jul | -0.20% | -0.20% |