Most major Asian stock markets are trading in the red, echoing the downturn witnessed in the US markets overnight. An exception to the trend is Japan’s Nikkei, which surged on the back of robust earnings reports from heavyweights like Honda and oil & gas explorer Inpex. This uplifted sentiment has simultaneously weighed on Yen, causing it to break near-term supports against key counterparts such as the Dollar, Euro, and Swiss Franc.

For the week, Yen finds itself as the most underwhelming performer, trailed by New Zealand Dollar, Swiss Franc, and Australian Dollar. On the flip side, the Dollar is establishing its dominance, with the Sterling and Euro in tow.

The forthcoming US CPI data will play a pivotal role in determining Dollar’s trajectory. While an inflation data that undershoots expectations could cement beliefs of Fed to be on hold in September, a higher-than-anticipated reading might amplify chances of another rate hike.

Market participants should note another data set on inflation and employment is due before the Fed’s subsequent meeting, making today’s market movements even more intricate and pivotal in discerning traders’ inclinations.

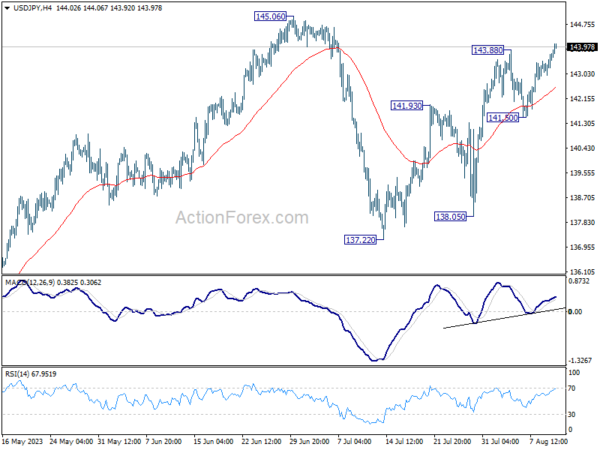

Technically, USD/JPY’s rally from 137.22 finally resumes despite lots of interim setbacks. Next focus is on 145.06 resistance. Firm break there will confirm resumption of whole rise from 127.20 towards 151.93 high. Nevertheless, rejection by 145.06 would probably bring another fall to extend the pattern from 145.06 and limit the upside momentum in other Yen crosses.

In Asia, at the time of writing, Nikkei is up 0.85%. Hong Kong HSI is down -0.68%. China Shanghai SSE is down -0.01%. Singapore Strait Times is down -0.01%. Japan 10-year JGB yield is up 0.0195 at 0.584. Overnight, DOW dropped -0.54%. S&P 500 dropped -0.70%. NASDAQ dropped -1.17%. 10-year yield dropped -0.014 to 4.012.

Japan’s PPI slows down for seventh consecutive month

Japan’s PPI for July has once again reported a slowdown, decelerating from 4.3% yoy in the previous month to 3.6% yoy. However, this figure slightly surpassed market expectations, which anticipated a drop to 3.5% yoy. It’s worth noting that this marks the seventh consecutive month of decline for PPI, tracing back from its December peak of 10.6% yoy.

Looking at some details, yen-denominated import prices saw a significant dip. The -14.1% yoy decline in July, a steeper fall than June’s -11.4% yoy, extends the negative trend to its fourth consecutive month.

Simultaneously, yen-denominated export prices also demonstrated downward trends, slipping from a positive growth of 0.8% yoy in the preceding month to a negative -0.2% yoy in July.

US CPI awaited, NASDAQ heading lower to 55 D EMA

Markets await key US consumer inflation data scheduled for release today, with projections centered on a 0.2% mom uptick for both headline and core CPI. On a yoy basis, headline CPI is anticipated to climb from 3.0% to 3.3%, while core CPI is projected to remain steady at 4.8%.

This anticipated rise in headline inflation, marking the first surge in over a year, can be attributed to unfavorable base effects and a moderate uptick in gas prices. Thus, this shouldn’t particularly alarm Fed officials.

If the inflation figures align with expectations, the 0.2% monthly increase in both core CPI would be largely consistent with Fed’s 2% inflation target. Such a scenario would strengthen the case for Fed to pause again in its September meeting, adopting a wait-and-see approach.

Following broad decline in US stocks, NASDAQ closed down -1.17% overnight. Current development suggests that a short term top at least formed at 14446.55. Deeper decline is expected to 55 D EMA (now at 13600.45).

The grappling question is whether rise from 10088.82, as the second wave of the medium term corrective pattern from 16212.22, has run off its course. It just missed target of 161.8% projection of 10088.82 to 12269.55 from 10982.80 at 14511.22.

Robust support from 55 D EMA would maintain near term bearishness for another rise through 14446.55 at a later stage. However, sustained break of this EMA would raise the chance of a bearish reversal. That is, the third leg of the medium term pattern has already started. NASDAQ would then test the second line of defense at 38.2% retracement of 10088.82 to 14446.55 at 12781.89 to determine its fate.

Elsewhere

ECB will publish monthly economic bulletin in European session. US will also release jobless claims in addition to CPI.

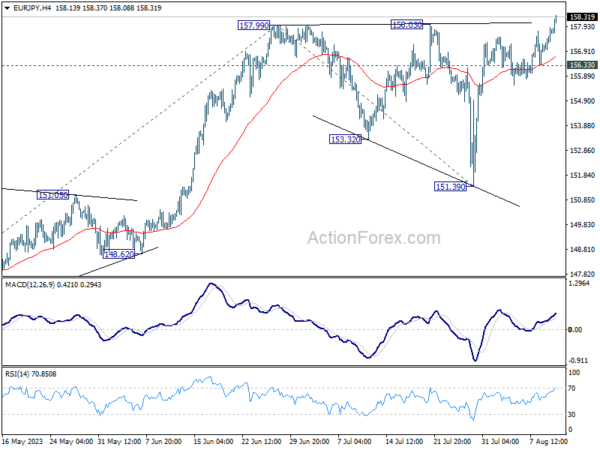

EUR/JPY Daily Outlook

Daily Pivots: (S1) 157.14; (P) 157.52; (R1) 158.12; More….

EUR/JPY’s break of 158.03 resistance indicates resumption of larger up trend. Intraday bias is back on the upside. Further rally should be seen to 61.8% projection of 139.05 to 157.99 from 151.39 at 163.09 next. For now, outlook will stay bullish as long as 156.33 support holds, in case of retreat.

In the bigger picture, rise from 114.42 (2020 low) is in progress. Next target is 100% projection of 124.37 to 148.38 from 139.05 at 163.06. Sustained break there will pave the way to retest long term resistance at 169.96. This will now remain the favored case as long as 151.39 support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Jul | -53% | -51% | -46% | |

| 23:50 | JPY | PPI Y/Y Jul | 3.60% | 3.50% | 4.10% | 4.30% |

| 01:00 | AUD | Consumer Inflation Expectations Aug | 4.90% | 5.20% | ||

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 12:30 | USD | Initial Jobless Claims (Aug 4) | 230K | 227K | ||

| 12:30 | USD | CPI M/M Jul | 0.20% | 0.20% | ||

| 12:30 | USD | CPI Y/Y Jul | 3.30% | 3.00% | ||

| 12:30 | USD | CPI Core M/M Jul | 0.20% | 0.20% | ||

| 12:30 | USD | CPI Core Y/Y Jul | 4.80% | 4.80% | ||

| 14:30 | USD | Natural Gas Storage | 24B | 14B |