Dollar has regained some prominence in today’s trading, albeit just as a part of this week’s oscillating trends. A majority of major currency pairs and crosses are confined within yesterday’s trading ranges. The day’s lull is evident, with a notable absence of significant economic announcements from Europe and US. Additionally, leading central bankers have remained silent.

In the broader currency landscape, Euro has also made modest gains against both Sterling and Swiss Franc but remains within familiar ranges. As it stands, Swiss Franc and Sterling are the worst performers for the day, while commodity currencies are mixed.

As market participants await tomorrow’s US CPI data – assuming they aren’t enjoying a summer break – several technical level come to the fore. These include 1.1046 minor resistance for EUR/USD, 1.2796 for GBP/USD, 0.8663 minor support in USD/CHF, and 141.50 minor support for USD/JPY. Simultaneous break of these levels could be a strong indication of selling momentum in the greenback.

In Europe, at the time of writing, FTSE is up 0.65%. DAX is up 0.77%. CAC is up 0.92%. Germany 10-year yield is up 0.046 at 2.515. Earlier in Asia, Nikkei dropped -0.53%. Hong Kong HSI rose 0.32%. China Shanghai SSE dropped -0.49%. Singapore Strait Times rose 0.12%. Japan 10-year JGB yield dropped sharply by -0.0465 to 0.565.

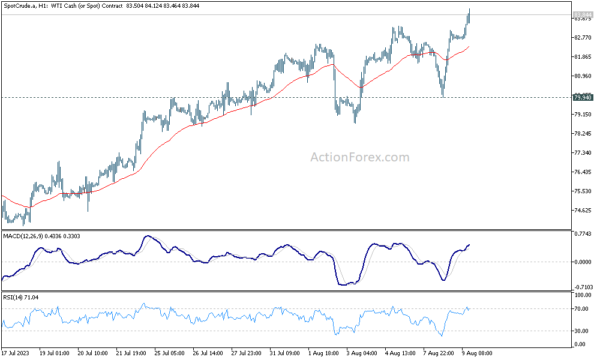

WTI hits highest level this year, targeting 85 next

WTI crude oil continued its impressive rally, marking its highest price point for the year. This surge comes in the wake of Saudi Arabia’s firm stance, as the nation’s cabinet confirmed yesterday its unwavering support for the precautionary strategies adopted by OPEC+.

Adding weight to this commitment, just last week, Saudi Arabia prolonged its voluntary slash in production by a significant 1 million barrels daily until the end of September. Besides, Russia further bolstered the market sentiment by announcing a reduction in oil exports by 300,000 bpd for September.

Technically, near term outlook in WTI will now stay bullish as long as 79.94 support holds. Next target is 161.8% projection of 63.67 to 74.74 from 66.94 at 84.85, and possibly above.

However, barring any dramatic development, strong resistance should be seen from 38.2% retracement of 131.82 (2022 high) to 63.67 (2023 low) at 89.70 to limit upside, at least on first attempt.

China CPI down -0.3% yoy, first negative since 2021

China’s CPI for July registered a drop of -0.3% yoy, marking its first decline since February 2021. Although this result is slightly better than the market’s expectation of a -0.4% drop, it underscores the economic headwinds faced.

Core inflation measure, which excludes the often erratic food and energy costs, showed a rise to 0.8% yoy from a mere 0.4% yoy. This points to some underlying demand within the economy, albeit muted.

A deeper dive into CPI reveals that food prices have seen a -1% fall yoy, a sharp contrast to the 2.3% yoy rise observed in the previous month. On the other hand, non-food prices climbed 0.5% yoy last month, bouncing back from a -0.6% yoy.

Dong Lijuan, chief statistician at the NBS, commented, “With the impact of a high base from last year gradually fading, the CPI is likely to rebound gradually.”

On the PPI front, situation remains challenging. PPI improved from -5.4% yoy to -4.4% yoy in July. This figure not only missed market expectations, which stood at -3.8% yoy, but also marked the tenth straight month of negative readings.

RBNZ business survey points to lower inflation expectations, steady interest rates

As seen from the latest Quarterly RBNZ Survey of Expectations, businesses have slightly tapered their inflation expectations in the near term but wage inflation expectations were on the rise. RBNZ OCR is expected to be unchanged at the current 5.50% through the quarter.

Expectations for annual inflation one year ahead have moderated, moving from 4.28% to 4.17%. However, a two-year horizon sees a marginal uptick in these expectations, which have climbed from 2.79% to 2.83%.

More long-term views, reflected in the five and ten-year ahead inflation expectations, both indicate a pullback, dropping to 2.25% (from 2.35%) and 2.22% (from 2.28%), respectively.

A notable area of concern stems from the annual wage inflation expectations. Over the course of both one and two years, these expectations are on the rise. For the year ahead, expectations climbed from 4.80% to 5.04%, and for the two-year mark, they increased from 3.53% to 3.66%.

Regarding monetary policy, the survey results indicate a stable outlook on the OCR. By the close of the September 2023 quarter, businesses anticipate OCR to average around 5.53%, a minimal climb from the prior quarter’s estimate of 5.47%. A one-year ahead mean estimate rose 32 basis points to 5.16% from the previous 4.84%.

Average one-year ahead GDP growth forecast surged to 1.02%, up from previous 0.48%. Moreover, businesses seem to be projecting continued momentum, with two-year ahead GDP growth expectations reaching 1.95% from preceding 1.66%.

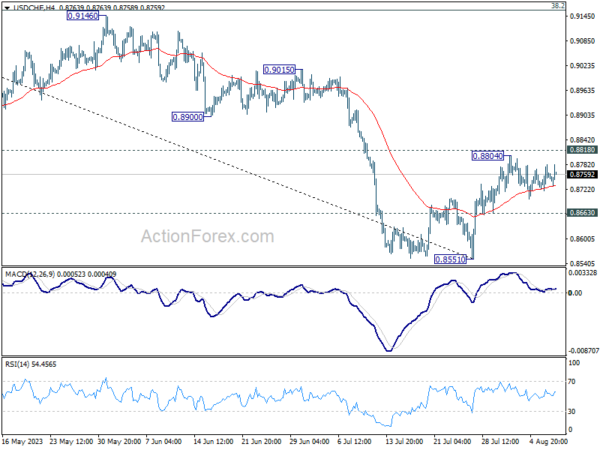

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8720; (P) 0.8752; (R1) 0.8785; More….

USD/CHF recovers mildly after hitting 55 4H EMA, but remains bounded in range. Intraday bias stays neutral at this point. On the downside break of 0.8663 minor support should confirm rejection by 0.8818 and turn intraday bias back to the downside for retesting 0.8551 first. Nevertheless, decisive break of 0.8818 will carry larger bullish implication, and target 0.9146 cluster resistance next.

In the bigger picture, down trend from 1.0146 is seen as in progress as long as 0.8188 support turned resistance holds. Next target is 61.8% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.8317. However, sustained break of 0.8818 should indicate medium term bottoming, and bring stronger rise back to 0.9146 cluster resistance (38.2% retracement of 1.0146 to 0.8551 at 0.9160), even as a correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | CNY | CPI Y/Y Jul | -0.30% | -0.40% | 0.00% | |

| 01:30 | CNY | PPI Y/Y Jul | -4.40% | -3.80% | -5.40% | |

| 03:00 | NZD | RBNZ Inflation Expectations Q/Q Q3 | 2.83% | 2.79% | ||

| 06:00 | JPY | Machine Tool Orders Y/Y Jul P | -19.80% | -21.70% | -21.10% | |

| 12:30 | CAD | Building Permits M/M Jun | 6.10% | 2.30% | 10.50% | |

| 14:30 | USD | Crude Oil Inventories | 2.1M | -17.0M |