- Euro kicks off the new trading week on the back foot vs. the US Dollar.

- Stocks in Europe open Monday’s session in the red.

- EUR/USD recedes to the vicinity of 1.0960 on Fed, risk-off mood.

- The USD Index (DXY) regains the area above 102.00.

- Industrial Production in Germany contracted 1.5% MoM in June.

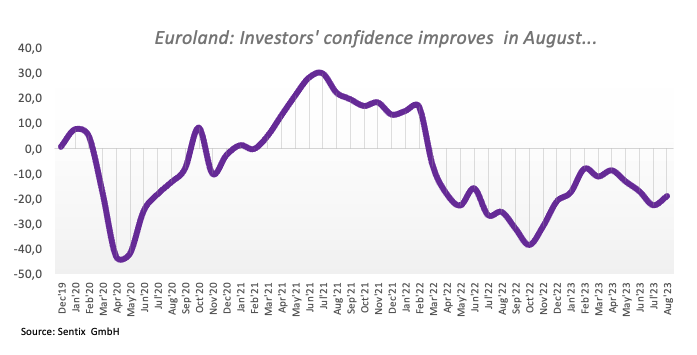

- EMU’s Investor Confidence improved in August.

The Euro (EUR) starts the week with an offered bias against the US Dollar (USD) and forces EUR/USD to revisit the sub-1.1000 region in the wake of the opening bell on the old continent on Monday.

On the flip side of the coin, the Greenback manages to regain traction after two consecutive daily pullbacks, regaining at the same time the area beyond 102.00 the figure, as investors continue to digest Friday’s release of the Nonfarm Payrolls figures (+187K).

On the latter, it is worth recalling that despite the US economy creating fewer jobs than initially projected, wage growth remained steady and the jobless rate improved to 3.5%, indicating that the resilience of the labour market appears almost intact.

Other than the prevailing risk-off sentiment, the renewed bid bias in the US Dollar appears propped up by comments by the FOMC’s Michelle Bowman, who advocated for further rate hikes (at the next meeting?) in case disinflationary pressures stall.

The latter comes in contrast to steady speculation that the Fed’s rate hike in July might have been its last for the foreseeable future. Additionally, the possibility of the European Central Bank (ECB) implementing further tightening measures beyond the summer seems to be losing momentum.

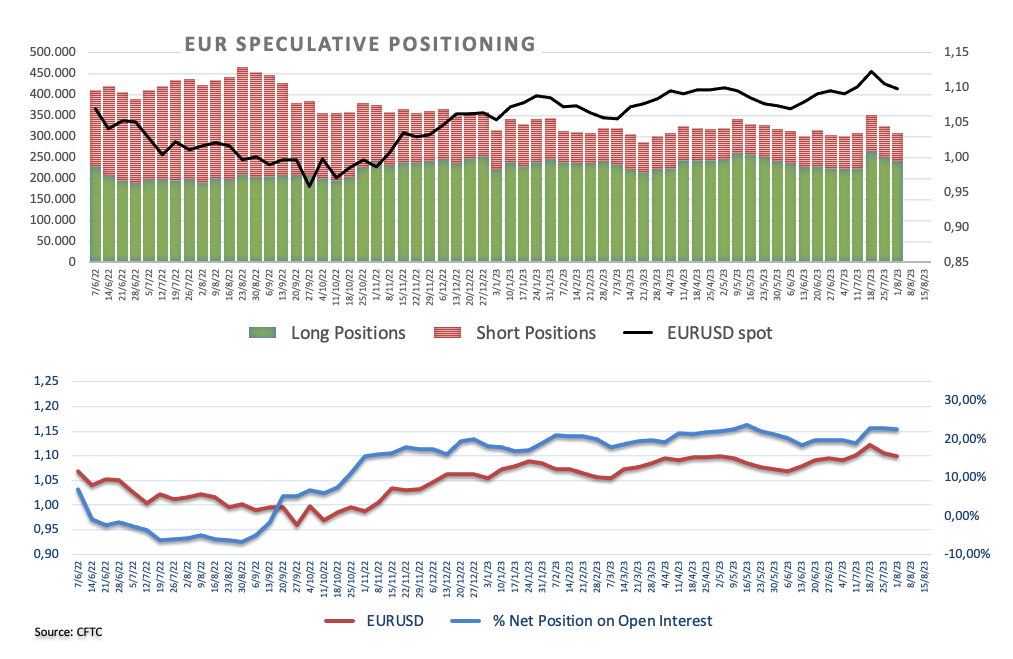

From the speculative community, EUR net longs receded a tad to three-week lows just above 172K contracts in the week to August 1 according to CFTC’s report. Under that period, spot saw its decline accelerate in the wake of the FOMC and ECB interest rate decisions on July 26 and July 27, respectively.

In the euro docket, Industrial Production in Germany contracted 1.5% MoM in June and 1.8% over the last 12 months. In addition, Investor Confidence tracked by the Sentix index improved to -18.9 for the month of August.

In the US, Consumer Credit Change will be the sole release along with short-term bill auctions.

Daily digest market movers: Euro gives away some gains as risk aversion picks up

- The EUR drops to the 1.0960 region vs. the USD on Monday.

- The USD Index (DXY) retakes the 102.00 hurdle and beyond.

- Risk aversion looks firm at the beginning of the week.

- Fed’s Bowman did not rule out extra tightening in the near term.

- CME Group’s FedWatch Tool sees no rate hikes by the Fed in H2 2023.

- Speculation that the Fed might have ended its hiking cycle remains steady.

- Investors’ focus is expected to shift to US inflation figures (August 11).

Technical Analysis: Euro faces the next support at the 1.0920/10 band

EUR/USD comes under renewed downside pressure and breaches the key psychological support at 1.1000.

The loss of the 1.0920 region, where the provisional 55-day and 100-day SMAs converge, leaves EUR/USD vulnerable to a probable drop to the July low of 1.0833 (July 6) ahead of the key 200-day SMA at 1.0748 and the May low of 1.0635 (May 31). South from here emerges the March low of 1.0516 (March 15) before the 2023 low of 1.0481 (January 6).

On the other hand, occasional bullish attempts could motivate the pair to initially dispute the weekly top at 1.1149 (July 27). Above this level, the downside pressure could mitigate somewhat and could encourage the pair to test the 2023 high at 1.1275 (July 18). Once this level is cleared, there are no resistance levels of significance until the 2022 peak of 1.1495 (February 10), which is closely followed by the round level of 1.1500.

Furthermore, the constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region.

The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro.

QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.