Dollar maintains its position as the week’s strongest major currency, although momentum has noticeably started to wane. The release of today’s non-farm payroll report is poised to be a critical determinant in whether the greenback can sustain its near-term rally. However, market reactions could be complex, given that robust numbers could be seen as both a blessing and a curse, contingent on interpretation. The challenge lies in navigating the thin line of an optimal outcome for both the US economy and Fed, the so-called “goldilocks” scenario.

In the rest of the forex markets, Swiss Franc and Euro are trailing closely behind Dollar as the next strongest currencies. Conversely, Australian Dollar currently sits at the bottom of the performance spectrum, with only a recovery in Copper prices breathing some life back into the currency. Following closely in terms of weakness is New Zealand Dollar, with Sterling securing the third weakest spot, despite regaining some ground from the post-BoE selloff. Canadian Dollar’s performance remains mixed as it awaits its own employment data, while Yen continues to display near-term consolidation patterns.

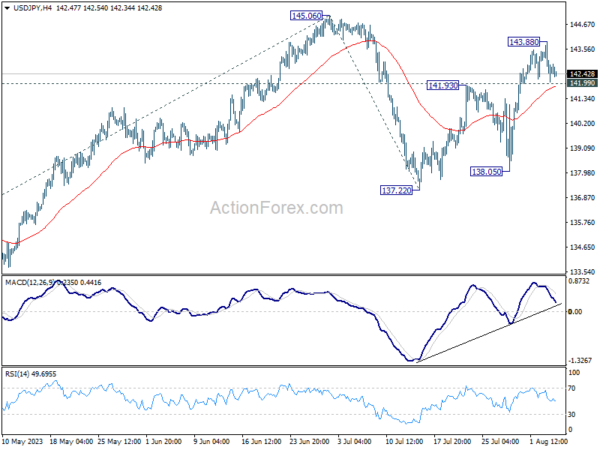

In a technical examination, USD/JPY has clearly experienced a slowdown in its upward momentum, ahead of 145.06 high. Even the surge in US 10-year yield, which broke a critical near-term structural resistance and reached its highest level since November, provided limited support. As it stands, further gains seem likely as long as 141.99 minor support remains intact. A rise beyond 143.88 would revive the rally and push for a retest of 145.06 high. However, strong break of 141.99 could indicate that the corrective pattern from 145.06 is commencing its third leg, possibly falling back towards 137.22/138.05 support zone.

In Asia, at the time of writing, Nikkei is down -0.05%. Hong Kong HSI is up 1.22%. China Shanghai SSE is up 0.66%. Singapore Strait Times is down -0.20%. Japan 10-year JGB yield is down slightly by -0.0007 at 0.653. Overnight, DOW dropped -0.19%. S&P 500 dropped -0.25%. NASDAQ dropped -0.10%. 10-year yield rose 0.111 to 4.189.

RBA downgrades 2023 CPI and GDP forecasts slightly

In the quarterly Statement on Monetary Policy, RBA reiterated that “some further tightening of monetary policy may be required”. This decision, however, would hinge on the incoming data and the evolving assessment of risks. Economic forecasts remain largely unchanged, with a slight downgrade in 2023 CPI forecast as well as 2023 and 2024 GDP projections.

The central bank’s outlook for inflation remains more or less steady as compared to three months ago. “CPI inflation is forecast to continue to decline, to be around 3¼ per cent at the end of 2024 and back within the 2–3 per cent target range in late 2025,” the statement highlighted. The Board maintains that the risks around the inflation outlook are “broadly balanced”.

While the labour market remains tight, conditions have seen slight relaxation. The bank notes, “In response to the tight labour market and high inflation, wage growth picked up to its highest rate in a decade.”

The economic growth perspective appears somewhat muted, with the statement acknowledging that “Growth in economic activity has been subdued this year.” Looking ahead, the central bank remains cautious, predicting that “Growth in the economy is expected to remain subdued over the period ahead.”

New economic forecasts

CPI inflation at (vs previous forecast):

- 4.25% in Dec 2023 (down from 4.50%).

- 3.50% in June 2024 (unchanged).

- 3.25% in Dec 2024 (unchanged).

- 300% in Jun 2025 (unchanged).

- 2.75% in Dec 2025 (new).

Trimmed mean CPI inflation at:

- 4.00% in Dec 2023 (unchanged).

- 3.25% in Jun 2024 (unchanged).

- 3.00% in Dec 2024 (unchanged).

- 3.00% in Jun 2025 (unchanged).

- 2.75% in Dec 2025 (new).

Year-average GDP growth at:

- 1.50 in 2023 (down from 1.75%).

- 1.25% in 2024 (down from 1.50%).

- 2.00% in 2025 (new).

NFP: Where’s the balance between job growth and wage inflation?

The imminent NFP report today poses a potential quandary for both Fed and market participants. On one hand, steady job growth aligns with Fed’s intention to engineer a soft landing for the US economy. On the other, elevated wages growth due to tight labor market could compel Fed to maintain its tightening course, potentially complicating the soft landing strategy.

Expectations are set for a 200k job increase in July, while unemployment rate is predicted to hold steady at 3.6%. Average hourly earnings are projected to climb 0.3% month-on-month.

Based on recent developments, economists are gradually warming to the idea that Fed might achieve its “soft-landing” scenario for the economy. Consistent job growth around the 200,000 region per month would provide further support for this possibility.

However, uncertainties loom regarding wage growth. With an expected 0.3% mom growth, the annual rate could comfortably remain above 4% yoy – a figure significantly higher than the levels consistent with Fed’s 2% inflation target. A strong report will certainly spark debates in the market about whether Fed will need to tighten its monetary policy further toward a peak of 6%, up from the current 5.25-5.50%.

Relevant employment data presents a mixed bag. ISM Services Employment index was at 50.7 in July, down -2.4 points from 53.1 in June. Meanwhile, ISM Manufacturing Employment was lower at 44.4, marking a decline of -3.7 points from 48.1 in June. In contrast, ADP reported private payrolls at 324k against forecast of 195k and prior month’s stronger 455k.

Elsewhere

Germany factor orders, France industrial output, Eurozone retail sales and UK construction PMI will be released in European session. Later in the day, Canada will also publish employment data and Ivey PMI.

USD/CHF Daily Outlook

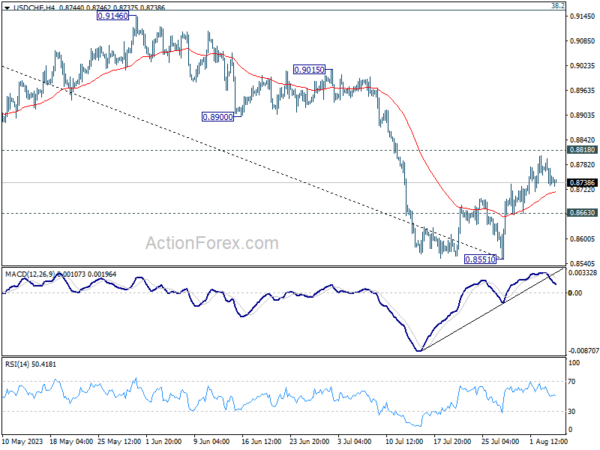

Daily Pivots: (S1) 0.8717; (P) 0.8758; (R1) 0.8783; More….

Intraday bias in USD/CHF remains neutral for the moment. Near term outlook stays bearish for now, with 0.8818 support turned resistance intact. On the downside, break of 0.8663 minor support should confirm rejection by 0.8818 and turn intraday bias back to the downside for retesting 0.8551 first. Nevertheless, decisive break of 0.8818 will carry larger bullish implication, and target 0.9146 cluster resistance next.

In the bigger picture, down trend from 1.0146 is seen as in progress as long as 0.8188 support turned resistance holds. Next target is 61.8% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.8317. However, sustained break of 0.8818 should indicate medium term bottoming, and bring stronger rise back to 0.9146 cluster resistance (38.2% retracement of 1.0146 to 0.8551 at 0.9160), even as a correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Monetary Policy Statement | ||||

| 06:00 | EUR | Germany Factory Orders M/M Jun | -2.00% | 6.40% | ||

| 06:45 | EUR | France Industrial Output M/M Jun | -0.30% | 1.20% | ||

| 08:00 | EUR | Italy Industrial Output M/M Jun | 0.00% | 1.60% | ||

| 08:30 | GBP | Construction PMI Jul | 48.2 | 48.9 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Jun | 0.30% | 0.00% | ||

| 12:30 | USD | Nonfarm Payrolls Jul | 200K | 209K | ||

| 12:30 | USD | Unemployment Rate Jul | 3.60% | 3.60% | ||

| 12:30 | USD | Average Hourly Earnings M/M Jul | 0.30% | 0.40% | ||

| 12:30 | CAD | Net Change in Employment Jul | 15.5K | 59.9K | ||

| 12:30 | CAD | Unemployment Rate Jul | 5.50% | 5.40% | ||

| 14:00 | CAD | Ivey PMI Jul | 50.2 |