Euro falls broadly today following release of weaker than expected German Ifo business climate data, although losses remain somewhat contained for the moment. It appears traders are holding their bets in anticipation of the upcoming FOMC and ECB rate decisions. Further, with July drawing to a close and the markets in a characteristic summer lull, significant movements are somewhat restrained.

Australian Dollar holds onto its position as the strongest performer of the day, bolstered by earlier gains and closely trailed by New Zealand dollar. Swiss Franc claims the third spot, given a boost by the weakening Euro. On the other end of the spectrum, Canadian dollar follows the common currency as the next weakest, while Dollar trails behind. Japanese Yen presents a mixed picture, with traders also keenly awaiting BoJ’s decision due on Friday.

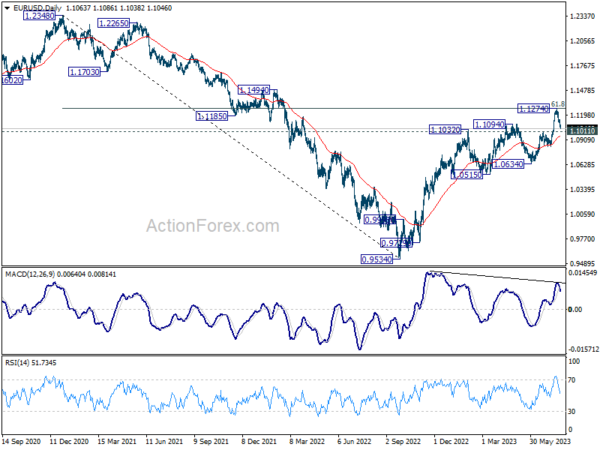

All eyes in the forex market will be on EUR/USD in the coming days. From a technical perspective, the pair could have peaked at 1.1274, after reaching the 61.8% retracement of 1.2348 (2021 high) to 0.9534 (2022 low) at 1.1273. However, decisive break through 1.1011 resistance-turned-support level would be needed for confirmation. Should this occur, deeper decline could be seen to 1.0634 support level before a rebound sets up the medium-term range.

In Europe, at the time of writing, FTSE is up 0.16%. DAX is up 0.05%. CAC is up 0.07%. Germany 10-year yield is up 0.0177 at 2.444. Earlier in Asia, Nikkei dropped -0.06%. Hong Kong HSI rose 4.10%. China Shanghai SSE rose 2.13%. Singapore Strait Times rose 0.64%. Japan 10-year JGB yield rose 0.0159 to 0.467.

Germany’s Ifo business climate fell to 87.3, economy turning bleaker

Germany’s Ifo Business Climate Index has fallen for the third consecutive month in July, from 88.6 to 87.3, slightly missing expectation of of 88.0. Both the Current Assessment Index and Expectations Index noted a drop, signaling a potential slowdown in Europe’s largest economy.

Current Assessment Index, which measures the present business conditions, dropped from 93.7 to 91.3, falling short of the expected 93.0. Meanwhile, Expectations Index, which gauges future business prospects, slipped from 83.8 to 83.5, although it managed to outperform the expectation of 83.0.

Ifo, the institute that conducts the survey, delivered a grim prognosis for the German economy. “The situation in the German economy is turning bleaker,” they said in their statement.

A breakdown by sectors shows a similar trend, with all reporting lower figures. Manufacturing took a hit, dropping from -9.7 to -14.2. Services sector also posted a decline, falling from 2.7 to 0.9. Trade sector suffered a fall from -20.2 to -23.7, and construction, too, saw a downturn, from -20.5 to -24.0.

AUD/CAD recovering, head and shoulder in the making?

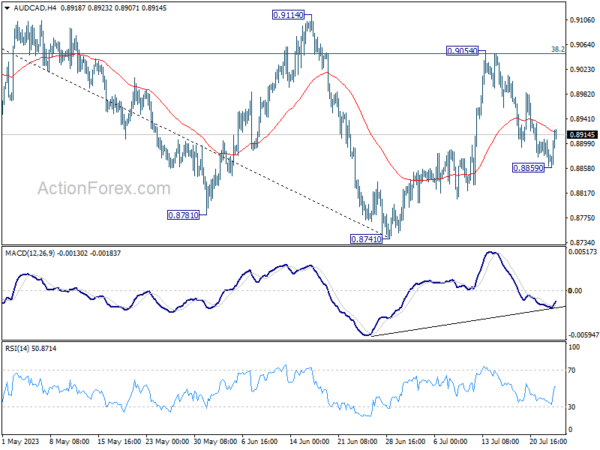

AUD/CAD is one of the top movers today, riding on Aussie’s broad based recovery. Immediate focus is on 55 4H EMA (now at 0.8191). Sustained trading above there will indicate that the pull back from 0.9054 has completed at 0.8859, and bring stronger rise back to 0.9054 resistance.

While it’s still a bit early, it’s worth to point out that AUD/CAD could be forming a head and shoulder bottom pattern (ls: 0.8781; h: 0.8741; rs: 0.8859). Decisive break of 0.9054 cluster resistance (38.2% retracement of 0.9545 to 0.8741 at 0.9048) will be a strong signal of bullish reversal. That would set the stage for further rise to 61.8% retracement at 0.9238 next.

EUR/GBP Mid-Day Outlook

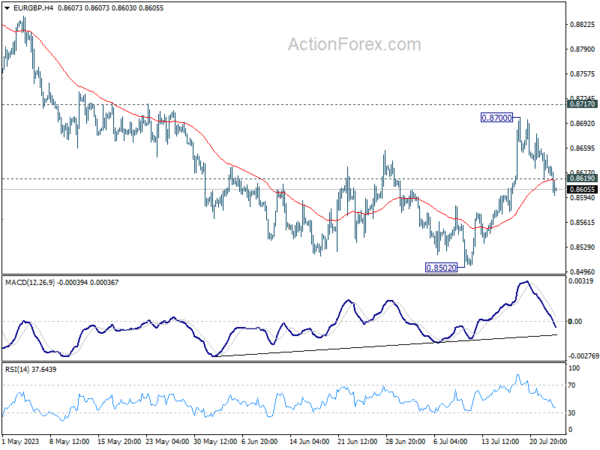

Daily Pivots: (S1) 0.8612; (P) 0.8636; (R1) 0.8653; More…

EUR/GBP’s break of 0.8619 minor support argues that rebound from 0.8502 has completed at 0.8700, ahead of 0.8717 support turned resistance. Intraday bias is back on the downside for retesting 0.8502 low. Firm break there will resume larger decline form 0.8977. Nevertheless, break of 0.8700 will revive near term bullishness for another take on 0.8717.

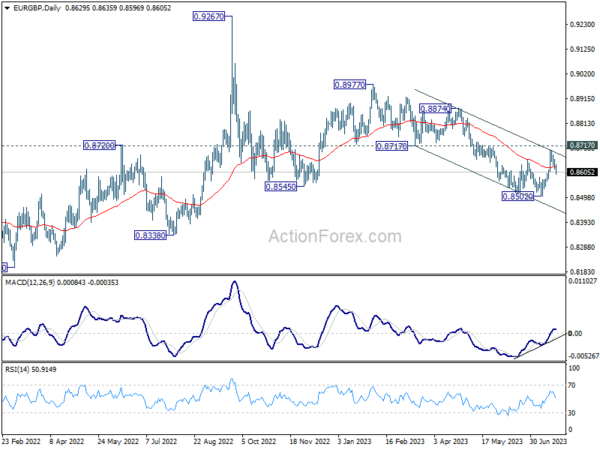

In the bigger picture, the down trend from 0.9267 (2022 high) is seen as part of the long term range pattern from 0.9499 (2020 high). Firm break of 0.8717 support turned resistance will argue that it has completed with three waves down to 0.8502. Further break of 0.8977 will bring retest of 0.9267 high. Nevertheless, rejection by 0.8717, followed by break of 0.8502 will resume the decline towards 0.8201 (2022 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | EUR | Germany IFO Business Climate Jul | 87.3 | 88 | 88.5 | 88.6 |

| 08:00 | EUR | Germany IFO Current Assessment Jul | 91.3 | 93 | 93.7 | |

| 08:00 | EUR | Germany IFO Expectations Jul | 83.5 | 83 | 83.6 | 83.8 |

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y May | -1.70% | -1.40% | -1.70% | |

| 13:00 | USD | Housing Price Index M/M May | 0.70% | 0.60% | 0.70% | |

| 14:00 | USD | Consumer Confidence Jul | 112.1 | 109.7 | ||

| 14:00 | USD | Richmond Fed Manufacturing Index Jul | -10 | -7 |