- USD/JPY bears are waiting to make the move.

- Bears eye key resistance near a 61.8% Fibonacci, but note higher prospects.

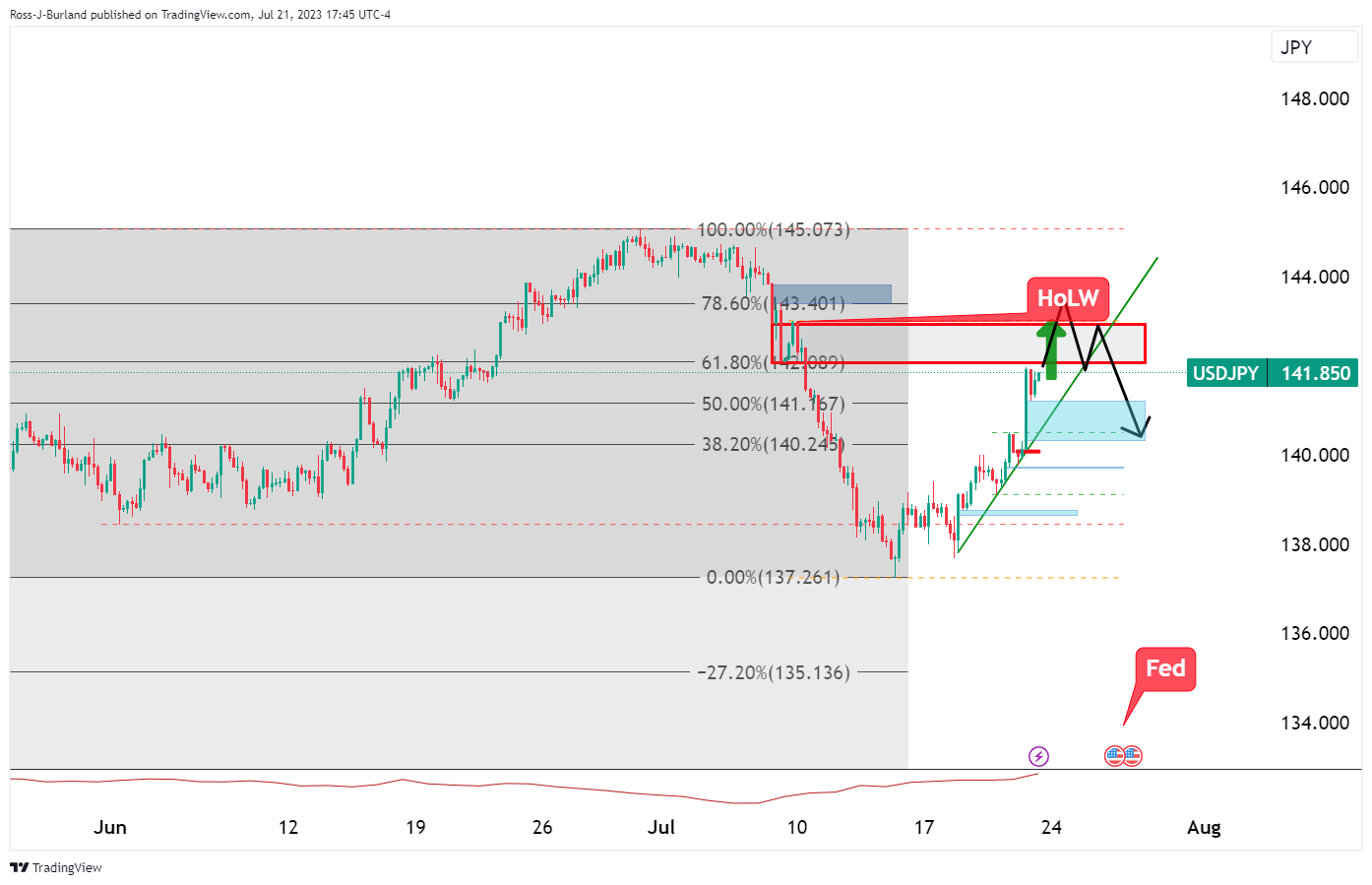

The yen dropped against the dollar on Friday after Reuters reported the Bank of Japan (BoJ) is leaning toward keeping its key yield control policy unchanged next week. We have seen a range of between 139.74 and 141.95 on Friday and this sets up next week for a possible correction from a 61.8% Fibonacci retracement area in the opening range:

USD/JPY technical analysis

USD/JPY H4 chart

However, the high of last week, HoLW, could be a target before where the area meets a 78.6% ratio. The current bullish trend line remains intact after all.

This article was originally published by Fxstreet.com. Read the original article here.