Today’s trading has been notably subdued after Asian session, characterized by limited news flow from Europe, and just US jobless claims and Philadelphia Fed survey in early US session. Sterling weakness continues to be a dominant theme for the week, experiencing a fresh round of selling as US session opens. Concurrently, slight softening is evident in Euro and Swiss Franc.

Despite Australian Dollar holding the position of the day’s strongest performer, it has not witnessed clear, sustained buying after its initial rise on job data, rebound in Yuan and copper. In contrast, US Dollar is making attempts to stage a stronger rebound, while Yen’s performance remains mixed as it awaits tomorrow’s CPI data release from Japan.

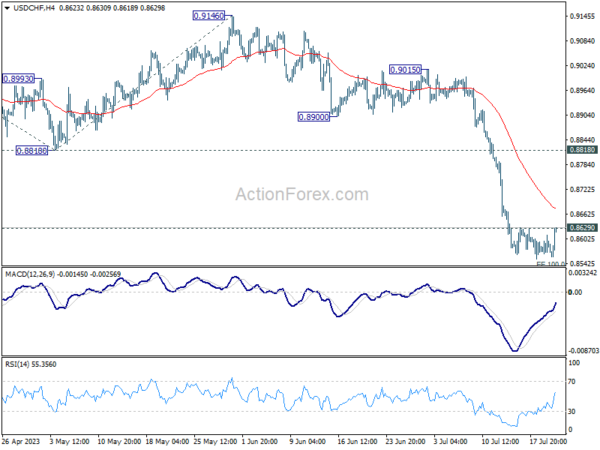

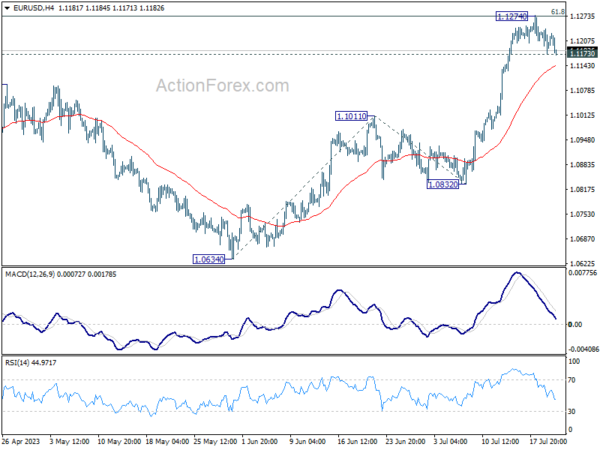

Technically, immediate focus is now on 1.1173 minor support in EUR/USD and 0.8629 minor resistance in USD/CHF. Firm break there this levels will indicate that stronger rebound in Dollar is underway. While that’s still far from a reversal signal even if realized, that would signal the start of a prolonged consolidations, probably extending to next week’s FOMC rate decision.

In Europe, at the time of writing, FTSE is up 0.62%. DAX is up 0.23%. CAC is up 0.36%. Germany 10-year yield is up 0.0230 at 2.463. Earlier in Asia, Nikkei fell -1.23%. Hong Kong HSI dropped -0.13%. China Shanghai SSE dropped -0.92%. Singapore Strait Times dropped -0.03%. Japan 10-year JGB yield dropped -0.0076 to 0.460.

Philadelphia Fed manufacturing outlook shows signs of optimism despite persistent negativity in general activity

The July Manufacturing Business Outlook Survey from the Philadelphia Fed presented a mixed bag of indicators. The diffusion index for current general activity marginally improved from -13.7 to -13.5, slightly exceeding expectations of -15.5. But it registered its 11th consecutive negative reading. Also, the persistent negativity was reflected as over 30% of the firms reported decreases, outnumbering the 17% that reported increases. Nearly half of the firms (49%) reported no change in current activity.

The new orders index took a hit, dropping -5 points to -15.9, marking its 14th consecutive negative reading. The employment index also dipped marginally from -0.4 last month to -1.0 this month. Furthermore, the prices paid diffusion index decline by -1 point to 9.5.

In a ray of hope, the diffusion index for future general activity saw a significant jump from 12.7 in June to 29.1, recording the index’s highest reading since August 2021. This indicates growing optimism about future business conditions. Nearly 40% of firms anticipate an increase in activity over the next six months, up from 33% last month, with only 11% expecting a decrease (down from 20%). Meanwhile, 46% anticipate no change, slightly up from 44% in the previous month.

US initial claims fell to 228k, below expectations

US initial jobless claims fell -9k to 228k in the week ending July 15, below expectation of 245k. Four-week moving average of initial claims dropped -9k to 238k. Continuing claims rose 33k to 1754k in the week ending July 8. Four-week moving average of continuing claims fell -2k to 1732k.

Japan’s export to US up 11.7% yoy in Jun, to EU up 15%, to China down -11%

Japan’s exports rose by 1.5% yoy to JPY 8744B in June. The significant rise in exports to US by 11.7% yoy and to EU by 15.0% yoy was offset by the -11.0% yoy decline in exports to China (marking the most significant drop since January).

Rise in US-bound exports was primarily driven by shipments of cars and mining machinery. Meanwhile, dip in exports to China was attributed the decreased shipments of steel, chips, and nonferrous metal, which led to an overall double-digit decline.

Japan’s imports contracted by -12.9% yoy to JPY 8701B. The decrease in value of imports is primarily linked to drop in crude, coal, and liquefied natural gas.

As a result, Japan recorded a trade surplus of JPY 43B, the first such instance in nearly two years since July 2021.

In seasonally adjusted term, exports rose 3.3% mom to JPY 8269B. Imports rose 0.5% mom to JPY 8822B. Trade balance reported JPY -553B deficit, versus expectation of JPY -550B.

Australia employment grew 32.6k, but demand met by people working more hours

Australian’s June employment data showed persistent tightness in the job markets. The 32.6k growth in employment significantly surpassed expectations of 15.0k. Employment-population ratio remained at record high. Monthly hours worked outpaced employment growth, suggesting that labor demand was met by people working more hours.

Among the 32.6k job growth, rise of 39.3k full-time employment was offset by a decrease of -6.7k in part-time roles. Unemployment rate remained steady at 3.5%, below expectation of 3.6%. Participation rate dipped slightly from 66.9% to 66.8%. Monthly hours worked rose 0.3% mom, faster than growth in employment at 0.2% mom.

Bjorn Jarvis, ABS head of labour statistics, stated: “The rise in employment in June saw the employment-to-population ratio remain at a record high 64.5 per cent, reflecting a tight labour market in which employment has recently increased in line with population growth.”

He further emphasized that the current labour market is stronger than it was prior to the pandemic. Jarvis elaborated, “In addition to there being over a million more employed people than before the pandemic, a much higher share of the population is employed. In June 2023, 64.5 per cent of people 15 years or older were employed, an increase of 2.1 percentage points since March 2020.”

Jarvis also highlighted the ongoing demand for labour, saying: “The strength in hours worked since late 2022, relative to employment growth, shows the demand for labour is continuing to be met, to some extent, by people working more hours.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1171; (P) 1.1206; (R1) 1.1237; More…

Intraday bias in EUR/USD remains neutral for the moment. On the downside, firm break of 1.1173 minor support will confirm rejection by 1.1273 fibonacci level. Intraday bias will be back on the downside for deeper pull back to 55 4H EMA (now at 1.1141) and below. Nevertheless, sustained break of 1.1273 will extend larger up trend to 161.8% projection of 1.0634 to 1.1011 from 1.0832 at 1.1442 next.

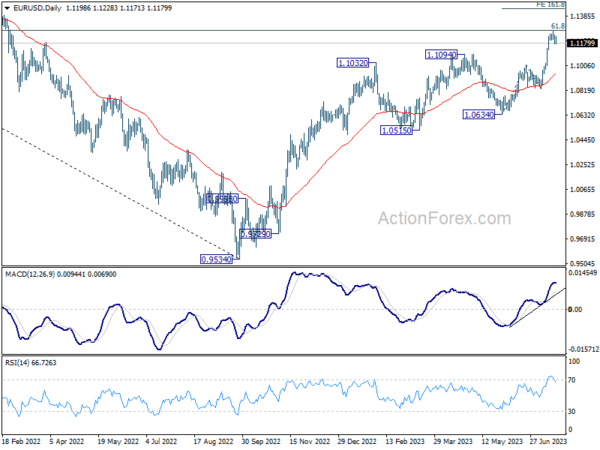

In the bigger picture, as rise from 0.9534 extends, focus is now on 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next. Meanwhile, outlook will continue to stay bullish as long as 1.0832 support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Jun | -0.55T | -0.66T | -0.78T | -0.77T |

| 01:30 | AUD | NAB Business Confidence Q2 | -3 | -4 | ||

| 01:30 | AUD | Employment Change Jun | 32.6K | 15.0K | 75.9K | 76.5K |

| 01:30 | AUD | Unemployment Rate Jun | 3.50% | 3.60% | 3.60% | 3.50% |

| 06:00 | CHF | Trade Balance (CHF) Jun | 4.82B | 4.23B | 5.48B | |

| 06:00 | EUR | Germany PPI M/M Jun | -0.30% | -0.40% | -1.40% | |

| 06:00 | EUR | Germany PPI Y/Y Jun | 0.10% | 0.00% | 1.00% | |

| 08:00 | EUR | Eurozone Current Account (EUR) May | 9.1B | 2.5B | 3.6B | 3.8B |

| 12:30 | USD | Initial Jobless Claims (Jul 14) | 228K | 245K | 237K | |

| 12:30 | USD | Philadelphia Fed Manufacturing Jul | -13.5 | -15.5 | -13.7 | |

| 14:00 | USD | Existing Home Sales Jun | 4.27M | 4.30M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Jul P | -16 | -16 | ||

| 14:30 | USD | Natural Gas Storage | 45B | 49B |