The financial markets kicked off the week on a sour note, grappling with disappointing Chinese GDP figures that undercut the overall sentiment. Despite a mixed bag of data for June, the weaker-than-expected economic expansion in China sent Australian Dollar – a bellwether for the commodities sector – on a slide, spearheading losses among commodity-linked currencies.

Simultaneously, Japanese Yen found fresh wind in its sails, shadowed closely by Swiss Franc and Dollar, a typical response in risk-off market environments. Euro and Sterling trod a mixed path, with the former eking out a slight edge in the early trade.

While steep selloff in the greenback last week is still fresh in market participants’ mind, there’s prospect of some stabilization in Dollar this week. Focus will be temporarily off the US, which only has retail sales data as a high-tier economic release. Meanwhile, cross-market volatility could pick up pace, fueled by release of CPI data from Canada, New Zealand, UK, and Japan.

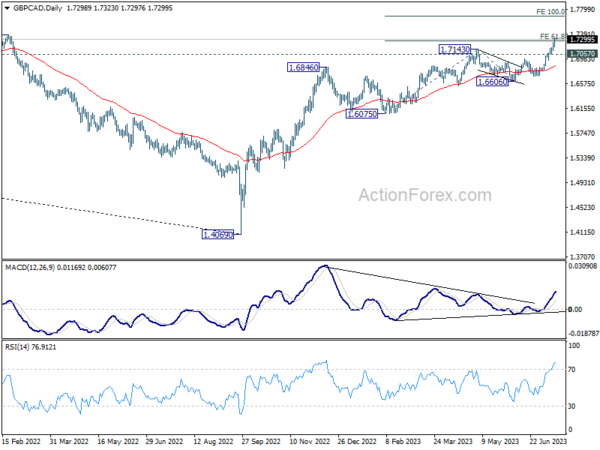

Technically, GBP/CAD’s up trend from 1.4069 resumed last week by breaking through 1.7143 resistance. 61.8% projection of 1.6075 to 1.7143 from 1.6606 at 1.7266 was also met. For now near term outlook will stay bullish as long as 1.7057 support holds. Sustained trading above 1.7266 will pave the way to 100% projection at 1.7674.

In Asia, Japan is on holiday. Hong Kong is off on typhoon. China Shanghai SSE is down -1.26%. Singapore Strait Times is down -0.28%.

China’s annual GDP growth missed expectations, youth unemployment hit new record

China’s Q2 GDP growth rose by 6.3% yoy, an improvement from Q1’s 4.5% but fell short of expectation 7.1% yoy. On a quarter-to-quarter basis, GDP grew by 0.8%, deceleration from the previous quarter’s 2.2% but still outpacing projected 0.5%.

Despite being the fastest annual pace since Q2 2021, this performance appears skewed due to low base effect from last year’s lockdown. For H1 as a whole, GDP expanded by 5.5% when compared to the same period last. This growth outperformed the government’s modest target of approximately 5% for the year.

Other figures published by the National Bureau of Statistics on Monday painted a mixed picture. In June, retail sales increased by 3.1% yoy, falling short of the expected 3.5% and down significantly from May’s 12.7% growth. On a brighter note, industrial production, reflecting activity in manufacturing, mining, and utilities sectors, surged by 4.4% yoy last month, a jump from May’s 3.5% and surpassing expectations of 2.6%.

Fixed-asset investment, traditionally used to bolster growth, rose by 3.8% yoy in the first half of 2023, a slowdown from the 4% increase witnessed in the first five months. However, this growth exceeded the expected 3.4%.

In terms of employment, the picture appears bleak for the younger generation. Unemployment rate for those aged 16-24 reached a record 21.3% in June, up from 20.8% in May. Conversely, overall urban surveyed jobless rate remained static at 5.2% last month.

In a separate announcement, PBoC maintained the rate on CNY 103B worth of one-year medium-term lending facility loans to some financial institutions at 2.65%.

Spotlight on Canada, New Zealand, UK, and Japan CPI

The upcoming week is marked with anticipation as consumer inflation data from Canada, New Zealand, UK, and Japan is slated for release. This data will undeniably have significant implications on the currency markets.

Canada’s CPI is predicted to further decelerate from May’s 3.4% yoy, potentially falling back to BoC’s target range of 1-3%, presumably close to the upper limit. Nonetheless, BoC’s prime concern will likely be the monthly increase in core CPI, serving as a barometer for persistence of underlying inflation pressure. Additionally, to validate the speculation that last week’s BoC rate hike marked the end of the current cycle, substantial progress needs to be observed in trimmed and median CPI, from the preceding month’s yoy figures of 3.8% and 3.9%, respectively.

Across the Pacific, New Zealand’s CPI is projected to decelerate from 1.2% qoq to 0.9% in Q2, with annual rate declining from 6.7% yoy to 5.9%. If these predictions hold true, it will be the third consecutive quarter where inflation has underperformed against RBNZ’s forecasts (1.1% qoq and 6.1% yoy for Q2 as stated in May’s Monetary Policy Statement). This scenario would augment the case for RBNZ to maintain interest rate at 5.50%, in line with its own projected peak.

In the UK, June’s CPI is forecasted to slow from 8.7% yoy to 8.2%, with the core CPI holding steady at 7.1% yoy. This performance keeps UK as the bottom of the class in major economics in combating inflation. While market anticipations on BoE peak rate vary, a consensus seems to be forming that rates will need to increase from the present level of 5% to above 6% eventually.

Turning to Japan, core CPI and core-core CPI are expected to hover around May’s level of 3.2% yoy and 4.3% yoy respectively. After release of robust wages growth data earlier this month, anticipations for a possible tweak in BoJ’s yield curve control parameters have been mounting. 10-year JGB yield has jumped from around 0.38% in early July to the current 0.48%. Any upside surprises in the CPI report would likely trigger further speculation and may transpire into a subsequent rally in 10-year JGB, surpassing BoJ’s cap of 0.50%.

In additional, focuses will also be on retail sales data from US, UK and Canada, as well as Australia job data and RBA minutes.

Here are some highlights for the week:

- Monday: China GDP, industrial production, retail sales, fixed asset investment; Canada wholesale sales; Empire State Manufacturing index.

- Tuesday: RBA minutes; Japan tertiary industry index; Canada CPI, IPPI and RMPI, housing starts; US retail sales, industrial production, business inventories, NAHB housing index.

- Wednesday: New Zealand CPI; UK CPI, PPI; Eurozone CPI final; US housing starts and building permits.

- Thursday: Japan trade balance; Australia employment, NAB quarterly business confidence; Swiss trade balance; Germany PPI; Eurozone current account; US jobless claims, Philly Fed survey, existing home sales, leading index.

- Friday: Japan CPI; UK Gfk consumer sentiment, retail sales; Canada retail sales, new housing price index.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6326; (P) 1.6382; (R1) 1.6477; More…

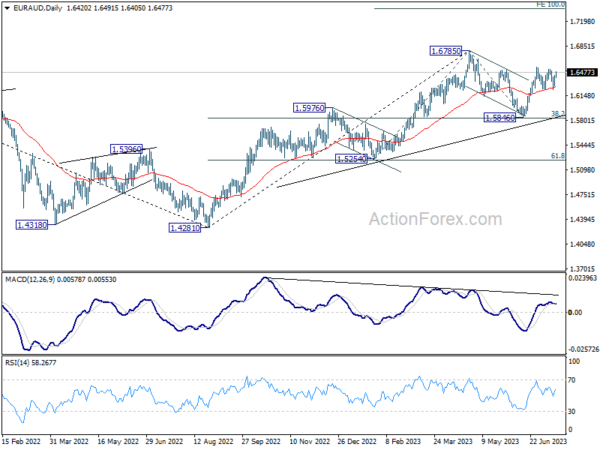

EUR/AUD rises notably today but stays below 1.6552 resistance. Intraday bias remains neutral at this point. Outlook is unchanged that correction from 1.6785 should have completed with three waves down to 1.5846. On the upside, break of 1.6552 will target a retest on 1.6785 high next. This will remain the favored case as long as 1.6231 support holds, even in case of another dip.

In the bigger picture, with 38.2% retracement of 1.4281 to 1.6785 at 1.5828 intact, rally from 1.4281 is still in progress. Firm break of 1.6785 will confirm rise resumption. Next target is 100% projection of 1.5254 to 1.6785 from 1.5846 at 1.7377. On the other hand, rejection by 1.6785 will extend the corrective pattern with another fall leg. But outlook will stay bullish as long as 1.5828 holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | CNY | GDP Y/Y Q2 | 6.30% | 7.10% | 4.50% | |

| 02:00 | CNY | Industrial Production Y/Y Jun | 4.40% | 2.60% | 3.50% | |

| 02:00 | CNY | Retail Sales Y/Y Jun | 3.10% | 3.40% | 12.70% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Jun | 3.80% | 3.40% | 4.00% | |

| 12:30 | USD | Empire State Manufacturing Index Jul | 0.0 | 6.6 | ||

| 12:30 | CAD | Wholesale Sales M/M May | 2.20% | -1.40% |