With mild risk aversion permeating the markets, Gold and some other commodities are weakening notably today. China’s latest economic indicators paint a dreary picture – a sluggish recovery, dampened consumer demand, record youth unemployment, and escalating deflation risk. With a key meeting of the Chinese Communist Party’s Politburo around the corner, all eyes are on the potential roll-out of substantial economic stimulus. Yet, market expectations remain modest for now.

The Swiss Franc is currently outperforming in the markets, followed closely by the Dollar and Euro. Conversely, Japanese Yen is showing signs of weakness as it continues to digest recent gains. Australian and New Zealand Dollars are languishing at the bottom of the performance list, with the British Pound hot on their heels.

Technically, Gold is trying to fall away from 38.2% retracement of 2062.95 to 1892.76 at 1957.77. Next focus is 55 4H EMA (now at 1940.07). Strong support from there will keep the rebound from 1892.76 alive. Sustained break of 1957.77 will pave the way to 61.8% retracement at 1997.93. Nevertheless, firm break of the EMA will argue that the rebound has completed and bring retest of 1892.76 low.

In Europe, at the time of writing, FTSE is down -0.26%. DAX is down -0.56%. CAC is down -1.22%. Germany 10-year yield is down -0.034 at 0.480. Earlier in Asia, Japan and Hong Kong markets were closed. China Shanghai SSE dropped -0.87%. Singapore Strait Times rose 0.18%.

US Empire State Manufacturing fell to 1.1, waning optimism and moderating price increases

US Empire State Manufacturing Survey showed a decline in the headline general business conditions index, falling from 6.6 to a modest 1.1 in July, slightly above expectation of 0.0. While 29% of respondents reported improved conditions over the month, 27% reported a deterioration.

Price increases showed a moderating trend. Prices paid index fell -5 pts to 16.7, and prices received index also declined by -5 pts to 3.9. Over the past year, the prices paid index has seen a near-50 point drop, while the prices received index has cumulatively fallen by -27 points.

On the other hand, index for future business conditions declined from 18.9 to 14.3, signaling that although businesses are anticipating better conditions ahead, overall optimism remains relatively subdued.

Bundesbank: German inflation to cool post Sep, but core to stay high

Bundesbank, in its monthly report, anticipates a dip in Germany’s inflation rate starting from September. One-off effects, such as the temporary introduction of the “tank discount” and nine-euro ticket, are expected to fade, easing the inflationary pressure.

The Bundesbank also envisions that the recent decrease in prices for primary products will progressively reflect in consumer costs, adding to the deflationary forces.

Contrarily, core inflation rat is projected to remain substantially high over the summer months. The summer season typically witnesses elevated prices for holidays packages, and this year is expected to be no different.

China’s annual GDP growth missed expectations, youth unemployment hit new record

China’s Q2 GDP growth rose by 6.3% yoy, an improvement from Q1’s 4.5% but fell short of expectation 7.1% yoy. On a quarter-to-quarter basis, GDP grew by 0.8%, deceleration from the previous quarter’s 2.2% but still outpacing projected 0.5%.

Despite being the fastest annual pace since Q2 2021, this performance appears skewed due to low base effect from last year’s lockdown. For H1 as a whole, GDP expanded by 5.5% when compared to the same period last. This growth outperformed the government’s modest target of approximately 5% for the year.

Other figures published by the National Bureau of Statistics on Monday painted a mixed picture. In June, retail sales increased by 3.1% yoy, falling short of the expected 3.5% and down significantly from May’s 12.7% growth. On a brighter note, industrial production, reflecting activity in manufacturing, mining, and utilities sectors, surged by 4.4% yoy last month, a jump from May’s 3.5% and surpassing expectations of 2.6%.

Fixed-asset investment, traditionally used to bolster growth, rose by 3.8% yoy in the first half of 2023, a slowdown from the 4% increase witnessed in the first five months. However, this growth exceeded the expected 3.4%.

In terms of employment, the picture appears bleak for the younger generation. Unemployment rate for those aged 16-24 reached a record 21.3% in June, up from 20.8% in May. Conversely, overall urban surveyed jobless rate remained static at 5.2% last month.

In a separate announcement, PBoC maintained the rate on CNY 103B worth of one-year medium-term lending facility loans to some financial institutions at 2.65%.

Oil and Copper slide after China concerns

The release of disappointing Chinese economic data earlier today has cast a shadow on global sentiment, instigating downturns in oil and copper prices, as well as European indices and US futures.

WTI crude oil experienced a fleeting rebound following a Reuters news alert suggesting that Saudi Arabia was extending voluntary output cut. However, the news alert was withdrawn shortly after, as it merely echoed an earlier report from June 4. Now, WTI prices are being pressured lower amid concerns over domestic demand in China and the partial restart of Libyan production that had been previously halted.

Technically, near term bias is neutral in WTI after a top was formed at 77.22, ahead of 100% projection of 63.37 to 74.74 from 66.94 at 78.1. While the stay above 55 D EMA is a near term bullish sign, i cannot be ruled out that rebound from 63.37 is merely a corrective bounce. Break of 72.57 support will argue that the rebound have completed and target 63.67 and possibly below. Nevertheless, firm break of 78.01 will add another evidence for trend reversal and target 83.46.

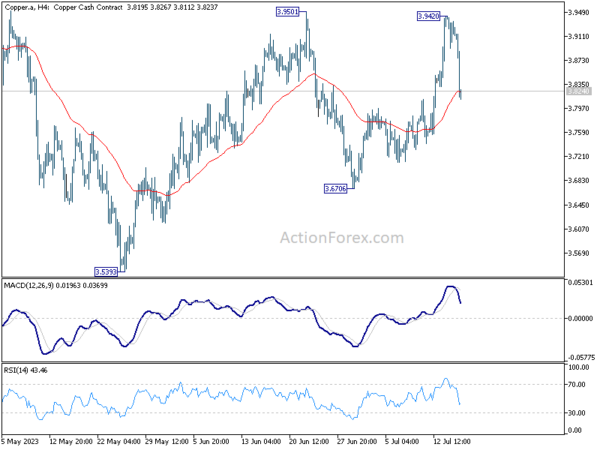

Copper, a commodity particularly sensitive to Chinese data, also felt the pinch. Rejection by 3.9501 resistance keep near term outlook neutral for now. While prior break of 55 D EMA is a bullish sign, upside is capped below falling trend line resistance (from 4.3556). On the upside, break of 3.9501 will resume the rebound from 3.5393 and argues that whole fall form 4.3556 has finished. However, break of 3.6706 would indicate that fall from 4.3556 is ready to resume through 3.5395.

EUR/USD Mid-Day Outlook

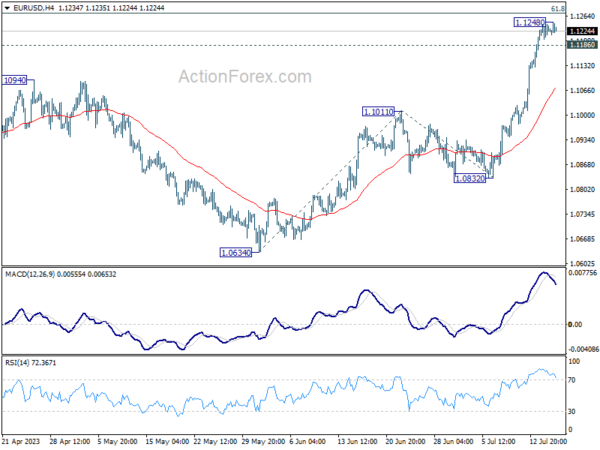

Daily Pivots: (S1) 1.1207; (P) 1.1226; (R1) 1.1248; More…

Intraday bias in EUR/USD is turned neutral with extended loss of upside momentum as seen in 4 H MACD. While further rise cannot be ruled out, upside should be limited by 1.1273 fibonacci level on first attempt. Break of 1.1186 minor support will bring deeper pull back first. Nevertheless, sustained break of 1.1273 will extend larger up trend to 161.8% projection of 1.0634 to 1.1011 from 1.0832 at 1.1442 next.

In the bigger picture, as rise from 0.9534 extends, focus is now on 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next. Meanwhile, outlook will continue to stay bullish as long as 1.0832 support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | CNY | GDP Y/Y Q2 | 6.30% | 7.10% | 4.50% | |

| 02:00 | CNY | Industrial Production Y/Y Jun | 4.40% | 2.60% | 3.50% | |

| 02:00 | CNY | Retail Sales Y/Y Jun | 3.10% | 3.40% | 12.70% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Jun | 3.80% | 3.40% | 4.00% | |

| 12:30 | USD | Empire State Manufacturing Index Jul | 1.1 | 0 | 6.6 | |

| 12:30 | CAD | Wholesale Sales M/M May | 3.50% | 2.20% | -1.40% |