Dollar’s extended selloff continues today, showing no clear signs of a turnaround. The slump comes on the back of the release of PPI and jobless claims data, which failed to inspire optimism among Dollar bulls. Meanwhile, global risk-on sentiment is prevailing, with noticeable rally in stock markets and corresponding dip in treasury yields. Japanese Yen is following behind the greenback as the second weakest currency, retracing its recent rally against other major currencies.

Contrasting the plight of Dollar, Aussie emerges as the standout performer of the day, with upside acceleration. It’s is riding on the coattails of a robust rebound in copper prices, and seemingly undeterred by dismal China trade data. New Zealand Dollar, while trailing Aussie, holds its position as the second strongest currency of the day, although Canadian Dollar languishes. European majors are presenting a mixed bag, but Swiss Franc is still holding the position as the top performer for the week.

Technically, Copper’s strong rally this week argues that pull back from 3.9501 has completed at 3.6706. Retest of 3.9501 should be seen in the near term. Firm break there will firstly confirm resumption of the rise from 3.5393. Secondly, that should solidify the case that fall from 4.3556 has completed with three waves down to 3.5393. With this as background, rise from 3.5393 should extend to 4.1743/3556 resistance zone, even as the second leg of a medium term corrective pattern. If released, the move should be accompanied by AUD/USD’s rally towards 0.7156 resistance.

In Europe, at the time of writing, FTSE is up 0.36%. DAX is up 0.73%. CAC is up 0.87%. Germany 10-year yield is down -0.1044 at 2.443. Earlier in Asia, Nikkei rose 1.49%. Hong Kong HSI rose 2.60%. China Shanghai SSE rose 1.26%. Singapore Strait Times rose 1.99%. Japan 10-year JGB yield dropped -0.0112 to 0.468.

US initial jobless claims fell to 237k, better than expectation

US initial jobless claims dropped -12k to 237k in the week ending July 8, below expectation of 250k. Four-week moving average of initial claims dropped -7k to -247k.

Continuing claims rose 11k to 1729k in the week ending July 1. Four-week moving average dropped -11k to -1735k.

US PPI up 0.1% mom, 0.1% yoy in Jun

US PPI for final demand rose 0.1% mom in June, below expectation of 0.2% mom. Services prices rose 0.2% mom while goods prices were unchanged. PPI less foods, energy and trade services rose 0.1% mom.

For the 12 month period, PPI slowed from 0.9% yoy to 0.1% yoy, below expectation of 0.4% yoy. PPI less foods, energy, and trade services rose 2.6% yoy.

ECB accounts: Preference initial expressed for 50bps hike

ECB’s account of its June meeting revealed a wide consensus in favor of a 25 bps rate hike. Interestingly, the minutes also noted an initial preference for an even steeper hike of 50 basis points.

“A preference was also initially expressed for raising the key ECB interest rates by 50 basis points in view of the risk of high inflation becoming more persistent,” the minutes noted.

However, the adopted “data-dependent, meeting-by-meeting approach” and uncertainties in the global economic landscape resulted in the final decision for a 25bps increment.

Meanwhile, the account noted, “Emphasis was put on the need to be sufficiently restrictive and persistent in the monetary policy tightening.”

It’s crucial, as per ECB’s narrative, to convey that their monetary policy still has a long way to go to bring inflation back to the target in a timely manner.

The meeting minutes convey this message clearly, stating, “It was seen as essential to communicate that monetary policy had still more ground to cover to bring inflation back to target in a timely manner.”

Eurozone industrial production rose 0.2% mom in May, EU up 0.1% mom

Eurozone industrial production rose 0.2% mom in May, below expectation of 0.3% mom. Production of capital goods grew by 1.0%, intermediate goods and durable consumer goods both by 0.5% and non-durable consumer goods by 0.3%, while production of energy fell by -1.1%.

EU industrial production rose 0.1% mom. Among Member States for which data are available, the highest monthly increases were registered in Slovenia (+7.9%), Croatia (+4.3%), Slovakia and Finland (both +2.5%). The largest decreases were observed in Ireland (-4.9%), Lithuania (-2.8%), Romania and Belgium (both -1.2%).

UK GDP contracts -0.1% mom, production a main contributor

UK GDP contracted by -0.1% mom in May, slightly better than expectation of -0.3% mom contraction. However, taking a wider view, GDP showed stagnation over the three months to May. The contraction in May was largely due to a decrease in production output by -0.6% mom, contributing significantly to the overall GDP decline. In contrast, services output remained stagnant while construction output dipped by -0.2% mom.

ONS shed light on the situation, attributing part of the contraction to additional bank holiday for King Charles III’s coronation on 8th May, which impacted a variety of manufacturing industries and construction businesses. On the brighter side, arts, entertainment, and recreation sector reported benefiting from the extra bank holiday.

The ONS report also highlighted that sectors such as health (specifically nursing), rail network, education, and civil service all saw industrial action take place in May 2023. Such strikes played a part in the month’s economic movements.

Also released, industrial production came in at -0.6% mom, -2.3% yoy, versus expectation of -0.4% mom, -2.3% yoy. Manufacturing production was at -0.2% mom, -1.2% yoy, versus expectation of -0.5% mom, -1.7% yoy. Goods trade deficit widened from GBP -14.6B to GBP -18.7B, larger than expectation of GBP -14.6B.

NIESR: With bank rate at 5% UK growth to be anaemic at best

NIESR forecasts a stagnation in UK’s GDP growth in Q2, suggesting that the trend of low economic growth will continue for the foreseeable future.

Paula Bejarano Carbo, an Associate Economist at NIESR, pointed out the influence of the current high Bank Rate, stating, “With the Bank Rate now at 5 per cent, suppressing demand, UK growth will continue to be anaemic at best in the coming months.”

The lingering effects of inflation, which is expected to remain high, are predicted to put a strain on household budgets, and in turn, restrain near-term demand. The high cost of borrowing is another contributing factor that is likely to impact consumer spending and growth.

The think tank indicated that these circumstances might particularly impact the service sector. It warned that service-sector output may continue to stumble, dragging down overall GDP in the upcoming months.

NIESR’s analysis further emphasized that the risks associated with GDP appear to be tilted towards the downside at the moment, due to persisting economic pressures.

NZ BNZ PMI fell to 47.5, sector remains entrenched in contraction

New Zealand’s manufacturing sector is experiencing a continuous contraction according to BusinessNZ Performance of Manufacturing Index. The Index showed a drop from 48.7 in May to 47.5 in June, marking another month of activity below the crucial 50.0 point mark which separates expansion from contraction.

An analysis of the sub-indices revealed mixed performances across different facets of the sector. While production showed a modest rise from 46.0 to 47.5, new orders experienced a significant drop from 50.2 to 43.8. Meanwhile, employment levels decreased from 49.3 to 47.0. Both finished stocks and deliveries saw rises, from 51.6 to 52.2 and 46.1 to 50.5 respectively.

Alongside this contraction in activity, the report noted an increase in negative sentiment among manufacturers. In June, the proportion of negative comments increased to 74.5%, up from 66.7% in May and 70.3% in April. According to manufacturers, the primary negative influences on current activity are declining demand, inflationary pressures, and issues surrounding production and staffing.

BusinessNZ’s Director, Advocacy Catherine Beard, pointed out the persisting contraction in the sector, saying, “the sector remains entrenched in contraction, with eight of the last ten months showing overall activity below the 50.0 point mark.”

China’s exports down -12.4% yoy in Jun, imports down -6.8% yoy

China’s trade dynamics in June spun a story of steeper than expected declines on both the import and export front. With the largest export drop since February 2020.

June’s figures reveal a -12.4% yoy slump in China’s exports, far exceeding anticipated -9.5% yoy decline and outpacing May’s -7.5% yoy drop. Imports followed a similar pattern, decreasing by -6.8% yoy, steeper fall than projected 4.0% and more significant contraction than May’s -4.5% yoy shrinkage.

Despite these challenges, China’s trade surplus managed to grow from USD 68.1B to USD 70.62B. However, this increase didn’t quite hit expectation of a USD 74.8B surplus.

Lu Daliang, a spokesperson for China’s customs bureau, cautioned that the nation’s trade is expected to face substantial pressure in the second half of the year. During a press conference, Lu attributed these pressures to high inflation in developed countries and geopolitical issues.

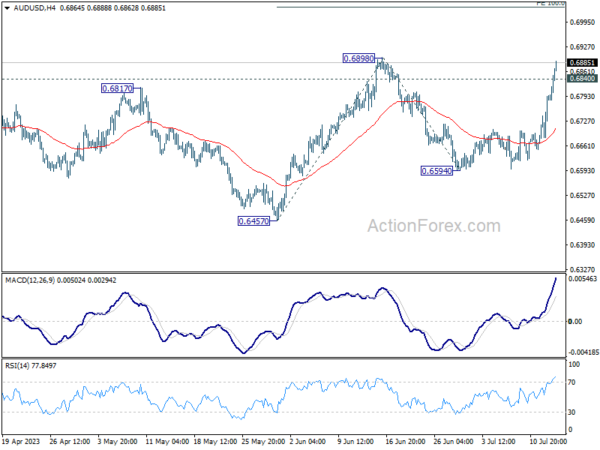

AUD/USD Mid-Day Report

Daily Pivots: (S1) 0.6714; (P) 0.6755; (R1) 0.6829; More…

AUD/USD’s rally accelerates to as high as 0.6888 so far today. Intraday bias stays on the upside at this point. Decisive break of 0.6898 resistance will firstly confirm resumption of rise from 0.6457. Secondly, that should also confirm completion of the fall from 0.7156 at 0.6457. Next target will be 100% projection of 0.6457 to 0.6898 from 0.6594 at 0.7035, and then 0.7156 resistance. On the downside, however, below 0.6840 minor support will turn intraday bias neutral first.

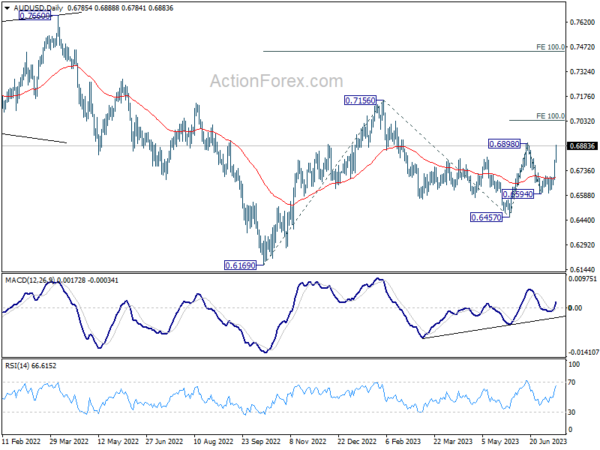

In the bigger picture, price actions from 0.7156 are seen as a correction to the rebound from 0.6169 (2022 low). Break of 0.6898 resistance will argue that rise from 0.6169 is ready to resume through 0.7156. Next target will be 100% projection of 0.6169 to 0.7156 from 0.6457 at 0.7444. For now, this will be the favored case as long as 55 D EMA (now at 0.6697) holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Jun | 47.5 | 48.9 | 48.7 | |

| 23:01 | GBP | RICS Housing Price Balance Jun | -46% | -30% | ||

| 01:00 | AUD | Consumer Inflation Expectations Jul | 5.20% | 5.20% | ||

| 03:00 | CNY | Trade Balance (USD) Jun | 70.6B | 74.0B | 65.8B | |

| 06:00 | GBP | GDP M/M May | -0.10% | -0.30% | 0.20% | |

| 06:00 | GBP | Industrial Production M/M May | -0.60% | -0.40% | -0.30% | -0.20% |

| 06:00 | GBP | Industrial Production Y/Y May | -2.30% | -2.30% | -1.90% | -1.60% |

| 06:00 | GBP | Manufacturing Production M/M May | -0.20% | -0.50% | -0.30% | -0.10% |

| 06:00 | GBP | Manufacturing Production Y/Y May | -1.20% | -1.70% | -0.90% | -0.60% |

| 06:00 | GBP | Goods Trade Balance (GBP) May | -18.7B | -14.6B | -15.0B | -14.6B |

| 09:00 | EUR | Eurozone Industrial Production M/M May | 0.20% | 0.30% | 1.00% | |

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:30 | USD | PPI M/M Jun | 0.10% | 0.20% | -0.30% | -0.40% |

| 12:30 | USD | PPI Y/Y Jun | 0.10% | 0.40% | 1.10% | 0.90% |

| 12:30 | USD | PPI Core M/M Jun | 0.10% | 0.20% | 0.20% | 0.10% |

| 12:30 | USD | PPI Core Y/Y Jun | 2.40% | 2.60% | 2.80% | |

| 12:30 | USD | Initial Jobless Claims (Jul 7) | 237K | 250K | 248K | 249K |

| 14:30 | USD | Natural Gas Storage | 49B | 72B |