Dollar’s decline accelerates again following US inflation data that reflected a more substantial than anticipated slowing in both core and headline CPI for June. Although the underwhelming data might not deter Fed from delivering another rate hike later this month, it may alleviate pressure for subsequent increases.

In response to the data, US stock futures appear to be on an upward trajectory, while 10-year yield is continuing its near term pull back. Correspondingly, gold is seeing a solid rally, propelled by greenback’s weakness.

For now, Yen appears to be the biggest beneficiary, maintaining its position as the strongest currency. Hot on its heels is Euro, but Sterling is currently floundering, ranking as the second weakest next to Dollar. Australian and New Zealand Dollars have also gained strength following Euro, although Canadian Dollar remains steady as traders adopt a cautious approach in anticipation of BoC’s imminent interest rate decision.

Technically, Gold’s rebound is also accelerating as seen in 4H MACD. Next focus is 38.2% retracement of 2062.95 to 1892.76 at 1957.77. Firm break there will pave the way to 61.8% retracement at 1997.93, with prospect of at least a test on 2000 psychological level.

In Europe, at the time of writing, FTSE is up 1.62%. DAX is up 1.20%. CAC is up 1.08%. Germany 10-year yield is down -0.0459 at 2.607. Earlier in Asia, Nikkei dropped -0.81%. Hong Kong HSI rose 1.08%. China Shanghai SSE dropped -0.78%. Singapore Strait Times rose 0.36%. Japan 10-year JGB yield rose 0.0239 to 0.480.

US CPI slowed to 3% yoy in Jun, core CPI down to 4.8% yoy, both below exp

US CPI rose 0.2% mom in June, below expectation of 0.3% mom. CPI core (all items less food and energy) rose 0.2% mom, below expectation of 0.3% mom, the smallest 1-month increase since August 2021. Food index rose 0.1% mom while energy index rose 0.6% mom.

Over the last 12 months, CPI slowed from 4.0% yoy to 3.0% yoy, below expectation of 3.1% yoy. That’s the lowest reading since March 2021. Core CPI slowed from 5.3% yoy to 4.8% yoy, below expectation of 5.0% yoy. Energy index was down -16.7% yoy while food index was up 5.7% yoy.

RBNZ holds OCR steady at 5.5%, expresses confidence in returning inflation to target range

In line with broad expectations, RBNZ keeps OCR unchanged at 5.5%, as tightening cycle has finally entered in to a pause phase.

RBNZ expressed its confidence in the current restrictive interest rate level, stating, “consumer price inflation will return to within its target range of 1 to 3% per annum, while supporting maximum sustainable employment.”

When discussing their Remit objectives, the Committee noted that it still expects inflation to fall within the target band by the second half of 2024. Risks surrounding the inflation projection as being “broadly balanced”. While employment remains above its maximum sustainable level, recent indicators suggest that “labour market conditions are easing.”

RBNZ also acknowledged the slight contraction in economic activity in Q1. It added that “growth is likely to remain weak in the near term.”

RBA Lowe: Further tightening possible, look into new forecasts in Aug

RBA Governor Philip Lowe noted the current economic outlook is a “complex picture” with significant uncertainties”. He said in a speech today, “the Board decided that, having already increased rates substantially, it was appropriate to hold interest rates steady this month and re-examine the situation next month.”

Looking ahead, Lowe noted, “It is possible that some further tightening will be required to return inflation to target within a reasonable timeframe,” adding that requirement for further action will largely depend on evolution of the economy and inflation.

He highlighted that the Board will be provided with an updated set of economic forecasts, a revised risk assessment, and fresh data on inflation, the global economy, labour market, and household spending at the next meeting in August to inform its decision-making process.

He pointed to recent forecasts in May which saw inflation returning to top of target band in “mid-2025:. But he acknowledge, Data received since then had suggested that the inflation risks had shifted somewhat to the upside.”

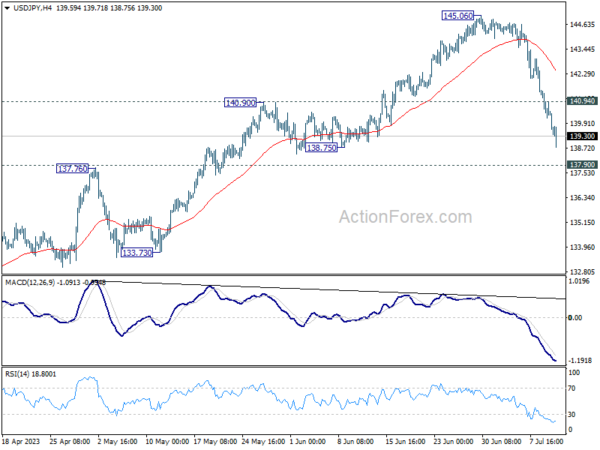

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 139.86; (P) 140.66; (R1) 141.16; More…

USD/JPY reaches as low as 138.75 so far today as fall from 145.06 continues today. Next target is 137.90 resistance turned support. Decisive break there will confirm the larger bearish case. On the upside, above 142.06 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another fall.

In the bigger picture, current downside acceleration, as seen in daily MACD, argues that fall from 145.06 is already the third leg of the corrective pattern from 151.93 (2022 high). Sustained break of 137.90 resistance turned support should confirm this case and target 127.20 (2023 low) and below. For now, this will remain the favored case as long as 145.06 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Jun | 4.10% | 4.50% | 5.10% | 5.20% |

| 23:50 | JPY | Machinery Orders M/M May | -7.60% | 1.20% | 5.50% | |

| 02:00 | NZD | RBNZ Interest Rate Decision | 5.50% | 5.50% | 5.50% | |

| 12:30 | USD | CPI M/M Jun | 0.20% | 0.30% | 0.10% | |

| 12:30 | USD | CPI Y/Y Jun | 3.00% | 3.10% | 4.00% | |

| 12:30 | USD | CPI Core M/M Jun | 0.20% | 0.30% | 0.40% | |

| 12:30 | USD | CPI Core Y/Y Jun | 4.80% | 5.00% | 5.30% | |

| 14:00 | CAD | BoC Interest Rate Decision | 5.00% | 4.75% | ||

| 14:30 | USD | Crude Oil Inventories | -1.1M | -1.5M | ||

| 15:00 | CAD | BoC Press Conference | ||||

| 18:00 | USD | Fed’s Beige Book |