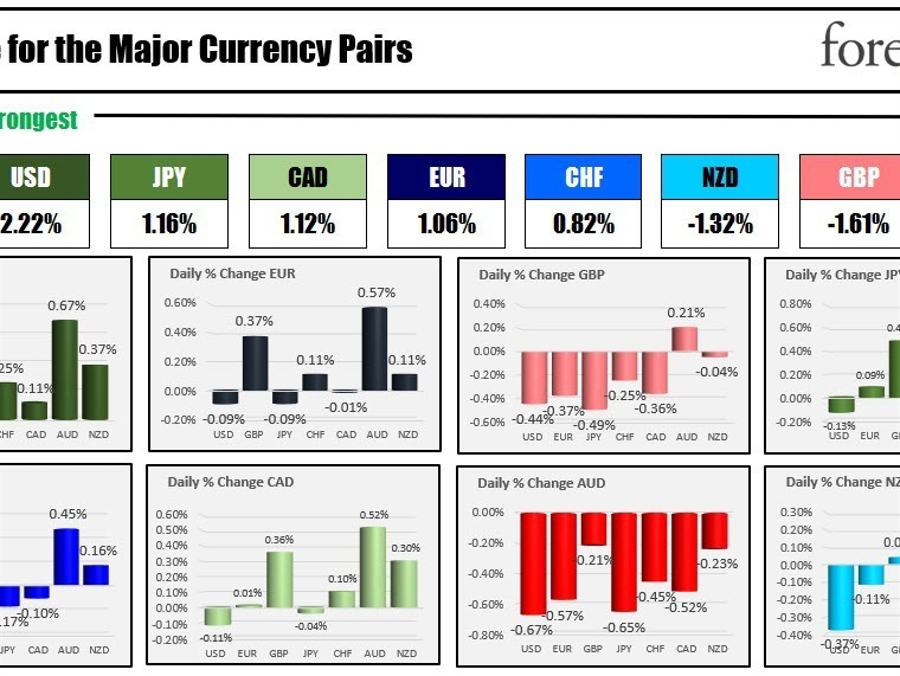

The strongest to the weakest of the major currencies

The USD is the strongest and the AUD is the weakest as the North American session begins.

Overnight, in June, China experienced its most significant drop in factory-gate prices in over seven years, and consumer prices neared deflation, signaling a slowdown in the world’s second-largest economy. Data from the National Bureau of Statistics showed that producer prices fell by -5.4% on an annual basis last month, exceeding analysts’ predictions of a -5.0% decrease. This was due to weakening domestic and foreign demand. Furthermore, the consumer price index remained unchanged year-on-year because of rapidly declining pork prices. This sluggish growth rate, the slowest since 2021, has fueled speculation that China’s central bank will continue to cut interest rates and introduce new stimulus measures to invigorate the country’s post-pandemic recovery.

- US Treasury Sec returned from China and called meetings “constructive”. The visit included 10 hours of talks with significant figures in Chinese finance and politics and was seen as an important step in maintaining a fragile stability. Both the U.S. and Chinese governments plan further talks to ease tensions, despite ongoing differences, especially concerning trade and tariffs.

- Just before Yellen’s arrival, China’s Commerce Ministry announced impending export controls on two metals used in semiconductor manufacturing.

- Yellen confirmed that the U.S. is considering investment restrictions on high-end Chinese tech, but any such measures would be “very narrowly targeted”.

- Yellen’s visit aims to prevent escalations and misunderstandings due to a lack of contact between U.S. and Chinese senior officials.

Meanwhile, the key events for this week’s economic agenda are the US CPI inflation figures on Wednesday and the second-quarter earnings from large U.S. banks (on Friday). The June consumer price index of the U.S. is predicted to rise by 3.1% annually, which would mark the slowest increase since March 2021, and to accelerate by 0.3% on a monthly basis. Similarly, the core reading is expected at 5.0% annually and 0.3% monthly, numbers that are likely to influence Federal Reserve policymakers who have been focusing on managing high inflation.

The US stock market is facing a crucial test as YES….the quarterly earnings season starts up at the end of the week (it seems like yesterday the last quarter earnings were over). Investors are set to evaluate whether stocks can sustain their rally despite weaker corporate profits. Analysts predict that S&P 500 companies will post a third consecutive quarter of declining profits due to persistent inflation, strained consumer demand, and the Federal Reserve’s interest rate hikes.

This week’s earnings results from JPMorgan Chase, Citigroup, Delta Air Lines, and PepsiCo will kick off the season on Friday. There are concerns over companies’ ability to maintain profits by passing on elevated costs to consumers, who have already endured numerous price hikes. This comes as the second-quarter revenue of S&P 500 companies is projected to have dropped 0.3% from the previous year, marking the first sales decline since the third quarter of 2020.

Speaking of Citi, they downgraded US stocks and made other adjustments to their other global stock market projections:

- For US equities they moved from “overweight” to “neutral”, as a consequence of their recent solid performance and impending recession risks.

- They scaled down their rating of global tech stocks due to potential vulnerabilities in large growth companies but has plans to invest in these stocks if their prices decrease.

- They showed a preference for investment in growing sectors and selective cyclical industries, hence elevating their stance on the Materials and Industrial sectors.

- At a regional level, Europe’s rating has been elevated to “overweight”, given it’s significantly cheaper in comparison to the US and stands to gain from a weaker USD and prospective Chinese stimulus.

- UK stocks were lowered to a “neutral” stance, resulting from insufficient exposure to growth companies and potential adverse impacts from a stronger GBP.

- Emerging markets have been upgraded to “overweight”, attributed to an enticing risk/reward profile that incorporates growth and materials.

- A slight deceleration in EPS is anticipated, and not an outright recession.

- They identify balanced risks in the outlook, inclusive of potential “soft landing” scenarios. Notwithstanding, stringent credit conditions and central bank liquidity are flagged as significant obstacles.

US stock prices are now trading mixed in pre-market trading. US debt market is also mixed with the shorter end lower and the longer end tilting to the upside.

Oil prices slipped on Monday as the weak Chinese inflation data sparked fresh worries over the nascent economic recovery of the world’s largest crude importer.

A snapshot of the markets currently shows:

- Crude oil is trading down -$0.52 or -0.72% at $73.32

- Spot gold is trading down -$1.00 or -0.06% at $1923.80

- Silver is trading unchanged at $23.05

- Bitcoin is trading steady at $30209. The high over the weekend reached $39439. The low today reached $29964

In the premarket for US stocks, the major indices are trading mixed. On Friday, selling into the close, sent the major indices lower

- Dow Industrial Average is trading up 35 points after Friday’s -187.3 point decline

- S&P index is trading down -0.45 points after Friday’s -12.64 point decline

- NASDAQ index is trading down 13.25 points after Friday’s -18.33 point decline

In the European equity markets, the major indices are trading higher.

- German DAX is up 0.60%

- France’s CAC is up 0.67%

- UK’s FTSE 100 is up 0.44%

- Spain’s Ibex is up 0.18%

- Italy’s FTSE MIB up 0.61% (delayed).

In the Asian Pacific market today, markets closed mixed

- Japan’s Nikkei fell -0.61%

- Australia’s S&P/ASX 200 fell -0.54%

- China’s Shanghai composite index rose 0.22%

- Hong Kong’s Hang Seng index rose 0.62%

In the US debt market, yields are mixed

- 2-year yield 4.906%, -2.5 basis points

- 5-year yield 4.312%, -2.3 basis points

- 10-year yield 4.045%, -0.4 basis points basis points basis points

- 30-year yield 4.047%, +1.2 basis points

In the European debt market, benchmark 10-year yields are mixed/modestly changed: