Dollar recovers mildly during today’s Asian trading session but remains generally weak. Concurrently, Japanese Yen has begun to pare back some of its late rally from last week, but there is no sign of sustained selling. Risk markets are showing a mixed performance, reacting minimally to China’s data that indicate escalating deflation risks.

Notably, the majority of major currency pairs stays bounded within Friday’s range, with New Zealand Dollar being an exception. Kiwi appears to be softening slightly as market anticipates RBNZ to maintain its current policy rate later in the week. Conversely, Canadian Dollar is experiencing a slight firming, buoyed by rise in oil prices and anticipated BoC rate hike. Meanwhile, European majors show no clear direction as of now.

Technically, WTI crude oil’s break of 72.57 resistance suggests that triangle consolidation from 74.74 has possibly completed at 66.94 already. Further rise is now in favor to 74.74 resistance first. Firm break there will target 100% projection 63.67 to 74.74 from 66.94 at 78.01. It’s too early to talk about larger bullish trend reversal in oil. So, focuses will be on topping signal around 78.01 projection level.

In Asia, at the time of writing, Nikkei is down -0.14%. Hong Kong HSI is up 0.75%. China Shanghai SSE is up 0.15%. Singapore Strait Times is up 0.34%. Japan 10-year JGB yield is up 0.0333 at 0.470.

China’s PPI down -5.4% yoy, CPI flat in Jun

China’s factory-gate inflation, as measured by PPI, marked its ninth consecutive decline in June, slumping by -5.4% yoy. This drop is the steepest since December 2015 and outstripped -4.6% yoy in May, a well as expectation of -5.0 yoy. PPI fell -0.8% on a month-on-month basis in June, slightly less than the -0.9% mom fall registered in May.

National Bureau of Statistics statistician Dong Lijuan pointed to tumbling commodity prices, particularly oil and coal, as the driving force behind the slump in factory-gate prices. The comparison to high base figures from the previous year also played a role in the significant drop.

Additionally, China’s CPI continued to lose momentum, sliding from 0.2% yoy in May to 0.0% yoy in June, its lowest reading since February 2021. This downturn defied expectations of a 0.2% yoy. On a month-on-month basis, June’s CPI mirrored the previous month, dipping by -0.2%.

Analysing the CPI’s components, core CPI, which excludes volatile food and energy prices, showed a tempered 0.4% yoy rise, compared to 0.6% yoy in May. Food prices accelerated by 2.3% yoya leap from May’s 1.0% yoy increase, while non-food prices moved in the opposite direction, falling by -0.6% yoy in contrast to a flat performance in May.

The sustained descent in PPI, coupled with lackluster CPI, underlines the ongoing deflationary pressures in China’s economy.

ECB Villeroy said rates nearing a high plateau

Speaking at a conference in Aix-en-Provence, France, ECB Governing Council member Francois Villeroy de Galhau stated that Eurozone was nearing the “high point” of interest rates, a level expected to be sustained to allow full transmission of monetary policy effects.

Villeroy added, “But when I say high point this isn’t a peak, rather it will be a high plateau, on which we will have to remain for a sufficiently long time to fully transmit all the effects of monetary policy.”

Joining him on the panel was fellow Governing Council member Mario Centeno, who underlined ECB’s focus on headline inflation, noting its more rapid than anticipated decrease. However, he also highlighted the importance of core inflation, which he acknowledged was not dropping as swiftly.

Centeno stressed, “We target headline inflation, that’s very important. And headline inflation is coming down, actually it’s coming down faster than the way up.”

Centeno went on to add, “Core inflation stands out as a very important indicator. It’s not coming down as fast as headline inflation, but we also need to remember that in the way up it played exactly the same trajectory. So we need to remain confident too in the way we are fighting inflation.”

RBNZ to hold steady, BoC to thread forward; US inflation, UK GDP, and more…

This week presents a significant blend of international central bank activities and key economic indicators. On the monetary policy front, the anticipated pause by RBNZ and BoC hike will be complemented by release of Fed’s Beige Book and ECB minutes. In addition, the release of inflation data from the US, as well as GDP and employment figures from the UK, will also be integral to the unfolding developments in the markets.

RBNZ is widely anticipated to maintain its interest rates unchanged at 5.50% this week, drawing the curtains on its 20-month tightening cycle. Following its May decision, which saw a 25bps rise in OCR approved by a 5-2 vote, economists interpret the statement as a shift by the central bank into a “wait and see mode.” Consensus amongst the country’s leading banks – ANZ, ASB, Bank of New Zealand, Kiwibank, and Westpac – aligns with the market’s expectation of no rate changes this round. Meanwhile, RBNZ is anticipated to reiterate its reluctance to initiate interest rate cuts any time in the near future.

In contrast, BoC is expected to forge ahead with its recently resumed tightening cycle, hiking interest rates by 25bps to 5.00%. While some analysts forecast a pause post-July, the trajectory beyond remains hazy. The central bank’s preferred CPI trim and median still linger at high levels, and the pace at which they’ll decelerate is uncertain. As a result, market will keenly parse BoC’s guidance for indications of its confidence post-rate hike.

In other central bank activities, ECB will publish accounts of June monetary policy meeting. The details shouldn’t deviate from recently repeated messages that another rate hike is there to be delivered this month. The case for September is uncertain and will be data-dependent. Meanwhile, Fed will also release Beige Book economic report.

On the data front, much focus will be on US CPI and PPI, and on whether they would support two or more Fed hikes this year as the “strong majority” of FOMC members anticipated. UK GDP and employment data will prove crucial amidst rising concerns about hard landing due to BoE extension of its tightening efforts to curb inflation. There are talks that BoE rate could hit as high as 7%. Observers are also keeping a keen eye on Germany’s ZEW economic sentiment, Australia’s Westpac consumer sentiment and NAB business confidence, along with China’s CPI and PPI.

Here are some highlights for the week:

- Monday: Japan bank lending, current account; China CPI, PPI; Eurozone investor confidence.

- Tuesday: Australia Westpac consumer sentiment, NAB business confidence; Germany CPI final, ZEW economic sentiment; UK employment.

- Wednesday: RBNZ rate decision; Japan machine orders PPI; US CPI, Fed’s Beige Book; BoC rate decision.

- Thursday: New Zealand BNZ manufacturing; China trade balance; UK GDP, production, trade balance; Eurozone industrial production, ECB meeting accounts; US PPI, jobless claims.

- Friday: Swiss PPI; Eurozone trade balance; Canada manufacturing sales; US import prices, U of Michigan sentiment.

AUD/USD Daily Report

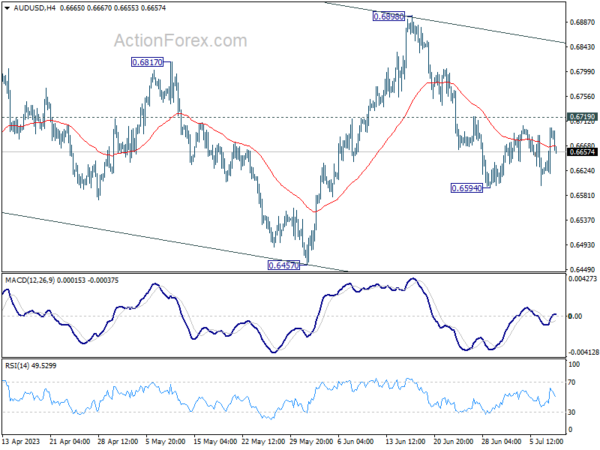

Daily Pivots: (S1) 0.6640; (P) 0.6671; (R1) 0.6723; More…

AUD/USD dips mildly today but stays inside established range above 0.6594. Intraday bias remains neutral for the moment. With 0.6710 resistance intact, further decline is in favor. On the downside, break of 0.6594 will resume the decline from 0.6898 to 0.6457 support next. Nevertheless, firm break of 0.6719 will turn bias back to the upside for stronger rebound.

In the bigger picture, price actions from 0.7156 are seen as a correction to the rebound from 0.6169 only, rather than part of larger down trend from 0.8006 (2021 high). Break of 0.6457 could cannot be ruled out but downside should be contained above 0.6169. Meanwhile, nevertheless, break of 0.6898 resistance will argue that rise from 0.6169 is ready to resume through 0.7156.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Jun | 3.20% | 3.50% | 3.40% | |

| 23:50 | JPY | Current Account (JPY) May | 1.70T | 1.87T | 1.90T | |

| 01:30 | CNY | CPI Y/Y Jun | 0.00% | 0.20% | 0.20% | |

| 01:30 | CNY | PPI Y/Y Jun | -5.40% | -5.00% | -4.60% | |

| 05:00 | JPY | Eco Watchers Survey: Outlook Jun | 53.6 | 54.8 | 55 | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Jul | -18.9 | -17 | ||

| 12:30 | CAD | Building Permits M/M May | 7.30% | -18.80% | ||

| 14:00 | USD | Wholesale Inventories May F | -0.10% | -0.10% |