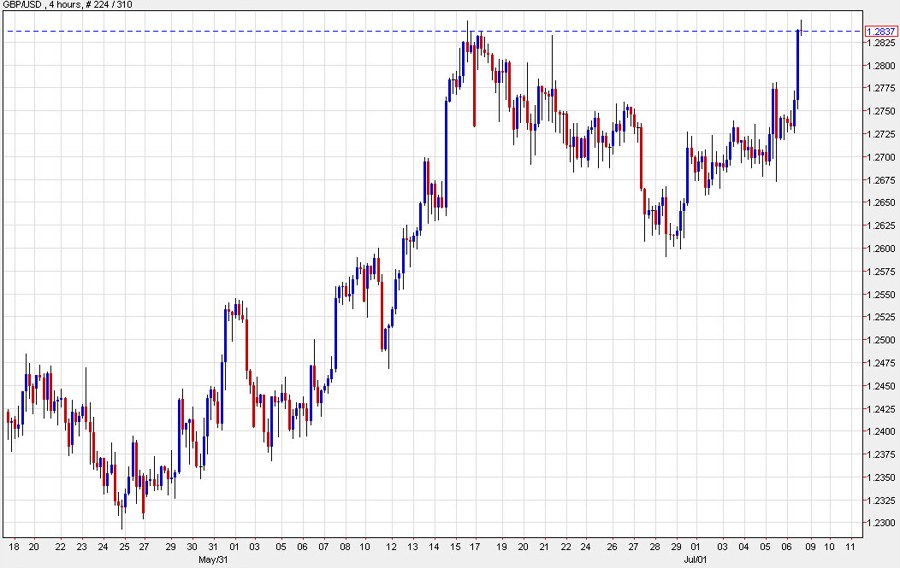

GBPUSD 4 hour chart

The pound has extended today’s day to 100 pips, touching 1.2848 in a late-week push. As the 4-hour chart above shows, buyers ran into the June high of 1.2848 exactly before backing off a few pips. The bulls may try to make another push late or in low liquidity at the Monday open in an attempt at a fresh 15-month high.

The pound is benefiting from a hawkish Bank of England and high inflation. I think ultimately this will prove to be playing with fire as some kind of accident happens if/when rates get to 6%. But for now it’s all about yield differentials and US dollar selling.

Some stops were already hit as 1.2800 gave way but with some real resistance above, the shorts have a good argument here.

Overall though, the US dollar is being sold hard in anticipation of next week’s CPI report. I also have to wonder if there are fears of Japanese intervention or a change from the BOJ as a factor.