The USD is ending the day as the strongest of the major currencies. The dollar gained in the Asian and early European trading, and then got another boost from the Fed minutes this afternoon.

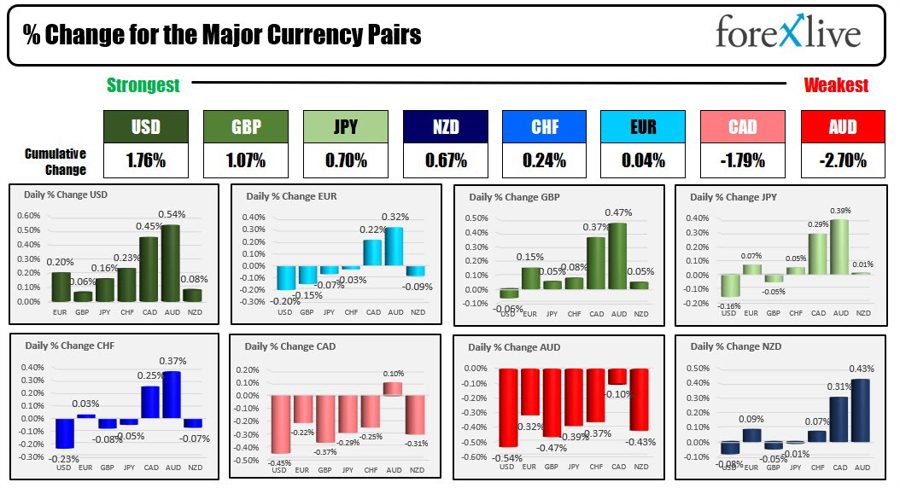

The strongest to weakest of the major currencies

At the June meeting, some Federal Reserve policymakers suggested they would have supported raising interest rates, despite the decision to leave them unchanged. According to the minutes released, several officials argued in favor of a rate increase due to stronger-than-expected economic activity and no clear signs of inflation returning to the Fed’s 2% target. Despite this, all 11 voting members of the Federal Open Market Committee agreed to maintain steady rates, given the rapid and high rate hikes in the past year. This was the first pause after 10 consecutive increases from March 2022, when rates were lifted from near zero. However, officials anticipated two more rate increases this year, as part of an effort to bring inflation down to the Fed’s target. Despite holding rates steady in June, Fed Chair Jerome Powell stated that greater economic resilience may necessitate continued rate increases. On inflation the minutes showed that:

- Inflation is viewed as unacceptably high.

- Declines in inflation have been slower than expected.

- Core goods inflation has moderated but slowed less rapidly than expected despite easing supply chain constraints.

- Some participants noted a recent moderation in housing services inflation and expected this trend to continue. However, a few pointed to upside risks in the same outlook.

Meanwhile, earlier today, US factory orders in May 2023 were softer than expected. The May 2023 numbers showed that orders increased by 0.3%, falling short of the expected 0.8% growth. This followed an upward trend, with orders rising in 5 of the past 6 months. However, there was a downward revision to April’s growth, from 0.4% to 0.3%. When excluding transportation, factory orders declined by 0.5%, a decrease from the previous month’s -0.2%, which was revised to -0.6%.

Regarding durable goods, orders increased by 1.8%, slightly above the preliminary estimate of 1.7% and higher than the previous month’s growth of 1.2%. Excluding defense, durable goods orders rose by 3.0%, an improvement from the previous month’s decrease of 0.5%. Durable goods orders excluding transportation also showed a positive trend with a 0.7% increase, an improvement from the prior month’s decrease of 0.6%. Nondefense capital goods excluding air also increased by 0.7%, compared to the prior month’s decrease of 0.2% (which was revised to -0.6%). The minutes suggested that soft defense orders are likely a timing issue and not indicative of economic weakness. However, the downward revision of the prior nondefense capital goods ex-air report is noteworthy. While the manufacturing sector appears soft due to the bullwhip effect, these numbers are not considered a significant disappointment. Inventory seems likely to drag again in the second quarter.

Looking at some of the major pairs,

- EURUSD: The EURUSD is closing near session lows at 1.0850. The current price is trading at 1.0854. The pair fell below the 38.2% of the move up from the end of May 2023 low at 1.08673. That area held support earlier in the day. A move back above that MA will be eyed in the new trading day as a close risk. Stay below is more bearish. Moving below a swing area between 1.0842 and 1.0848 would have traders targeting the 100-day moving average and 50% midpoint retracement from the May 31 low at 1.0823. I would expect risk-focused buyers near that level in the new trading day (with stops on a break below)

- GBPUSD: The GBPUSD fell back lower in the US session and in the process tested the 200-hour moving average at 1.26916. Support buyers came in against that level (and also the rising 100-hour moving average at 1.26851). The price is trading at 1.2702 going into the new trading day. It will take a move below the 100 and 200-hour moving averages in the new trading day to increase the bearish bias.

- AUDUSD: The AUDUSD did fall below its converged 100 and 200-hour moving averages near 0.6661. The price is trading at 0.6653 going into the close for the trading day. Traders will be watching the moving averages for resistance. If the price should move back above the 2 moving averages with momentum, I would expect sellers to turn back to buyers. Absent that, and the sellers are in control

- USDJPY: The USDJPY traded above and below both the 100-hour MA (currently at 144.55) and the lower 200-hour moving average currently at 144.214. The price is currently above both at 144.677 helped by the afternoon USD buying.

Take a look at other markets as the day comes to a close:

- Crude oil rose today as Saudi Arabia vowed to keep supply contained to keep the price of crude oil supported. The prices trading up $2.12 or 3.04% at $71.91

- Gold is reacting to the higher dollar and higher rates. Its prices is down $-10.16 or -0.52% at $1915.14

- Bitcoin is trading policy steady at $30,485. That is why say higher from the early US trading level at $30,428.

In the US stock market today, major indices moved lower:

- Dow industrial average fell -129.83 points or -0.38% at 34288.65

- S&P index fell -8.77 points or -0.20% at 4446.81

- NASDAQ index fell 25.13 points or -0.18% at 13791.64

In the US debt market, yields are higher with the longer end moving up the most:

- 2 year yield 4.948%, +0.9 basis points

- 5 year yield 4.249%, +6.2 basis points

- 10 year 3.933%, +7.6 basis points

- 30 year 3.96%, +5.0 basis points