In today’s trading, Euro takes the limelight, soaring broadly and reaching new heights against the frail Yen. While comments from ECB officials continued to be hawkish, there was basically nothing substantially new. The rationale propelling the shared currency is yet unclear. Following closely behind, Aussie and Kiwi mark themselves as the second and third strongest, respectively. Dollar, on the other hand, trails as the day’s weakest performer, shadowed by Yen and Swiss Franc. Meanwhile, Sterling and Canadian Dollar deliver a mixed performance.

Technically, some focuses will be on 0.8635 resistance in EUR/GBP. Firm break there should indicate short term bottoming at 0.8517 and bring stronger rebound. If realized. that might help EUR/CHF rises through 0.9840 resistance, and push EUR/USD towards 1.1094 high. Let’s see how it goes.

In Europe, at the time of writing, FTSE is down -0.17%. DAX is down -0.14%. CAC is down -0.19%. Germany 10-year yield is up 0.007 at 2.321. Earlier in Asia, Nikkei dropped -0.49%. Hong Kong HSI rose 1.88%. China Shanghai SSE rose 1.23%. Singapore Strait Times rose 0.49%. Japan 10-year JGB yield rose 0.0205 to 0.374.

US durable goods orders up 1.7% mom in may

US durable goods orders rose 1.7% mom to USD 288.2B in May, much better than expectation of -1.0% mom decline. Ex-transport orders rose 0.6% mom to 185.6B. Ex-defense orders rose 3.0% mom to 269.9B. Transportation equipment rose USD 3.9% mom to USD 102.6B.

Canada CPI slowed to 3.4% yoy, lowest since Jun 2021

Canada CPI slowed from 4.4% yoy to 3.4% yoy in May, matched expectations. That’s the lowest reading since June 2021, largely driven by lower year-over-year prices for gasoline (-18.3% ) resulting from a base-year effect.

Excluding gasoline, CPI also slowed from 4.9% yoy to 4.4% yoy. Mortgage interest cost index (+29.9%) remained the largest contributor to year-over-year CPI increase. Excluding mortgage interest cost, CPI rose slowed from 3.7% yoy to 2.5% yoy.

CPI median fell from 4.2% yoy to 3.9% yoy. CPI trimmed fell from 4.2% yoy to 3.8% yoy. CPI common fell from 5.7% yoy to 5.2% yoy.

On a monthly basis, CPI rose 0.4% mom, matched expectations.

ECB Lagarde reiterates further tightening in July

ECB President Christine Lagarde, while speaking at the ECB Forum today , emphasized that the bank”s job was far from over. She reiterated that “barring a material change to the outlook, we will continue to increase rates in July.”

As ECB treads further into restrictive territory, Lagarde indicated that the central bank would be paying close attention to two aspects of its policy – the “level” of rates and the communication around future decisions, particularly in terms of “length” of time rates are expected to stay at that level.

She underscored the presence of two main uncertainties affecting the “level” and “length” of the bank”s interest rate policies.

The first is the uncertainty about inflation persistence, which makes the peak level of rates state-contingent. The second involves the uncertainty around monetary policy transmission, an issue heightened by the fact that Eurozone has not experienced a sustained phase of rate hikes since the mid-2000s and has never witnessed such swift rate rises.

ECB Kazaks: Rates will need to be raised past July

ECB Governing Council member Martins Kazaks expressed concerns about the persistent high inflation, indicating that an economic slowdown may not be enough to counter it. He also pushed back against market expectations of an ECB rate cut in the first half of next year.

Kazaks stated, “The softness of the economy is unlikely to deal with inflation, which is still very high, with strong risks of persistence.”

Further suggesting the need for rate hikes beyond July, Kazaks said, “In my view, we will still need to raise rates and I don’t think that in July we’ll be comfortable enough to say: ‘we’re done’. I think rates will need to be raised past July but when and by how much will be data-dependent.”

Highlighting the divergence between his stance and market sentiments, he remarked, “The major problem with market pricing is the expectation of rates coming down so quickly. In my view, it’s wrong and the reason is that the market must be pricing in a different macro scenario with inflation coming down much more quickly.”

His views on potential rate cuts were very clear. Kazaks sees the need for rate cuts only when “it becomes quite certain that inflation is about to start significantly and persistently undershooting our target of 2%. And not at the end of the forecast period but towards the middle of the forecast period.”

China steps up efforts to curb yuan’s decline, defends 7.25

The Offshore Chinese Yuan (CNH) is witnessing a revival today, as China appears to be intensifying its efforts to curb the currency’s recent slump. Market participants view 7.25 level against Dollar as a significant psychological threshold to uphold.

According to a report by Reuters, there’s evidence that major state-owned Chinese banks are selling dollars in the offshore spot foreign exchange market. This activity suggests that authorities are keen to slow the yuan’s precipitous decline in recent times.

In an additional bid to temper the yuan’s slide, China set its daily reference rate for the managed currency at a stronger-than-anticipated level for a second consecutive day. This move underscores PBoC’s dissatisfaction with the currency’s recent rapid and unilateral depreciation, particularly the swift move from 7.25.

EUR/JPY Mid-Day Outlook

Daily Pivots: (S1) 155.92; (P) 156.33; (R1) 156.90; More….

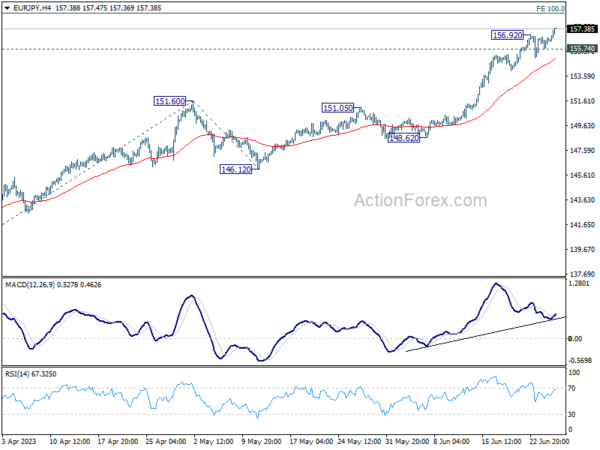

EUR/JPY’s rally resumed after brief consolidations and intraday bias is back on the upside. Current up trend should target 100% projection of 139.05 to 151.60 from 146.12 at 158.67. On the downside, break of 155.74 minor support will turn intraday bias neutral and bring consolidations first, before staging another rise.

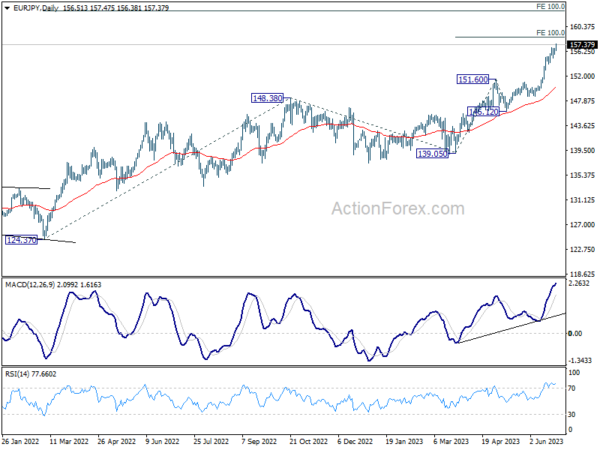

In the bigger picture, rise from 114.42 (2020 low) is in progress. Next target is 100% projection of 124.37 to 148.38 from 138.81 at 162.82. For now, medium term outlook will remain bullish as long as 151.60 resistance turned support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 12:30 | CAD | CPI M/M May | 0.40% | 0.50% | 0.70% | |

| 12:30 | CAD | CPI Y/Y May | 3.40% | 3.40% | 4.40% | |

| 12:30 | CAD | CPI Median Y/Y May | 3.90% | 4.00% | 4.20% | |

| 12:30 | CAD | CPI Trimmed Y/Y May | 3.80% | 4.00% | 4.20% | |

| 12:30 | CAD | CPI Common Y/Y May | 5.20% | 5.40% | 5.70% | |

| 12:30 | USD | Durable Goods Orders May | 1.70% | -1.00% | 1.10% | 1.20% |

| 12:30 | USD | Durable Goods Orders ex Transportation May | 0.60% | 0.10% | -0.30% | -0.60% |

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Apr | -1.70% | -0.70% | -1.10% | |

| 13:00 | USD | Housing Price Index M/M Apr | 0.70% | 0.30% | 0.60% | 0.50% |

| 14:00 | USD | Consumer Confidence Jun | 103.6 | 102.3 | ||

| 14:00 | USD | New Home Sales M/M May | 663K | 683K |

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)