Sterling is surprisingly soft this week even though markets are raising bets on a more aggressive than expected BoE rate hike, after yesterday’s UK CPI data. It’s clearly weighed down in selloff against the stronger Euro. Swiss Franc is comparatively steady as SNB rate decision is also awaited. Overall, currency markets appear more attuned to a shift away from risk-on sentiment, evidenced by a notable decline in Australian and New Zealand Dollar. US Dollar and Japanese Yen, however, are displaying a mixed performance.

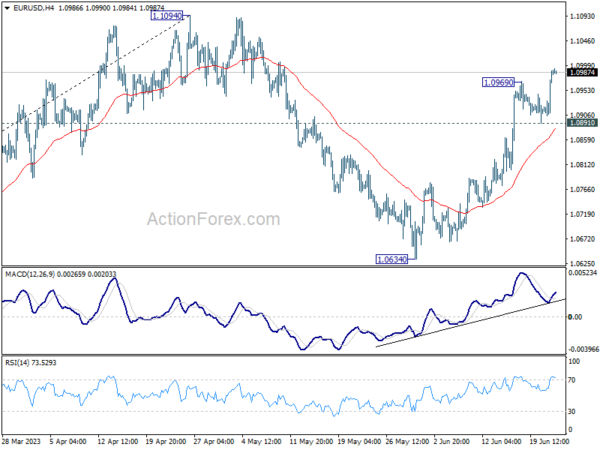

Technically, EUR/USD’s rally from 1.0634 resumed after brief consolidations. There are two questions regarding the development. Firstly, current upside momentum as seen in 4H MACD doesn’t warrant a firm break through 1.1094 yet. Break of 1.0891 support would indeed extend the corrective pattern from 1.1094 with another falling leg towards 1.0634 before completion.

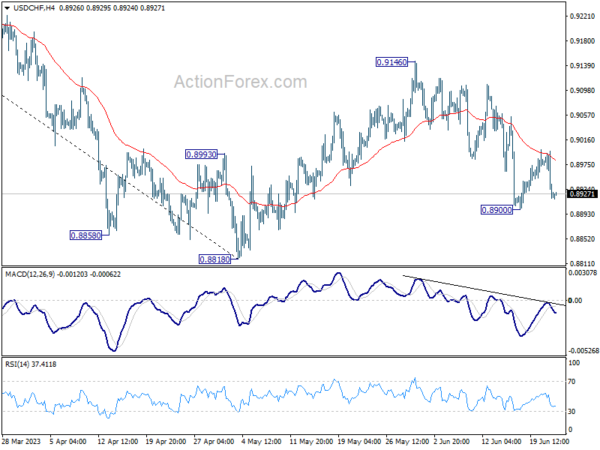

Secondly, USD/CHF was rejected by 55 4H EMA and tumbled notably. But downside is contained above 0.8900 temporary low. Extended rally in EUR/USD could help USD/CHF break through 0.8900 towards 0.8818 low.

In Asia, at the time of writing, Nikkei is down -0.75%. Singapore Strait Times is down -0.20%. Japan 10-year JGB yield is up 0.0015 at 0.375. Overnight, DOW dropped -0.30%. S&P 500 dropped -0.52%. NASDAQ dropped -1.21%. 10-year yield dropped -0.006 to 3.723.

BoE and SNB to hike for sure, but… by how much?

As BoE gears up for its monetary policy decision today, market observers find themselves divided on the scale of the expected rate hike. This indecision comes in the wake of a consumer inflation report released yesterday that muddied the waters. Headline CPI for May remained static at 8.7%, exceeding BoE’s own forecasts, while core CPI climbed to 7.1%, reaching its highest level since 1992.

Market participants are currently betting on a 40% probability of a more substantial 50bps increase to 5.00%, and a 60% chance of a modest 25bps hike. The critical shift also lies in elevated projections for the terminal rate, which has shot up to 6.00%, a marked rise from below 5% merely a month ago.

The verdict for today’s decision will also pivot significantly on the voting breakdown, which will serve as a bellwether for BoE’s future steps. Known doves Silvana Tenreyro and Swati Dhingra are more likely to vote against any changes. The real wildcard, however, is how many of the remaining seven members will advocate for a 50bps hike, even if a 25bps increase is ultimately implemented.

SNB is also expected to announce its own rate hike from the current 1.50%. Chairman Thomas Jordan has signalled that interest rates may need to ascend above 2% threshold – a restrictive level – to reel inflation back below 2% mark. The quotes lies in timing of the attainment of this peak rate. Presently, the likelihood of either a 25bps or a 50bps hike today seems evenly split, making it a nail-biter.

Some previews on BoE and SNB:

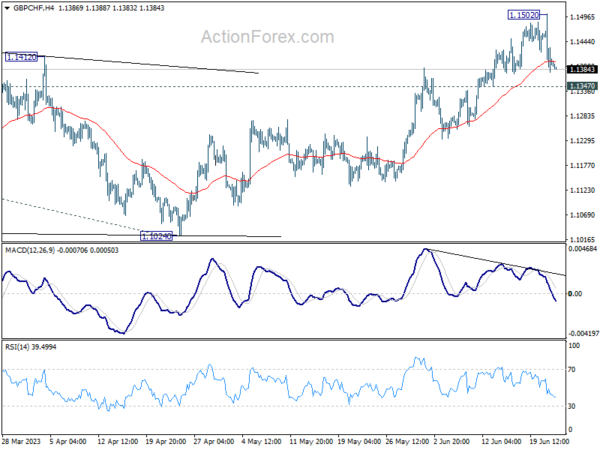

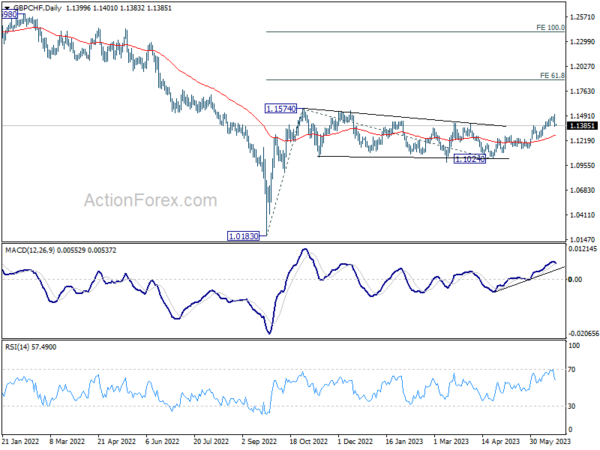

GBP/CHF’s rally was choked after hitting 1.1502 earlier in the week, kept below 1.1574 resistance. For now, the favored case is still that triangle consolidation pattern from 1.1574 has completed at 1.1024. Rise from 1.1024 is seen as resuming the whole rally from 1.0183. Decisive break of 1.1574 will confirm this bullish case and target 61.8% projection of 1.0183 to 1.1574 from 1.1024 at 1.1884. However, firm break of 1.1347 support will dampen this view, and extend the pattern from 1.1574 with another fall.

BoJ Noguchi: Important to maintain monetary easing

BoJ board member Asahi Noguchi underlined the necessity of maintaining monetary easing as Japan navigates signs of wage growth.

“What’s most important now is for the BOJ to maintain monetary easing and ensure budding signs of wage growth become a sustained, strong trend,” he said.

Noguchi predicts that core consumer inflation, which has been running above the bank’s 2% target, will likely drop below this level around September or October. He attributed this anticipated decrease to the fading effects of past increases in raw material costs.

However, he noted that the possibility of inflation bouncing back above 2% later on and maintaining that level hinges largely on future wage trends and service prices.

New Zealand goods exports up 2.8% yoy in may, imports rose 4.4% yoy

New Zealand’s monthly trade balance in May registered smaller surplus than anticipated, clocking in at NZD 46m against expected NZD 350m. This outcome followed rise in goods exports by NZD 189m (2.8% yoy) to NZD 7.0B, while goods imports saw an increase of NZD 292m (4.4% yoy), totalling NZD 6.9B.

China led the growth in monthly exports, with total exports increasing by NZD 308m (18% yoy). USA also reported a significant rise in exports, up by NZD 68m (9.7% yoy), while Japan experienced a modest increment of NZD 18m (4.2% yoy). On the other hand, total exports to Australia and the European Union fell by NZD -122m (-14% yoy) and NZD -60m (-11% yoy) respectively.

When it comes to imports, USA claimed the top spot with a massive jump of NZD 435m (87% yoy). South Korea followed with an increase of NZD 152m (41% yoy), while Australia and the European Union saw increases of NZD 81m (11% yoy) and NZD 31m (3.2% yoy) respectively. However, China’s imports into New Zealand declined by NZD 52m (-3.6% yoy).

Fed Bostic: Rates should stay at current level for the rest of 2023

Atlanta Fed President Raphael Bostic shared his insights on the current monetary policy landscape in an interview on Yahoo Finance. Bostic argued for a pause on tightening , suggesting that federal funds rate should remain stable at the current level of 5.00-5.25% for the rest of the year.

“My baseline is that we should stay at this level for the rest of the year,” he stated. He suggested that Fed’s tightening work should be allowed to ripple through the economy.

He asserted, “It takes time for monetary policy changes to meaningfully influence economic activity. We have good reasons to expect our policy tightening will be increasingly effective in coming months.”

Elsewhere

US will release jobless claims, current account and existing home sales today too.

EUR/GBP Daily Outlook

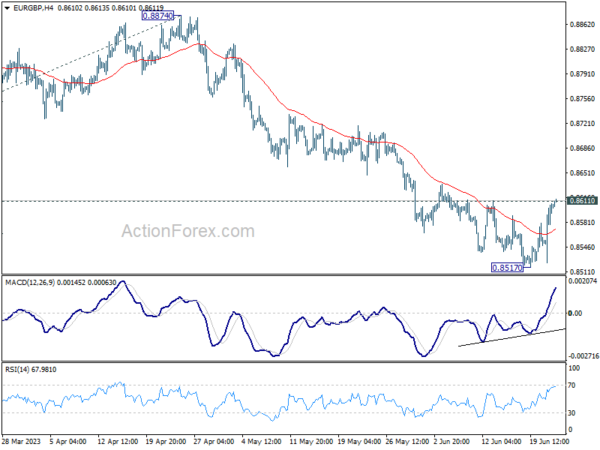

Daily Pivots: (S1) 0.8551; (P) 0.8580; (R1) 0.8635; More…

Immediate focus is now on 0.8611 resistance in EUR/GBP. Decisive break there will confirm short term bottoming at 0.8517, stronger rebound would then be seen to 55 D EMA (now at 0.8670) and above. Nevertheless, rejection by 0.8611, will maintain near term bearishness. Further break of 0.8517 will resume the fall from 0.8977 to 161.8% projection of 0.8977 to 0.8717 from 0.8874 at 0.8453.

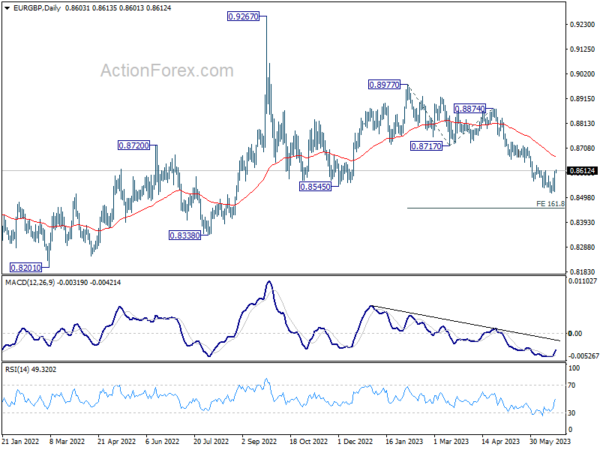

In the bigger picture, the down trend from 0.9267 (2022 high) is still in progress. It’s seen as part of the long term range pattern from 0.9499 (2020 high). Deeper fall would be seen towards 0.8201 (2022 low). But strong support should be seen from there to bring reversal. This will now remain the favored case as long as 0.8717 support turned resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) May | 46M | 350M | 427M | 236M |

| 07:30 | CHF | SNB Rate Decision | 1.75% | 1.50% | ||

| 08:00 | CHF | SNB Press Conference | ||||

| 11:00 | GBP | BoE Rate Decision | 4.75% | 4.50% | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 7–0–2 | 7–0–2 | ||

| 12:30 | USD | Initial Jobless Claims (Jun 16) | 256K | 262K | ||

| 12:30 | USD | Current Account (USD) Q1 | -217B | -207B | ||

| 14:00 | USD | Existing Home Sales May | 4.25M | 4.28M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Jun P | -17 | -17.4 | ||

| 14:30 | USD | Natural Gas Storage | 89B | 84B | ||

| 15:00 | USD | Crude Oil Inventories | 0.3M | 7.9M |